🧘♂️No One Expected THIS to Happen

Market Meditations | June 10, 2022

Dear Meditators

Like an annoying rash, the scandal surrounding Terraform founder Do Kwon just refuses to go away. This time, we’re focusing on whether or not Terraform Labs sold unregistered securities using its Mirror Protocol.

Elsewhere, we note that defi hacks and exploits are all too common these days. With the infinite number of projects out there, it seems that every other day brings news of another protocol with drained liquidity. This week one of those protocols was Osmosis, a large dex in the cosmos ecosystem.

Let’s review all the above and some key bitcoin technical analysis.

Today’s Meditations:

- Bitcoin Technical Analysis

- Do Kwon Has Been Served

- A Seriously Strange Story About Osmosis

- No one was expecting THIS to happen!

⏰ Top Headlines

- Optimism exploiter claims willingness to return 18 million OP tokens

- Inflation Unexpectedly Reaccelerated to 8.6% in May, Hitting a Fresh Four-Decade High

- Mastercard announces new crypto partners for its NFT payments service

- Samsung Asset Management to launch blockchain ETF in Hong Kong

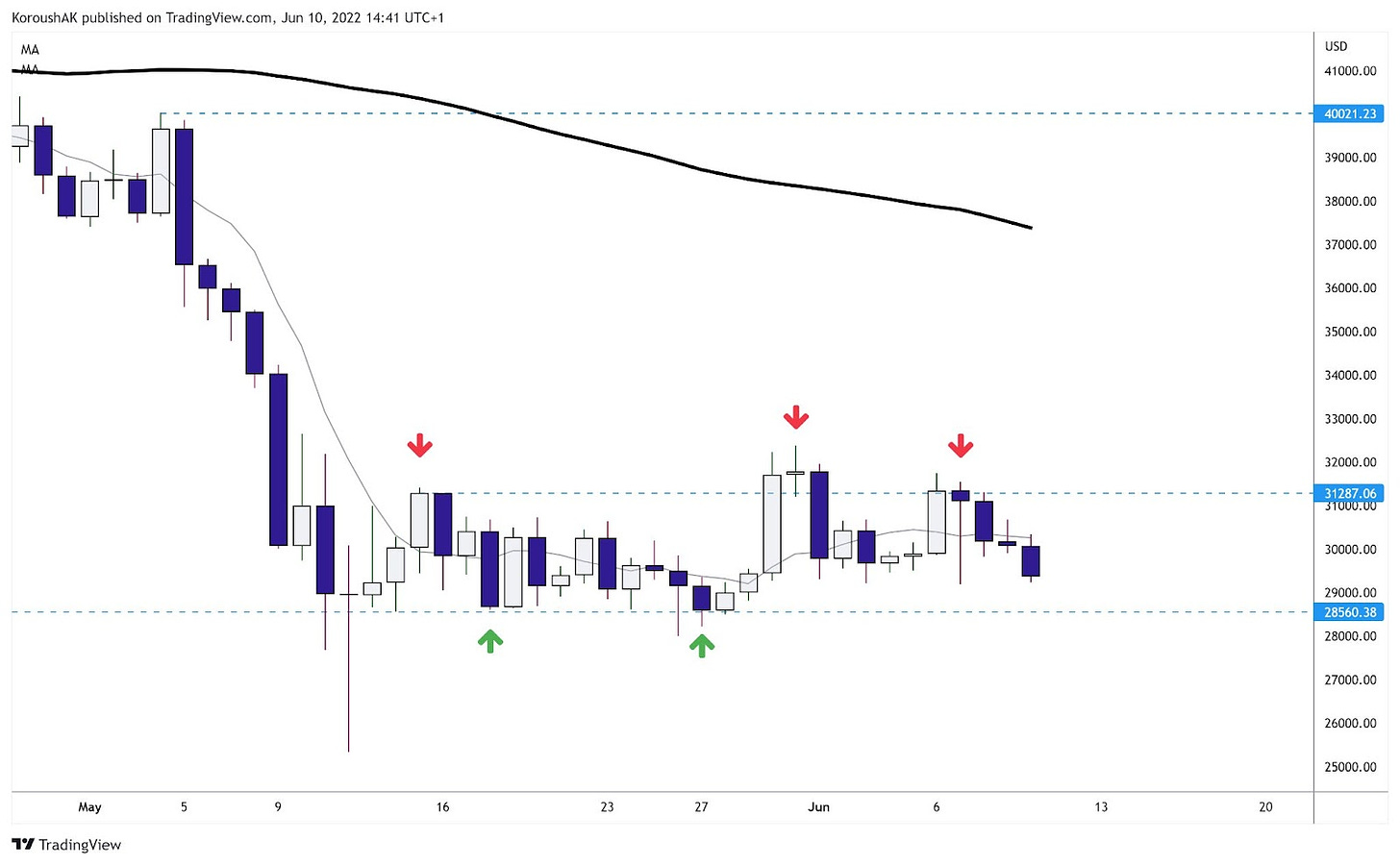

BTC/USD

Macro Structure: Back to range. As expected earlier this week.

Looking backward: Patience was key, as we emphasised in our technical analysis feature on Monday, link here. The move seemed like a bull trap thus we were waiting for further confirmation, mainly the crossing of the 7-day moving average, before changing bias.

Key Resistance: $29,000

Key Support: $28,500

?⚖️You’ve Been Served

Do Kwon’s dispute of an SEC subpoena was rejected by the U.S. Court of Appeals for the Second Circuit yesterday.

- The appeal claimed that the Securities and Exchange Commission violated rules outlined in the Administrative Procedure Act and other regulations in serving the subpoena.

- It also disputed the jurisdiction over the case, citing Terraform’s lack of contact with the United States.

- Kwon’s problems aren’t only made in America.

- South Korean authorities are still currently investigating tax evasion and market manipulation charges surrounding Kwon’s Terraform Labs.

Regardless of how investors feel about Terra, or its rebranded launch of Terra 2, none of this is good news. Being surrounded by controversy is one thing, but being caught in the middle of a hailstorm of legal action is anything but promising.

Need to catch up on the current state of Terra? Give our coverage a read here.

? Getting In On The Action

A reddit user, with a now deleted post, first warned of an Osmosis vulnerability. He discovered that if someone added funds to an Osmosis liquidity pool and removed it, the position would increase by 50%.

- Users were able to drain $5 million of liquidity before the developers halted the chain.

- In an interesting twist, Firestake, a validator on the Osmosis chain, admitted that upon discovering the bug they joined in on the exploit, draining $2 million with only a $226 position.

- A validator is a computer that maintains the integrity of the blockchain. They had to stake a large amount of Osmosis to even be selected, which will be less valuable now.

- After contacting the Osmosis team, Firestake took to Twitter to confess their sins to the community and announced that they would be leaving the Cosmos ecosystem.

- The official Twitter account for the Osmosis dex said this bug was due to a software error in their recent upgrade to Osmosis V9.0 that went live only one day before the exploit.

- Osmosis has stated that it will replace any funds that are not recovered from their treasury.

Developers can make mistakes that are often very costly to speculators and community members alike, but it isn’t every day that validators of the chain jump in on the exploitation. Hopefully, this type of behavior doesn’t become a statistic of what to expect in a bear market!

? Watch

- Watch our How to Get Rich Trading Crypto Course if you struggled with today’s technical section.

? Read

- Read the following Technical Analysis guides for more insight:

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Kyle F., Max P., Nick T., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.