🧘♂️ALERT: Future of Crypto

Market Meditations | March 3, 2022

Dear Meditators

Ukraine has canceled its planned airdrop. Even though crypto has been growing for years now at an unprecedented rate, it still does feel slightly odd to say that…

What’s more, the Ukraine-Russia conflict has highlighted crypto’s use cases. Going far beyond ‘digital gold’ and instead, offering a new world order.

Today’s Meditations:

- As Good As Gold: Crypto’s Evolving Use Cases

- This article helps us understand the future of crypto

- Ukraine’s Canceled Airdrop

- New NFT Project Snowcrash

⏰ Top Headlines

- Anti-war Russians start donating crypto to support Ukraine

- Anchor Protocol’s ANC Rallies 23% – Here’s Why

- Bitcoin Mining Rig Maker Canaan Surges After Strong Results and Guidance

- Kaizen Guild Dashboard Went Live by BlockchainSpace

⚖️ As Good As Gold

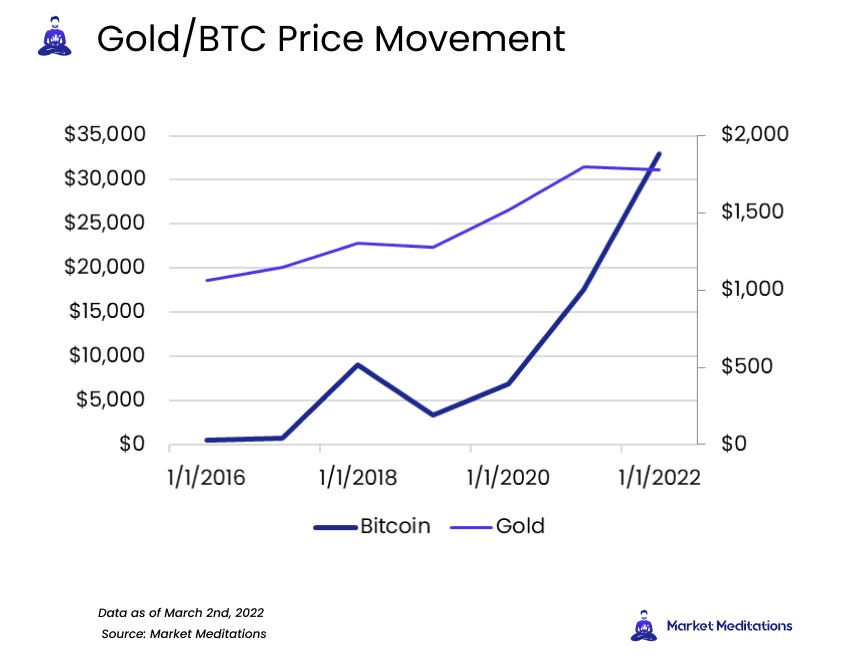

Gold and Bitcoin have shared a narrative since BTC’s popularity began to trend upward back in 2016. Some say the world’s largest cryptocurrency is digital gold, while others view it as a risk asset.

The chart below shows periods of correlation between the price action of gold and Bitcoin.

- 2019 featured a reversal in both the price of Bitcoin and gold. The pandemic had spread rapidly by the end of the year, and people began seeking out ways to shelter their capital from the storm.

- This trend did support the argument for Bitcoin as an inflation hedge. Precious metals are known for their rising prices in the face of events like increasing inflation, economic uncertainty, and crises.

- In the second half of 2021, gold began coming back down, while BTC accelerated its uptrend. This data suggests investors aren’t likely viewing Bitcoin as purely an inflation hedge.

Is Bitcoin still a hedge against inflation?

Some of the time.

From 2019 to 2021, the data looks like the world’s largest cryptocurrency was, indeed, perceived as an inflation hedge – and a far superior one to gold. Governments scrambled to assist plummeting economies. The United States took quantitative easing measures to mitigate worsening poverty levels in the face of mandated shutdowns.

But as we look at the second half of 2021 to present, the correlation has decoupled.

- Some have compared BTC to tech stocks, saying the digital asset bears more resemblance to these risk assets than gold.

- Anticipation of interest rate hikes on the horizon might be responsible for the lowering price of gold as investors turn to higher-yielding investments even though traditional stocks typically suffer the largest outflow of capital in the face of rising interest rates.

- The crisis in Ukraine has been saturated with headlines regarding Russians and Ukrainians alike turning to cryptocurrency as a method of avoiding the risks of holding fiat currency in an unstable political climate.

Even ignoring the practical technological use-cases of Bitcoin, its intrinsic differences from gold make it appealing for a broad array of reasons. Gold has clearly taken a seat as an inflation hedge, with little appeal elsewhere. Bitcoin continues seeing demand grow.

? You Qualified For An Air-Not

Ukraine has now received over $40 million in cryptocurrency donations since the country first tweeted on February 26th. Initially only BTC, ETH and USDT were accepted in donations. DOT was added on March 1st after the project’s co-founder, Gavin Woods donated $5 million in Polkadot to Ukraine’s cause.

- In response to the generous donations received, the Official Twitter account of Ukraine tweeted that an airdrop was confirmed.

- News of an airdrop was met with a flurry of micro-donations in Ethereum as shown by Etherscan.

- Many of the donations are between 0.001 ETH to 0.01 ETH which equates to around $0.30 to $30.

- According to Dune Analytics total donations increased at the time the airdrop was announced from 28,700 to over 80,000 total contributions.

- From this data, it is clear that some market participants are executing multiple transactions of little value, in an attempt to profit from the airdrop.

- Further data from Etherscan shows that the official Ukraine crypto donations wallet was testing the airdrop with a newly created token.

Just over 24-hours later, the Ukrainian government canceled plans for the airdrop. Vice Prime Minister, Mykhailo Fedorov announced in a tweet that instead, they would “announce NFTs to support Ukrainian Armed Forces”.

Regardless of whether contributors will receive an airdrop or an NFT, this has served as an important example of how the power of crypto can positively impact normal people in need.

? Like A Rolling NFT

Sony and Universal are usually competing, but this time they have teamed up! In the midst of the conflicts ensuing in Europe, NFTs just took a huge step forward for the music industry.

Sony and Universal just spent $550 million buying Bob Dylan’s music rights in order to partner with Bob Dylan and his newest NFT project. Make way for the newest platform – Snowcrash.

What is Snowcrash?

- The NFT trading platform was co-founded by Bob Dylan and his son. They are now partnering with Sony and Universal for this NFT venture.

- Snowcrash’s platform runs on the Solana blockchain and is owned by a Delaware-based company called Snowcrash Markets Inc.

- They entered a joint venture with FTX and are a partner of Solana labs.

- As of right now, NFTs will release on the platform from Bob Dylan, Miles Davis, and emerging artist, Varvara.

While several artists have dabbled with digital music as NFTs, this space is still largely untouched. If this platform takes off, we can see a big change in the way artists release music. This could create a different connection and dynamic between artists and fans. It would also put more money in the pockets of artists as they could set up royalties with smart contracts.

Delighted to say this article is brought to you by FTX. Make sure to use our link to get a 10% discount. Based in the U.S? Here’s a discount link for you: FTX.US.

- Based on past history, my views of the future world were never 100% spot on. Sometimes a bit off, often way off. It’s not the ability to see into the future that matters. It’s having the humility to adjust quickly – CZ

- I’m struggling to see how we are going to avoid a global recession. The odds are rising every day. Not a certainty yet but close – Raoul Pal

- If Metamask/Infura is open and willing to block countries like Venezuela by IP addresses, it’s only a matter of time until they are forced by regulators to censor individual people’s IP addresses. We need alternatives immediately, hoping that Alchemy and others don’t do this – Larry Cermak

- Netflix is planning to tell the tale of the unforgettable crypto hack that involved fake identities and physical gold – CoinMarketCap

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.