Guide to Not Get Liquidated

Market Meditations | July 1, 2022

? How the Mighty Have Fallen

At a high level, most hedge funds and venture capitalist firms (VCs) operate similarly.

- Users invest in a fund with the promise of a return on their investment. In the case of Celsius, users deposited cryptocurrencies, like ETH, to earn a yield on those deposits.

- Institutions have to make money to cover the cost of paying incentives. To do this, they assume certain risks to earn returns.

This is pretty standard practice. Banks operate in the same way by earning interest on deposits, then sharing some of it with their users in interest-bearing accounts.

?Going Sideways

Some of these institutions took on higher risk to earn higher rewards.

- While Celsius claimed to only use user funds for lending and bitcoin mining operations, large investments were made to accrue staked ETH (stETH). When stETH “de-pegged”, dropping in value against ETH, Celsius was no longer able to sell stETH to honor promised yields and withdrawals without realising loss. As the price gap between stETH-ETH widened, Celsius headed toward insolvency.

- Separately, Three Arrows Capital faced troubles of its own. One investment involved providing $245 million worth of ETH to Aave, and borrowing $189 million in stablecoins against it. If the loan-to-value ratio on this loan falls below 85%, ETH is liquidated (sold on the open market) by Aave until the ratio is restored to 3AC’s position.

Sure, it’s easy to wag the finger at these institutional investors. The only thing in shorter supply than liquidity for these two might be sympathy, but even the most prudent investor could be in for their fair share of fallout.

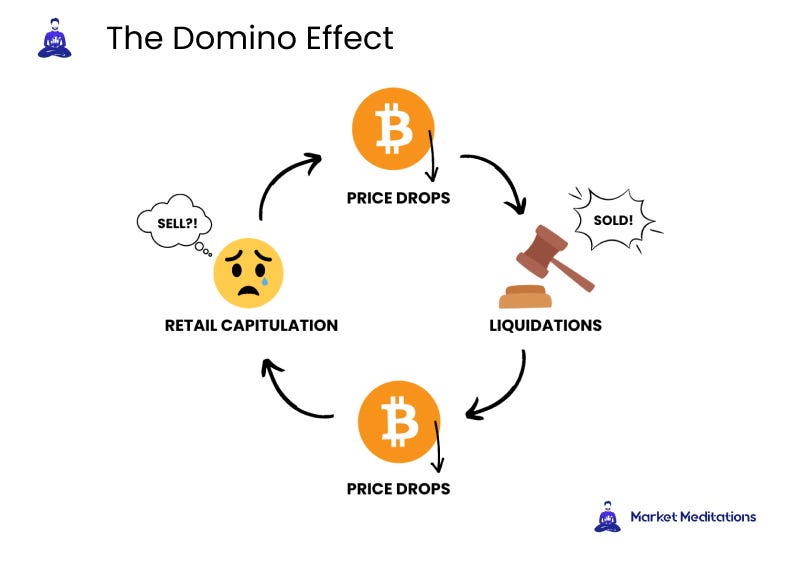

As falling prices trigger liquidations of positions held by lending bodies like Aave, more tokens enter the market which drives prices down further. This causes fear in investors, which incites them to take action and sell what they have left, perpetuating the cycle.

⏬ Look Out Below!

While million-dollar margin calls and leveraged liquidations may not affect the everyman, the affected price of assets could be cause for concern.

- When collateral is liquidated by lenders, sell pressure is applied to the open market. This translates to higher available supply in the face of already lowered demand. Crypto assets, like ETH and BTC may suffer as they’re sold to honour loans.

- In anticipation of a Celsius token (CEL) price crash, some whales have been aggressively entering short positions, betting on falling prices to play out.

- A growing trend on twitter dubbed #CelShortSqueeze is calling on retail investors to purchase CEL and remove them from exchanges, lowering the supply in hopes of mimicking the Game Stop short squeeze of 2021.

❗Don’t Be Exit Liquidity

Just like with Terra, warning signs are in plain view, but very few of us thought to look. Now that prevention is out of the question, we’re postured to protect ourselves if history repeats.

- Nansen is absolutely indispensable in monitoring token movements. Learn how to use it using our guides available here.

- Twitter is one of the best places to identify emerging headlines. Fill your feed with sources like TheDeFiEdge, TheCalculatorGuy, and others committed to looking into risky positions.

- Put these tools to use before investing in a platform. Assume nothing is safe. Always do your research before depositing.

Retail investors aren’t the only parties subject to defaults and liquidations, but they may stand to lose the most. Get informed and be proactive to minimize the chance of paying someone else’s debt.