🧘♂️ALERT: Big Profit Strategy

Market Meditations | April 6, 2022

Dear Meditators

For the past 4 weeks we have highlighted individual NFT sectors, showing how we can use Nansen to track their performance, break them down into subcategories and ultimately, spot opportunities for profit.

Today we are going to summarize these NFT sectors and introduce one index that allows us to track the entire NFT market.

Today’s Meditations:

- NFT Sectors and Index

- Including big profit strategies

- $34 Million in Crypto Seized by Operation TORnado

- LooksRare has been accused of wash trading

With Nansen’s On-Chain data, you get an edge over everyone else by tracking the behaviour and on-chain activity of prominent wallet addresses.

- Exciting New Opportunities. Follow Smart Money, identify new projects, and trace transactions down to the most granular level.

- Perform Due Diligence. Get more information on projects or tokens before you invest.

- Defend Your Positions. Create real-time custom alerts and get notified when and where a wallet has been moving its funds.

- Track The Biggest NFT Traders. See what the most profitable NFT wallets are investing in.

⏰ Top Headlines

- Binance.US raises over $200 million at a $4.5 billion pre-money valuation

- Sky Mavis Raises $150M Round Led by Binance to Reimburse Ronin Attack Victims

- OpenSea goes live with support for Solana-based NFTs

- Starbucks announces NFT initiative as union-busting controversy continues

- Near Protocol Raises $350M

? An Open Sea of NFT Opportunities

Today we are going to summarize these NFT sectors and introduce one index that allows us to track the entire NFT market.

Sub-Sectors

1. Social (full breakdown)

Description: Social NFTs focus on creating a social connection.

Subcategories: Profile-picture projects, Access & Membership and Utility

Examples: Bored Ape Yacht Club, Cryptopunks

2. Art (full breakdown)

Description: Art is the expression of human creativity demonstrated in a variety of forms (often visual or audio). Art NFTs are simply an extension of this definition, applying this expression in a digital format where ownership can be verified on the blockchain

Subcategories: Generative, Digital and Physical

Examples: Lost Poets, Art Blocks

3. Gaming (full breakdown)

Description: Gaming NFTs are those that relate to online gaming. Thus far, gaming studios have owned the rights to all in-game assets (weapons/items), often prohibiting secondary markets.

Subcategories: Play-to-earn, Role-Play and Game-Fi

Examples: CyberKongz, Neo Tokyo

4. Metaverse (full breakdown)

Description: The metaverse can be defined as a network of virtual worlds that is looking to replace what is currently possible in the physical world including gaming, entertainment and commerce. NFTs allow those interacting with the metaverse to prove ownership of assets – an essential building block of any virtual world.

Subcategories: Assets, Land & Real Estate, Avatar and Utility

Examples: Sandbox, Meebits

NFT-500 Index

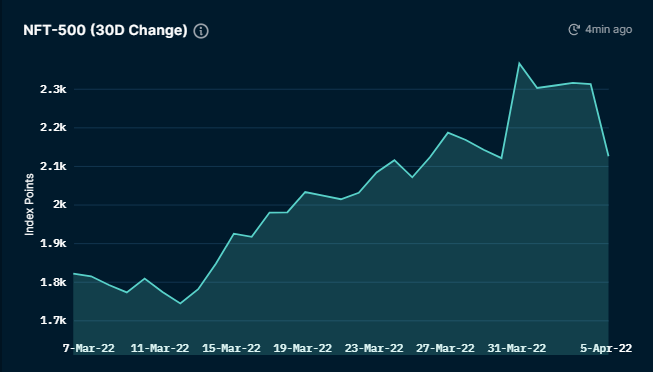

Nansen’s NFT-500 index tracks the top 500 NFT projects on the Ethereum network, weighting them by market capitalization. It shows how the entire NFT market is performing and can act as a strong benchmark.

By comparing the performance of any NFT collection or any sub-market NFT index against the NFT-500, we are able to understand whether our assets are trending upwards against the market or whether they are underperforming. This helps us determine the best opportunities and can bolster profits.

Performance over 30 days

Nansen.ai: 06/04/2022 – NSN-NFT500 30 day performance

- The index has performed well over the past 30 days, increasing its market cap by 54% in USD terms.

- Even though it has recently dropped by almost 10%, the sector continues to trend upwards over this time period.

- This indicates that there are opportunities to be found in the NFT market and to dive deeper we would look at the individual NFT sectors on Nansen.

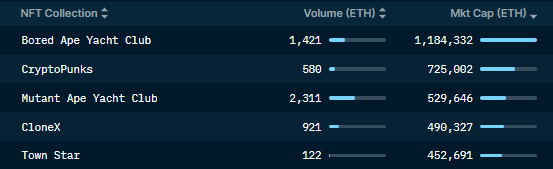

Largest Projects

Nansen.ai: 06/04/2022 – NFT Paradise (sorted by Market Cap)

- After their recent acquisition, Yuga Labs now own the 3 largest NFT projects.

- 3 of the top 5 fit into the social category.

- Bored Ape Yacht Club is the largest NFT project with a market cap of $4bn.

Tip: Nansen allows us to dive even deeper into individual projects, understanding price movements and whether any of the top-performing crypto investors are involved.

Conclusion

The NFT market has presented huge profit opportunities over the previous 12 months and after a period of cooling off, we are seeing a resurgence in trading activity. Through Nansen’s free tools, we are able to understand all sub-sectors of the market and use the NFT-500 index to spot exactly where the best opportunities lie.

?️ $34 Million in Crypto Seized by Operation TORnado

A joint investigation led by the OCDETF (Organized Crime Drug Enforcement Task Force) with federal, state, and local law enforcement agencies, called Operation TORnado, led to more than $34 million worth of crypto being forfeited to the US Federal Government. The target of the investigation, a South Florida resident, raked in millions of dollars per day in illicit activity.

- The South Florida resident used an online alias to make over 100,000 sales of illicit items.

- He sold hacked online account info on several of the world’s largest Dark Web marketplaces, such as account info for popular services like HBO, Netflix, Uber, and more.

- He was able to access the dark web by utilizing the TOR (The Onion Router) Network, which is a special network of computers around the world used to anonymize a user’s internet traffic by concealing a computer’s IP address.

- Using Tumblers and illegal Dark Web money transmitter services, (a technique called “chain-hopping”) he swapped one cryptocurrency for another, violating federal money laundering regulations.

This was the largest cryptocurrency forfeiture action ever filed by the United States. Asset forfeiture is the seizure of cash, property, or other items suspected of being tied to criminal activity. If one bad apple can ruin the bunch, we suppose one bad onion can also ruin the TOR Network or at least their reputation.

♻ LooksBare

People respond to incentives. However, sometimes those incentives can have unintended consequences. Last week we reported that the NFT marketplace LooksRare has been accused of wash trading and recent analysis suggests their tokenomics design is causing the problem:

- In January this year, LooksRare burst onto the scene looking to loosen OpenSea’s stranglehold on the NFT market.

- The decentralised platform quickly started to pick up users due to its lucrative incentives program, which included a token airdrop, lower trading fees, and staking rewards.

- However, based on CryptoSlam’s analysis, there are estimates that up to $18 billion (or 95% of volume) was linked to wash trading.

- Wash trading is when a single user creates multiple accounts to buy and sell items to artificially inflate their value and create the impression of high demand.

- Because $LOOKS tokens are rewarded to users based on the percentage of platform sales they represent, it incentivises traders to generate fake volume by doing business with themselves.

- When asked for comment by Forkast, LooksRare said that “token farming and wash trading are two entirely different concepts”.

- Data on Dunes Analytics suggests that organic growth is still happening, albeit at a slower rate, given the recent drop in overall NFT transactions since February.

A decentralised alternative to OpenSea is a welcome addition to the space and the reduction in daily awards should help reduce wash trading. However, when buying your own NFTs, make sure to check the history for trade irregularities and be aware of the risks of trying to flip quickly.

Solana is a player in the DeFi space.

Tomorrow, we’re looking at Marinade Finance to see how utilizing liquid staking can yield greater returns with varying levels of risk.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Isambard FA, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.