🧘♂️ALERT: Awesome Crypto Tips

Market Meditations | February 10, 2022

Dear Meditators

It’s been a dramatic week. We are all still getting our head around the billion dollar heist. 2 arrests made in connection with the 2016 Bitfinex hack of $3.6 billion worth of Bitcoin. As the dust starts to settle, we revert our attention to the essentials: crypto opportunities and how to use them to build financial freedom.

Today’s Meditations:

- Top Headlines

- Unlocking Dry Powder: 2 Liquidity Strategies (Our Awesome Crypto Tips)

- Russia’s Crypto Developments

- Big Step Forward for NFTs

Nexo is one of the most user-friendly crypto lending and earning platforms in the industry. Unlock the Power of Your Crypto:

- ✅ Earn Up to 17% Annual Interest, Paid Out Daily

- ✅ Borrow Instantly: 21 Cryptocurrencies Available As Collateral

⏰ Top Headlines

- FLOW Tokens Surge on Beijing 2022 Olympics Winter Games License

- Man United onboards Tezos as its official Web3 and training kit partner

- Gucci buys virtual land on The Sandbox as part of metaverse experience bid

- El Salvador plans to issue first bitcoin bond next month

? Get Out of Jail Free

Imagine buying Cryptopunk #1945 for 145 ETH five months ago… or using up all your dry powder to secure some Terra during a dip in the market.

Investments are a necessary part of advancing portfolios.

Unfortunately, expansion comes with cost. The problem is once you’ve made your speculative purchase your buying power is affect.

Enter DeFi. Freeing up liquidity is a popular subject in the world of new finance.

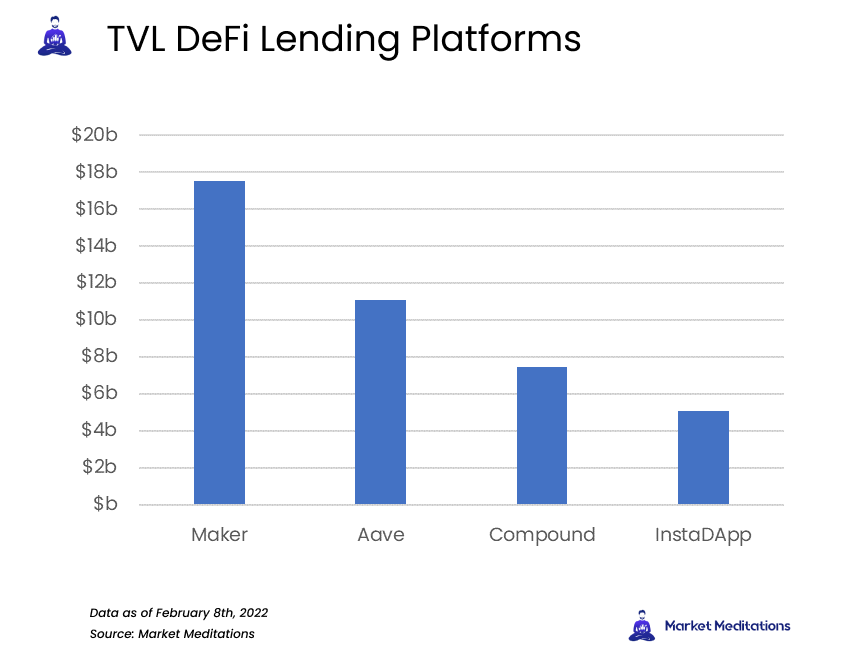

From the above data, we can not only see that MakerDAO is the most popular DeFi lending platform, but also the capital locked in the top four combined is more than considerable.

MakerDAO is a decentralized autonomous organization built on Ethereum designed to allow lending and borrowing without the need for middlemen.

- MakerDAO brings a degree of predictability into the lending system by combining loans with the stablecoin, DAI, to smooth out some of the volatility innate to cryptocurrencies.

- The platform allows users to lock up tokens like BTC and ETH in smart contracts to create a proportionate amount of DAI.

- This effectively frees up some of users’ liquidity, allowing them to collateralize token holdings to receive DAI in return.

Oasis is the most popular app facilitating trading, borrowing and saving for the MakerDAO platform. Get started here.

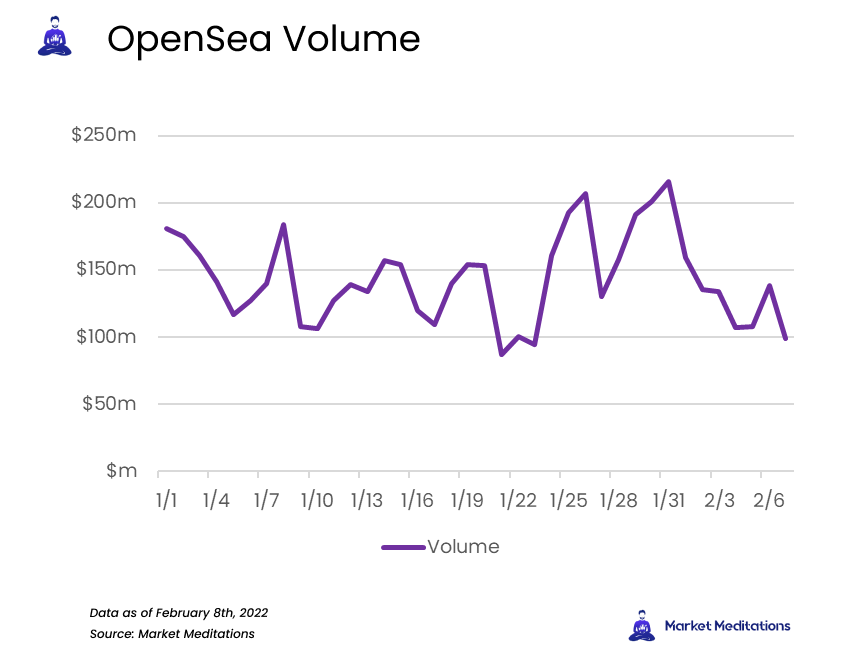

Looking at the volume on OpeanSea this year, it’s easy to see that money isn’t consistently leaving the NFT space.

Coins and tokens are far from the only things in the crypto world responsible for locking up liquidity. NFT’s continue to gain momentum, taking capital with them.

NFTfi allows NFT owners to unlock liquidity otherwise lost to the original investment by purchasing NFT assets.

- The platform serves as a marketplace for NFT holders by offering a whitelist of eligible assets which can be listed as collateral in return for loans.

- By allowing borrowers to specify desired loan amounts, durations, and interest rates, NFTfi gives users the ability to customize loans. Potential lenders can shop available NFTs to find the perfect match.

- Once the loan is accepted, the NFT is transferred to the NFTfi escrow smart contract and held until the loan reaches term.

Using NFTfi requires a MetaMask wallet and some account setup on the website, but the process is reasonably intuitive. To read more about how to make the most of NFTfi, head here.

❗Borrowing with collateral does, however, carry with it some inherent risks. Provisions for defaulting are written into the smart contracts which handle these loans. In most cases, the penalty for failing to pay back a collateralized loan is forfeiture of any underlying assets leveraged to secure it.

Unlocking liquidity stored in crypto assets restores purchasing power. Should the market dip, taking out a loan against your tokens or NFTs may be the perfect solution to an empty-pockets problem.

?️ Russia is on board!

Crypto adoption has been looming across the world. While some countries are hesitant and would like to ban it, there are others such as El Salvador who are diving headfirst.

On Tuesday, Russia announced that they would draw legislation no later than February 18 to recognize crypto as a form of currency! It seemed like it was only last month (because it was) that Russia was proposing a ban on miners and other crypto operations, so let’s take a look to see what is going on:

- Russian regulation will seek a particular circulation of digital currencies while not “threatening the stability of [the Russian] financial system”.

- Regulation will help “reduce the use of cryptocurrencies for illegal purposes.”

- There will be identity checks once an individual has purchased more than $8,000.

- Attempting to transact outside of the parameters the Russian government will set will be a criminal offense and one will be expected to pay a fine.

Russia is expecting this to bring digital currency out of the shadows and create the possibility for the vibrant legal crypto business ideas we are seeing in other parts of the world.

? Making a House an NFT

Leslie Alessandra, a Florida homeowner is auctioning her house as an NFT. The auction will begin on February the 10th, starting at $650,000. The current owner told her local newspaper that “it’ll be the first piece of U.S. real estate to be auctioned as a non-fungible token”.

- Real-estate technology company Propy will mint the property rights as an NFT and host the online auction.

- The house will only be purchasable via cryptocurrency.

- The NFT will act as a DeFi asset that can be borrowed against.

Alessandra is a crypto native having co-founded Tampa Bay blockchain company DeFi Unlimited. She states her main incentive for selling the property rights as an NFT is to “stimulate conversation”.

Aside from headlining some cool news, this is a perfect example of blockchain technology solving real world inefficiencies. It will improve slow and difficult transactions in the property market whilst proving that crypto is not just about magic internet money going up and down.

Our recent podcast with Diran Li, Head of Data at Messari stood out to us in particular. In tomorrow’s newsletter, we will share his incredibly valuable insights in written format.

Keep missing pumps and opportunities? Consider becoming a FREE subscriber to stay ahead of the crypto market.

? Free subscribers get full access to:

- ✅ Our Daily Crypto Newsletter

- ✅ Bitcoin Reports and Ethereum Deep Dives

- ✅ Altcoin Analysis and Crypto Project Coverage

- ✅ Regular Technical Analysis

- ✅ Podcasts With Crypto Leaders

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.