Beginner’s Bear Market Guide

Market Meditations | June 7, 2022

? How To Survive Thrive In a Bear Market

Everyone keeps telling you to survive the bear market. We’ve decided to make a guide on how to thrive in the bear market.

? First, Plan Your Investments

Thriving in a bear market becomes easier when you have a plan. Making a plan involves deciding your risk profile, and then considering options accordingly.

Considering these three variables sets you up for success: Beta (risk), altcoin exposure, and yield opportunities.

❗TIP: Beta refers to the measurement of a token’s volatility compared to the volatility of the overall market. BTC is a lower beta asset while lower market cap altcoins are higher beta assets.

The sample portfolios below are for educational purposes. Do not copy them.

Lower Risk Profile:

- Low Risk (reward potential in line with the overall market).

- We split our crypto exposure between the safest assets (BTC, ETH) and stablecoins.

- Stablecoins are deposited on a low-risk platform generating a low yield.

- Maple Finance offers a respectable yield of 12% on USDC.

- Learn how to identify stablecoin yield opportunities using our staking guide.

Higher Risk Profile:

- More risk via higher beta assets.

- We split our altcoin exposure between layer 1s (ETH, AVAX, ATOM) and our native exchange token (FTT).

- Smaller stablecoin exposure.

- Willing to invest in high-risk platforms for a high yield return.

- Smaller protocols like Osmosis offer lower-cap coin pairings (like ATOM-OSMO at ~50%) with the possibility of impermanent loss at much higher yields.

- DeFiLlama offers yield farming listings sortable by APR. Targeting higher yields comes with higher risk.

The two different approaches above yield different results. High risk can equal high reward. For most, safer portfolios will do better. Craft your plan to suit your risk tolerance.

Regardless of risk-exposure level, bear markets offer more downtime. This time is best spent investing in yourself.

? Next, Invest in Yourself

Now that you have a plan in mind, use the downtime to learn new skills and craft your edge. Three types of skills offer a big return on investment:

1) Timeless income skills

Skills able to generate income regardless of market conditions. Technical analysis is a great example as it’s a skill that can be carried over to different markets.

- Check out our free How to Get Rich Trading Crypto Course to get started.

2) Timeless investing skills

Skills that will help you to maintain and grow your money regardless of market conditions. The ultimate goal of these skills is to develop a useful bias. Now could be an opportune time to:

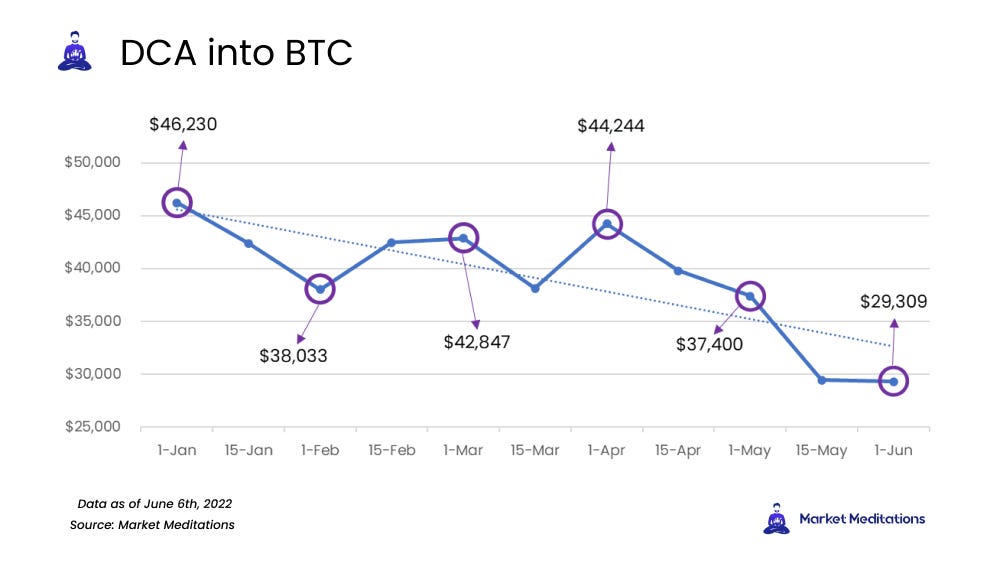

- Study investment strategies such as Dollar Cost Averaging (DCA). Instead of purchasing a large amount of BTC when you feel like it or trying to guess when to enter, decide that you will purchase a set amount at a set interval. We have set up this scenario in the graphic below using actual BTC prices.

Consider you decide you want to buy $600 worth of BTC on 1st January.

Scenario 1: Without DCA. It’s 1st January 2022. New year, new you. You decide this is a great entry and buy $600 worth of BTC. You have purchased all in one, therefore your average purchase price is $46,230.

Scenario 2: With DCA. You decided to DCA into buying $600. That is, you decide you will purchase a set amount ($100) for a set interval (on the 1st of the month for 6 months). We have circled the exact purchase prices in the chart above. You have purchased at multiple entry points and therefore your average purchase price is $39,677.58 (refer to the table below to see how this was calculated).

Another way to visually see this is to note how the blue-dashed line is trending downwards on average. This conveys that DCA drives down the average price of BTC purchases.

❗TIP: Remember, you want to buy low and sell high. Therefore, you only stand to benefit from buying BTC at lower prices through a DCA strategy.

For more guidance, refer to our DCA tutorial.

- Learn how to use on-chain data. Simply sign up for a Nansen account and consider the wealth of free tutorials we have for how to use Nansen to make a profit in NFTs, Defi, Yield Farming, and much more. Our tutorials are available here under the ‘Nansen’ section. Nansen also gives you the opportunity to observe Smart Money. These are the biggest crypto wallets and arguably, some of the brightest minds. They know how to thrive in a bear market. So, they are good people to monitor and track for bear market opportunities.

- Create a process for investing in crypto projects. In a bear market, it will take more for crypto projects to perform well. It can still happen but compared to a bull market where most projects ‘moon’, you need to be able to separate the wheat from the chaff. Start learning how to identify hot projects with our ‘How to Research New Projects’ tutorial and dive deep into our ‘Tokenomics 101’ guide.

3) Timeless discipline skills

Techniques and practices that will prime you for growth and consistency. Check out KoroushAK’s ‘6 Most Important Habits’ for actionable advice on how to optimise your daily routine.

Serious wealth can be created in bear markets. You just need to know where to start.

Now you do.