🧘♂️ALERT: Awesome Crypto Strategy

Market Meditations | February 17, 2022

Dear Meditators

Interest, inflation, and stock markets. What do these have to do with cryptocurrencies? At first glance, it may not seem like much at all. But beneath the surface lie valuable tools we can unearth to gain an advantage as investors.

Today’s Meditations:

- Top Headlines

- Undercover Analysis: Bitcoin, Inflation and Stock Markets

- And through the analysis → our awesome crypto strategy

- NYSE Building an NFT Marketplace?

- Former Crypto Opponent JP Morgan Enters the Metaverse

⏰ Top Headlines

- DeFi Project Ref Finance Closes $4.8M Round led by Jump Crypto

- Animoca Brands snaps up mobile game maker Grease Monkey Games

- UAE to Issue Crypto Licenses in Bid to Become Industry Hub

- Circle valued at $9 billion under revamped SPAC deal terms

? Hedging Risks

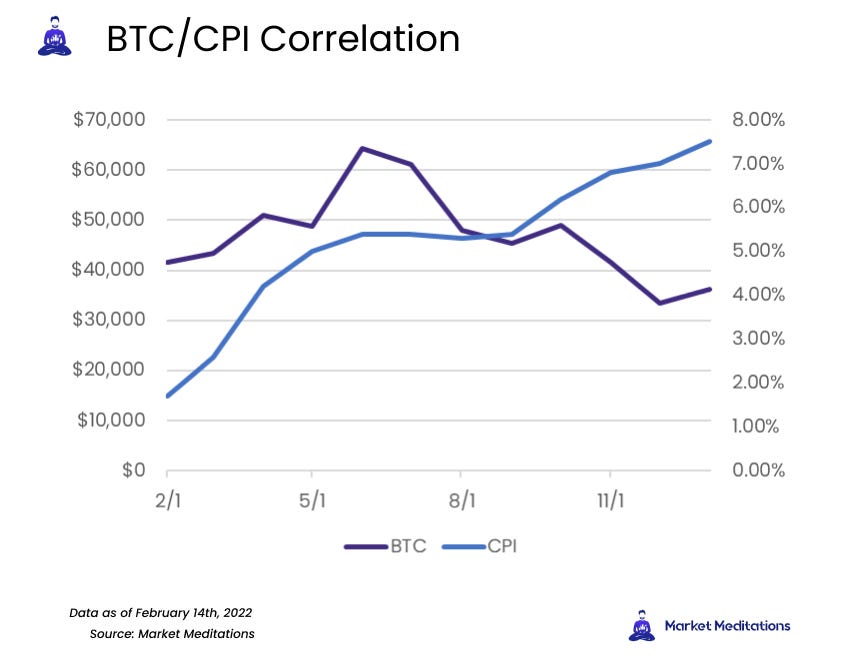

The chart above shows a distinct correlation between BTC and the movement of the Consumer Price Index (CPI) from February until the summer in 2021. After that point, investors began easing off Bitcoin as the inflation rate evened out around 5% in anticipation of incoming mitigation measures.

CPI measures the change over time of a basket of consumer goods in the United States. It is one of the most reliable ways the US government tracks inflation.

The rise in inflation convincingly corresponded with Bitcoin buying all the way until it approached the 5% level. We can see that investors wised up and began being a bit more cautious in anticipation of interest rate hikes, which inevitably must be introduced to control inflation.

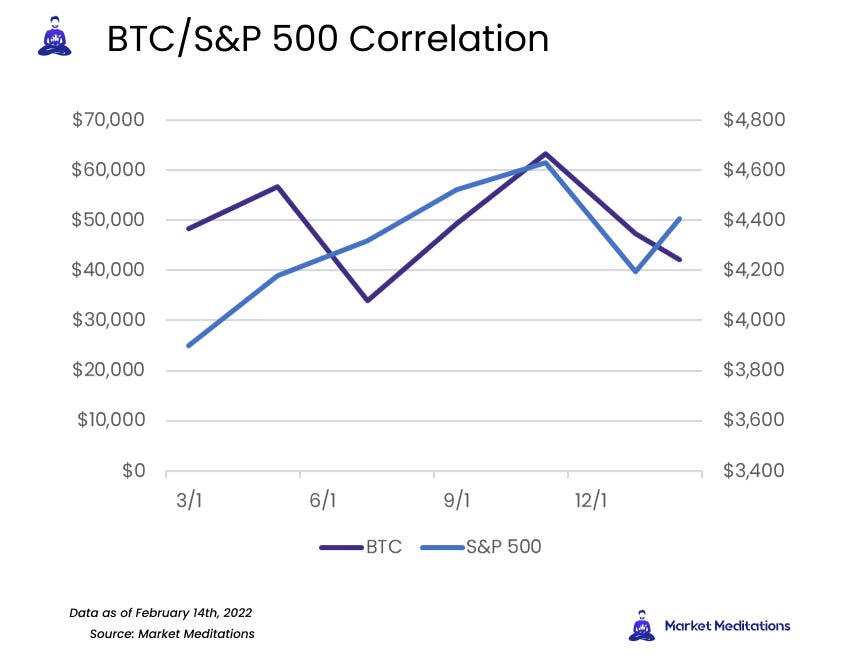

From 2017 to 2019, Bitcoin’s correlation to the S&P 500 was virtually non-existent. However, with the arrival of the pandemic a shift in this correlation has clearly taken place. The International Monetary Fund (IMF) published a report documenting the correlation moving from 0.01 across years to 0.36 in 2021.

In the case that Bitcoin is not a bona fide inflation hedge, it may be gaining validity as a risk asset.

- Risk assets include cryptocurrencies, stocks and commodities.

- These assets are ripe opportunities for investors looking to earn a return on investment (ROI) when the government is significantly providing liquidity or other tangible forms of support.

- When the yield offered in the bond market is low, risk assets tend to perform better.

Whether inversely or directly, a correlation seems to exist between Bitcoin and inflation. How do we better understand inflation in an attempt to leverage this relationship to our benefit?

- The Federal Open Market Committee publicly publishes its calendar riddled with events, inflation-related and otherwise.

- The Fed’s balance sheet can be an indicator of quantitative easing, a direct result of the government injecting money into the economy. It is published weekly.

- Nonfarm payroll measures the number of nonfarm (and a narrow classification of other sectors) employees. When it grows, it means the economy is expanding. If it grows too quickly it can indicate an impending rise in inflation

- CPI charts and publications are regularly released. Keep an eye on Market Meditations’ Scan of the Week for these dates and events.

- Government officials and financial institutions often conduct speeches addressing matters directly related to inflation or on topics which will have undeniable impact.

Cryptocurrency has been consistently growing. As it does so, becoming closely related to stock markets can objectively be interpreted as money coming in following the same sentiment. Start considering more than just price charts when approaching digital investments. Your wallet will be glad you did.

? NYSE Marketplace?

What happens when the world’s biggest stock exchange decides to get into the NFT business? We may just find out. The New York Stock Exchange (NYSE) recently filed an application to the U.S. Patent and Trademark Office to be able to provide an online marketplace for digital goods — which includes NFTs!

- NYSE filed an application for an online marketplace.

- According to a NYSE spokesperson, they have no plans of launching crypto or NFT trading saying “(The NYSE) regularly considers new products and their impact on our trademarks and protects our intellectual property rights accordingly.“

- The application points to potentially entering the metaverse as well saying that they seek to provide “virtual reality, augmented reality and mixed reality software.”

This is not the first time the NYSE and NFTs are murmured in the same sentence. Last April a NYSE spokesperson said that they were minting NFTs merely for commemorative purposes. These NFTs live atop Crypto.com’s native blockchain.

Though they say they have no plans to enter the space, it appears they are inching closer to getting in the game. If this is the case, their marketplace could compete with the likes of Rarible and OpenSea. It would also validate NFTs to an older community that has good knowledge of the NYSE.

? JP Morgan Enters the Metaverse

JP Morgan is the largest bank in the U.S. and the fifth-largest in the world by market capitalisation. In the past, they have publicly criticized cryptocurrencies and blockchain technologies but have since changed their tune.

- On Tuesday 15th February they became the first institutional bank to enter the metaverse, having opened the ‘Onyx Lounge’ within Decentraland.

- In addition, they released a document outlining how businesses can navigate the metaverse called ‘Opportunities in the metaverse’.

- Within the document, analysts predict that the main revenue driver within the metaverse will come from in-game advertising spending, which the bank predicts will reach $18.41 billion by 2027.

Major institutions entering the space are often met with mixed opinions, especially when they are the reason many of us got into crypto.What is for certain is there will be more people and money entering the space. This will translate to more growth and create opportunities for you to profit. A key talking point is growth in virtual land prices across major metaverses. To learn how you can profit from this growing trend, check out our podcast ‘How to Profit from Virtual Land with DCL Blogger’.

- Read our Inflation 101 Guide. If today’s ‘Big Idea’ was a bit complicated for you, use this guide to go back to basics.

- Watch this exclusive Koroush AK Consultation Call. A private mentoring session hosted by Koroush AK. Awarded as a giveaway to one of our Premium Members.

Delighted to say this article is brought to you by crypto.com, the world’s fastest growing crypto app. Our favorite features:

- ? Earn Interest. Grow your portfolio by earning up to 14% interest on your crypto assets.

- ? Crypto.com Visa Card. Spend with the crypto.com Visa Card and get up to 8% back.

- ✅ Buy and Sell Cryptos. Join 10m+ users buying and selling 100+ cryptocurrencies at true cost.

? You can use our link to download the crypto.com app.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.