🧘♂️ALERT: Future of Crypto

Market Meditations | May 17, 2022

Dear Meditators

Stablecoins have had their names dragged through the mud recently.

Collateral damage has spilled over into more established digital assets, like USDT, as a result of Terra’s collapse. Regulators may use recent events as fuel for the CBDC fire, making the case that it’s a safer option for consumers.

Today we examine CBDCs and Stablecoins; what they are and how they will affect the evolution of digital currency.

We also share in-house data breaking down Terra price action and categorising the sellers at various stages.

Today’s Meditations:

- What CBDCs Mean For Stablecoins

- In-House Data and Analysis on Terra

- Latest Positive Developments for Crypto Infrastructure

⏰ Top Headlines

- EY unveils supply chain tracking service on Polygon Nightfall

- Do Kwon summoned to parliamentary hearing following UST and LUNA crash

- Revolut founder set to launch venture capital fund powered by artificial intelligence

- Spotify reportedly tests NFT galleries on musician profiles

❓Is CBDC-eason Around the Corner?

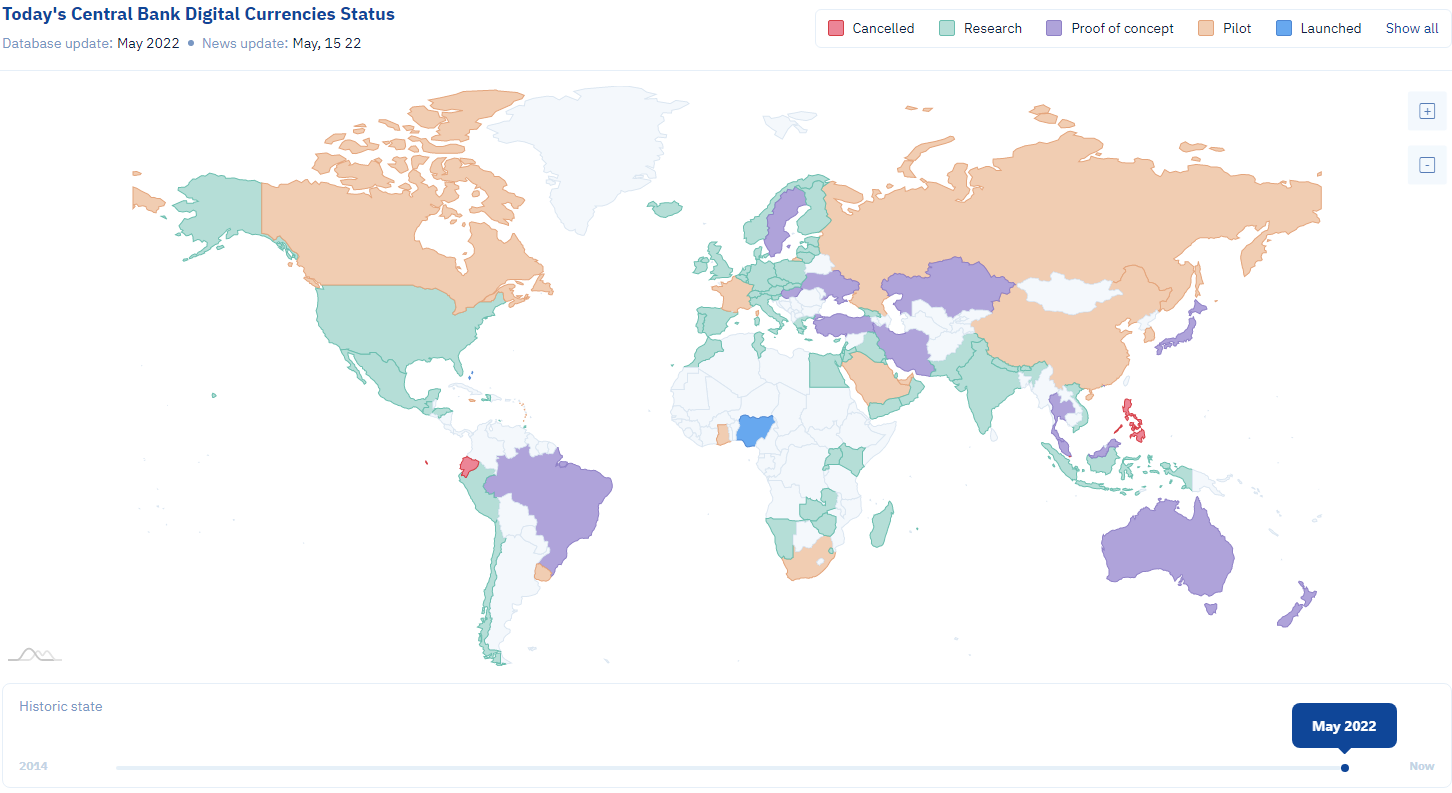

Data according to CBDCtracker.org shows a plethora of countries exploring the development of CBDCs in various stages of development. While few have launched, research is invariably leading to proofs of concept around the world, identifying valid government interests.

Central Bank Digital Currency (CBDC)

As the name implies, CBDCs are issued by a central bank instead of a private organization. The Federal Reserve (The Fed) and the Bank of England are examples of central banks. CBDCs are government-issued, and regulated by a central authority. As such, they are much more easily regulated and controlled. The upside is that CBDCs will almost certainly be insured and backed by governments, ostensibly increasing stability and security of holders.

Stablecoins

By now, most of us are familiar with these mainstays of the crypto space.

- These coins and tokens derive their moniker from being pegged (directly linked) to an asset, often fiat currencies such as the U.S. dollar or Japanese Yen.

- They are issued by non-governmental organisations, like Centre in the case of USD Coin(USDC) or MakerDAO in the case of DAI.

It might seem like these are two sides of the same coin, and they are – but with some key differences:

- Centralisation is the most important difference between these two contenders. Some stablecoins, like Dai, are decentralised. CBDCs are not.

- CBDCs are issued by governments, with no mechanism controlling their genesis. Stablecoins are dependent upon the supply of the asset to which they are pegged.

✅ Tip: Central banks, also known as reserve banks or monetary authorities, are institutions charged with managing currency and monetary policy for a state or country. These banks are controlled by governments and implement legislation and monetary policy.

What Does This Mean for Crypto Users?

The issuance of CBDCs will introduce competition to the stablecoin market. Many institutions hesitate to invest in cryptocurrency because of a lack of regulation and oversight. But those valuing decentralisation above security are likely to be more reluctant to go all-in on a government currency.

Moreover, cryptocurrency projects aren’t likely to integrate CBDCs before they’re in circulation. Even then, there may be philosophical reasons to hold off on welcoming these assets with open arms.

Development is picking up momentum around the globe as governments come to terms with the future of digital currencies.

What Does the Future HODL?

Regulation is likely, especially following UST’s collapse. CBDCs may hedge out stablecoins, impacting their price action. Frankly, it’s impossible to know, but staying abreast of this emerging topic will be advantageous no matter what happens.

The outcome rests on people like us. Institutions and governments undoubtedly control the trajectory of monetary digitisation, but the king of the hill is ultimately chosen by the people willing to use it.

Don’t want to be caught off guard? Check out Earnst & Young’s recommendation for banks and read the Fed’s publications on CBDCs.

? You Snooze You Lose

In times of crisis, failing to act quickly enough can be the difference between rich and rekt. There are no financial gurus wandering among the injured performing triage on who can be saved. Every LUNA and UST holder was on their own last week with a decision to make, and they fell into roughly four categories based on when volume surges were seen:

- Peg Watchers – on May 8th hourly trading volume suddenly quadrupled, as UST de-pegged for more than 4 hours. This had happened a few times before, dropping as low as 0.96 in May 2021. The ultra-cautious (or those with inside information!) cashed out here.

- Decisive Sellers – when the peg dropped to a new low of $0.75 on May 10th, volume shot up again peaking at nearly $9 billion. This group was led by panic-sellers offloading into the dip and the more astute traders selling into the relief rally back above 90 cents.

- Reluctant Sellers – the big crash on May 11th took people’s breath away and sellers who were reluctant before were now relieved to be able to get out when it briefly bounced back up above 80 cents.

- Bagholders – unfortunately, those who woke up with heavy bags on Friday the 13th were left feeling the weight upon their chests. Volume dead as a dodo and price unresponsive below 25 cents.

Some traders or investors may have suffered from a freeze response, which can be overcome through training and having a plan in place.

There are parallels here with the decisions firefighters and soldiers have to make in the field, and researchers have found that “redundant deliberation” normally happens when no standard policy (read: system) is in place, or when they encounter a new situation.

? Dawn of the Crypto Infrastructure

On Monday, Elwood Capital said that they had raised $70 million for their digital asset trading infrastructure.

- One of Europe’s largest B2B venture capital firms [by total assets under management – $1.5 billion], Dawn Capital, and Goldman Sachs just led a $70 million funding round.

- This funding is going toward expanding Elwood’s product offerings and global operations (e.g., building their crypto infrastructure).

- Elwood CEO James Stickland said that “The rich mix of investors participating in [the] raise reaffirms the movement of financial institutions working closely with their native digital asset technology providers.”

But I thought crypto was in a state of no return?

Many companies realize the opportunity that they currently have. Dawn capital general partner, Josh Bell, said, “Our investment in Elwood was a natural fit given the business’s cutting-edge technology, experienced team and significant market opportunity.”

Delighted to say this article is brought to you by crypto.com, the world’s fastest growing crypto app. Our favourite features:

- ? Earn Interest. Grow your portfolio by earning up to 14% interest on your crypto assets.

- ? Crypto.com Visa Card. Spend with the crypto.com Visa Card and get up to 8% back.

- ✅ Buy and Sell Cryptos. Join 10m+ users buying and selling 100+ cryptocurrencies at true cost.

You can use our link to download the crypto.com app.

- It has been inspiring to partake in the dynamic discourse regarding the best next steps for Terra. Taking feedback from the community and thoughtful proposals, I would like to suggest the following for the path forward – Do Kwon

- There goes my plans for a sunny retirement. Portugal has announced that it will begin taxing capital gains on cryptocurrency. – Coin Bureau

We’re Watching

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Isambard FA, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.