🧘♂️ALERT: Big Crypto Secret

Market Meditations | February 25, 2022

Dear Meditators

Crypto finds itself at the heart of global events. Its power has become too difficult to ignore.

Today’s Meditations:

- BTC and LUNA Technical Analysis

- Read until the end of this section for our Big Crypto Secret

- How Russian Sanctions Might Affect Crypto

- Warner Music Group Partners with Splinterlands

⏰ Top Headlines

- $4.4 Million In Bitcoin Has Been Donated To Ukrainian Military Support Groups

- Bitcoin price briefly shown at steep discount on Robinhood app

- Brazil Set To Follow El Salvador In Full-Scale Adoption Of Bitcoin

- E-commerce giant Rakuten launches its own NFT marketplace

? Wait and BT See

BTC/USD

Macro Structure: Trend remains firmly downwards with no sign of recovery yet. Only slightly bullish variable is that we didn’t make a new lower low despite the extremely bad news events. However, that’s not to say that we don’t reject off $40k and head straight down.

Key Support: New key support at $35k. $38k has been invalidated.

Key Resistance: New key resistance at $40k. Coinciding with the 30 Day Moving Average.

Highest Probability Bet: Not bullish until we get above $45k (confluent with 100 Day Moving Average).

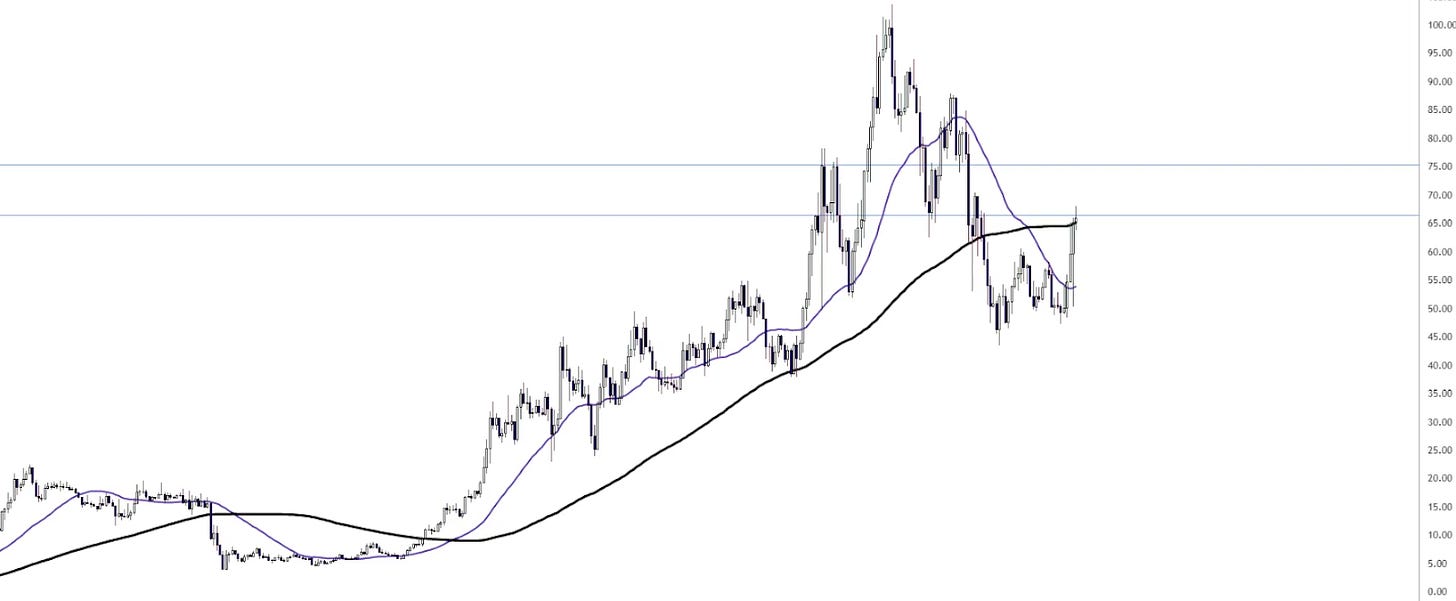

LUNA/USD

Macro Structure: Aggressive pump into 100 Day Moving Average resistance.

Key Resistance: Testing key resistance at $66. Next resistance at $75.

Highest Probability Bet: Potential for breakout move to $75 (around 13% move) if we close above $66 (confluent with the 100 Day Moving Average). However, this would require LUNA to go ahead of the entire market. Not to mention, the 100 Day Moving Average is tough to break. If it does break, we might see a lot of momentum.

✅ Big Crypto Secret: It’s rare to see isolated coins pump in a bear market. Many take a long position hoping to see this happen and lose money. The one time they don’t enter, the coin will actually end up pumping. This can lead to survivorship bias and a mindset that the next coins will certainly pump. Be wary of this emotional factor that might be playing into your trading decisions.

⚔️ How Sanctions Might Affect Crypto

For several weeks, news networks in the west have reported that US Intelligence agencies had uncovered a Russian plan to invade Ukraine. Although Russia denied those rumors, they were certainly confirmed after Russian forces were deployed and began attacks on various areas of Ukraine. International leaders at the G7 summit have promised heavy sanctions. Although the thought of the war is tanking many global markets along with crypto, the imposed sanctions could turn out to be a driving factor in the adoption of bitcoin and other digital currencies.

The current sanctions include :

- Large Russian banks, including VTB & Sberbank as well as Russian elites and their family members.

- Restricting Russian companies whose assets exceed $1.4 trillion ability to raise additional money.

- New limitations on what can be exported to Russia from the US.

Many feel that these sanctions are not enough to deter Russia from a full occupation of Ukraine. When Biden was asked why he did not bar Russia from using the electronic payments system SWIFT (Society for Interbank Financial Telecommunication), he responded that these sanctions will have a similar effect on the Russian economy. With the recent government investigations into crypto, the President may know that barring Russia from using SWIFT could push Putin to use crypto to avoid those sanctions.

Sanctions and fear are not the only way this war is affecting crypto markets. On the first day of the war, the military in Ukraine received more than $400,000 in bitcoin donations. Ukraine has imposed its own cash withdrawal limits for citizens.

Keep missing pumps and opportunities? Consider becoming a FREE subscriber to stay ahead of the crypto market.

? Free subscribers get full access to:

- ✅ Our Daily Crypto Newsletter

- ✅ Bitcoin Reports and Ethereum Deep Dives

- ✅ Altcoin Analysis and Crypto Project Coverage

- ✅ Regular Technical Analysis

- ✅ Podcasts With Crypto Leaders

?? Warner Music Group Partners with Splinterlands

Warner Music Group (WMG) is a record label conglomerate and one of the most well-known names in the music industry. They first entered the crypto space last month when they announced that they had purchased land in the Sandbox. They aim to open a ‘musical theme park’ to allow their artists to perform in the metaverse.

- On Wednesday 23rd February, WMG announced that they had entered a partnership with leading blockchain gaming developers Splinterlands.

- WMG is the first major player to partner with a blockchain game developer, giving them a first-mover advantage.

- According to DappRadar, Splinterlands is the most popular blockchain game with over 300,000 daily active users.

- WMG is initially focused on building mobile-friendly, arcade-style games to gain “wider adoption and community building”.

Oana Ruxandra, Chief Digital Officer of WMG, said in a statement “As we build, we will be unlocking new revenue streams for our artists and further solidifying fans; participation in value created.”

WMG understands the power blockchain technologies can bring to their business and they have a plan to utilize the creator economy to enhance their brand.

Nexo is one of the most user-friendly crypto lending and earning platforms in the industry. Unlock the Power of Your Crypto:

- ✅ Earn Up to 17% Annual Interest, Paid Out Daily

- ✅ Borrow Instantly: 21 Cryptocurrencies Available As Collateral

- Watch our How to Get Rich Trading Crypto Course if you struggled with today’s technical section.

- Read the following Technical Analysis guides for more insight:

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Kyle F., Max P., Nick T., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.