🧘♂️ALERT: $1.7 Million Stolen

Market Meditations | February 21, 2022

Dear Meditators

A combination of Ukraine-Russia tension, fear of interest rate hikes and nervousness around the OpenSea hack created sell-pressure over the weekend. Let’s recap on everything you need to prepare yourself for the week ahead.

Today’s Meditations:

- BTC and SOL Technical Analysis

- Phishing on the OpenSea

- $1.7 Million Stolen

- Vitalik Sheds Light on Market

- Crypto Calendar of the Week

⏰ Top Headlines

- Pro-Bitcoin president of El Salvador to offer citizenship for foreign investors

- Jambo secures $7.5 million in seed funding to build Africa’s web3 ‘superapp’

- FTX Starts Gaming Unit to Promote Crypto Adoption

- Coinbase rewards researcher $250,000 for discovering “market-nuking” bug

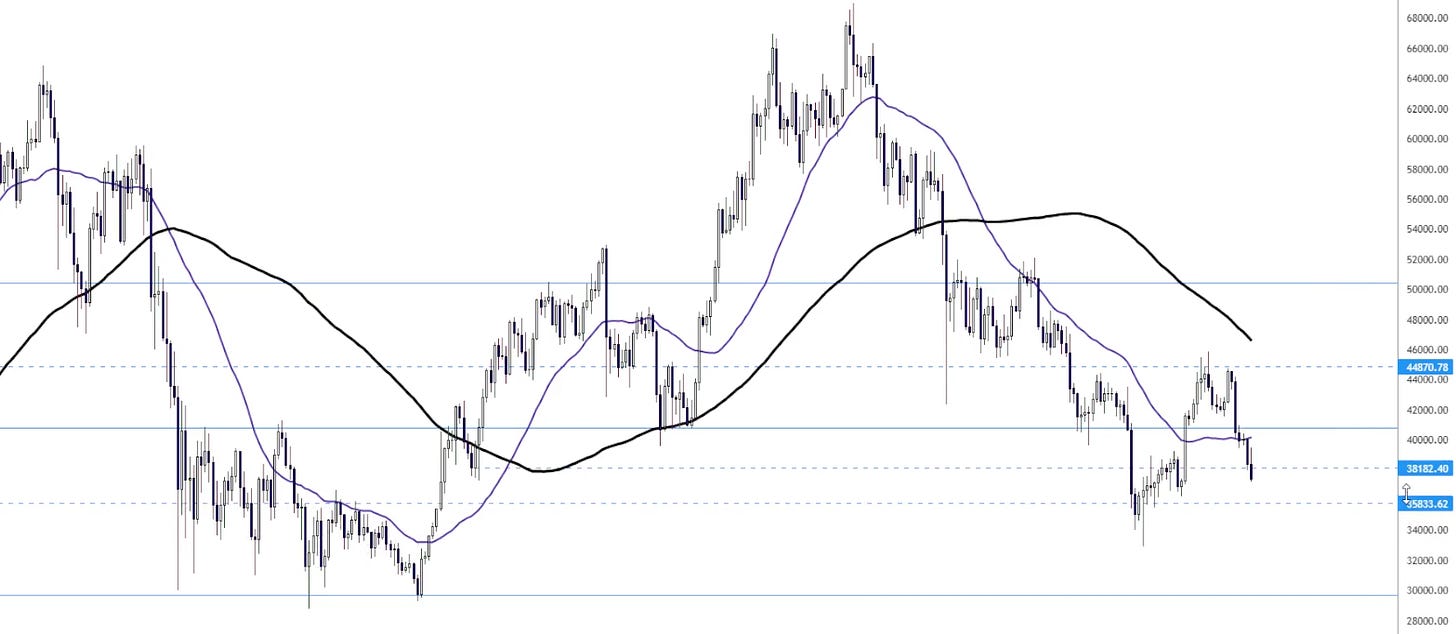

⬇️ The Road to Key Support Is Paved With Good Intentions

BTC/USD

Macro Structure: Attempt to break upwards has failed.

Key Support: Key support level lost at $40k.

Highest Probability Bet: Further downside seems likely. With a test of next support at $36k seeming probable. Whilst we hope that this will hold, it’s uncertain given the continued downtrend we are experiencing. These conditions make altcoins more dangerous.

SOL/USD

Macro Structure: Steady downtrend.

Key Support: Looks like we are losing the key $90 support level. Next support is at $70.

Highest Probability Bet: Test of $70 doesn’t seem out of the question.

? Phishing the OpenSea

Last Saturday, 32 users had NFTs stolen from their OpenSea accounts. It appears to be a phishing scheme that plagued the OpenSea users.

- On Saturday, attackers stole 254 NFTs, including tokens from Decentraland and Bored Ape Yacht Club (per blockchain security service – Peckshield).

- The estimated value of all NFTs stolen is roughly $1.7 million.

- Targets first signed a partial contract, with a general authorization leaving large portions blank.

- With the signatures in place, the attacker in essence had a blank check and was able to send the NFTs to a place of their choosing.

- The attacker’s address was slapped with a “phish/hack” warning badge on Etherscan.

- While we hope they can recover NFTs and all funds involved, we should remember that it’s never a good idea to click on unknown links.

Though in retrospect it may seem obvious, phishing links often come from very realistic-looking emails. To be sure you are taking all proper precautions to protect your crypto investments, be sure to take a look at our crypto security guide!

❄️ Winter Sale?

The weekend was not kind to crypto. Downward movement dominated the charts as most digital assets saw their value diminish. Vitalk Buterin has his eyes set on the silver lining for the cloudy climate, however.

- In an interview with Bloomberg, the Ethereum founder, said “The people who are deep into crypto, and especially building things, a lot of them welcome a bear market.”

- Parabolic rises attract short-term speculative attention, while money coming in during “crypto winters” tends to stick around and be more stable.

- From 2018’s crypto winter to the present, we have seen an explosion in projects and tokens, coming to exceed 12,000 currently listed on CoinGecko.

- “The winters are the time when a lot of those applications fall away and you can see which projects are actually long-term sustainable.” said Buterin, further commenting on the merits of a sustained bear market.

Teams with conviction and all the appropriate green flags are easier to spot in bearish markets. You just need to know where to look. Start with our guide to separate the wheat from the chaff here.

Monday, 21 February

- ?$GMEE Listing

CoinEx to list Arc8’s GMEE token with the trading pair GMEE/USDT. Deposits and withdrawals available starting at 3 a.m. UTC 21 February following trading availability at 7 a.m. UTC the same day.

Tuesday, 22 February

- ?️BitTorrent Mainnet Launch

BTFS 2.0 Mainnet launches in the middle of a 3-week airdrop plan during the transition period. BitTorrent File System will be distributing the rewards proportionately between 1.0 and 2.0 nodes.

Thursday, 24 February

- ?Kadena Chainweb Mainnet 2.12

Version 2.12 to replace all previous versions, with deprecated versions to be shut down. A number of improvements to the Kadena network will be implemented.

Friday, 25 February

- ?Tenset BNB Buyback

500 BNB automatic buyback will begin on PancakeSwap. Purchases of ~1 BNB worth of $10SET will take place every hour, with the purchased tokens being burned.

- ?Jobs Reporting

U.S. Bureau of Labor Statistics will release February’s Strike Report this Friday giving insight into the U.S. employment climate. It’s anticipated that around 200,000 jobs have been added.

- PrimeDAO is focused on building tooling to support DAO operations independently, but also to plugin & work efficiently with other DAOs – Messari

- Bitcoin Fear and Greed Index is 25 — Bitcoin Fear & Greed Index

- Short-Term Holders currently own 54.5% of all coins held at an unrealized loss (2.56M $BTC), creating sell-side headwinds for price – Glassnode

- Bitcoin Is The Freedom Technology The Western World Needs. “Millions of people come for the profits, but stay for the revolution. Bitcoin has a unique way of teaching economics, personal finance, mathematics, philosophy, geopolitics, & more.” – Pomp

- 2022 season. You ready? We are. Mercedes-AMG F1 – FTX

- When Dolce & Gabbana enter the #NFT game and end up selling a 9 piece collection for $6 million, you know things are getting serious… – Real Vision

- Watch our How to Get Rich Trading Crypto Course if you struggled with today’s technical section.

- Read the following Technical Analysis guides for more insight:

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Kyle F., Misael Calleja, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.