🧘♂️ALERT: Important Crypto Metric

Market Meditations | July 7, 2022

Dear Meditators

Understanding market caps can be confusing, but when fully comprehended, these metrics can provide invaluable insight into a cryptocurrency’s health and trajectory.

Join us as we demystify the numbers and use them to our advantage in assessing projects’ chances of success!

Today’s Meditations:

- Understanding Market Capitalization

- U.S. Dollar Dominance

- Bifrost Finance Raises the Stakes

⏰ Top Headlines

- Voyager Digital files for Chapter 11 bankruptcy, proposes recovery plan

- One of Wall Street’s largest trading firms is hiring a crypto trader for the weekends

- India’s cryptocurrency industry reels as new tax hammers trading

- Korea and US agree to share investigation data on Terra-Luna

? Thinking Caps

Market capitalisation is a crucial weapon in your arsenal when combating the crypto market. Market capitalisation (“market cap”) is a simple way to determine a cryptocurrency’s size. There are two types of market cap:

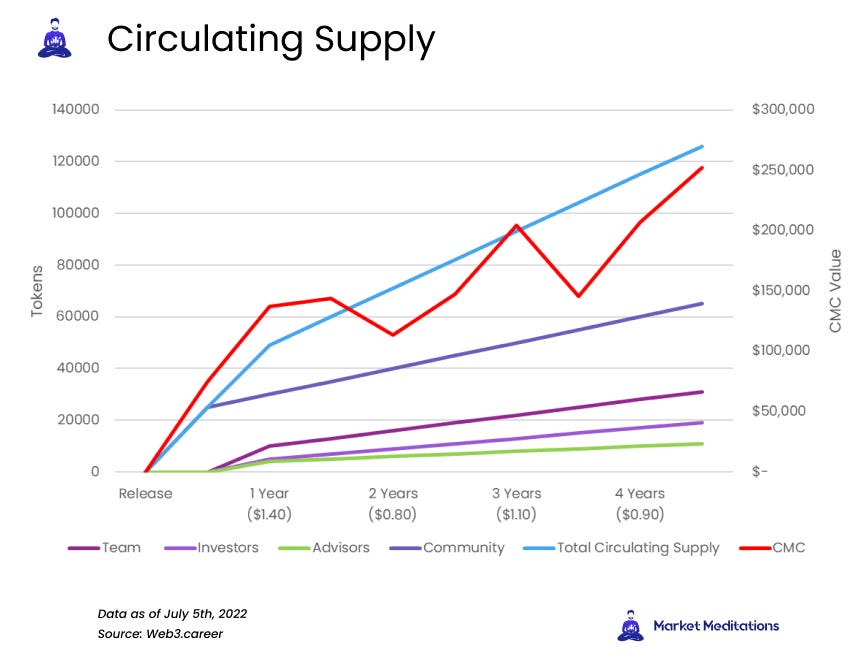

1️⃣ Circulating Market Cap (CMC) represents an individual token or coin’s market value according to the current circulating supply. CMC is calculated using: Current Price x Circulating Supply. This does not take into consideration tokens unlocked at a future date, meaning it should not be utilised in isolation.

The number of tokens in circulation increases as different groups of supporters receive emissions according to a schedule. The CMC can be calculated by multiplying the number of total tokens in circulation (the red line) by the token’s price (shown under each year).

2️⃣ Total Market Cap (TMC) represents the overall value of all cryptocurrencies. This data can easily be found on CoinMarketCap and CoinGecko alongside many other metrics for individual tokens. TMC helps form a broad macro outlook on how the cryptocurrency sector is performing.

✅ Tip: When using CMC to compare projects, be sure to dive deep into the project’s whitepaper to understand how and when more tokens will be unlocked.

Market cap is oftentimes considered alongside Fully Diluted Valuation (“FDV”).

3️⃣ Fully Diluted Valuation (FDV) represents the asset’s market cap once all future tokens are minted or unlocked. FDV is calculated using: Current Price x Maximum Supply. FDV is an important metric, as it can give investors a complete picture of the project’s future. The relevance of FDV within crypto is widely debated, but using it as a measure of confluence could support a potential investment.

✍️ Example:

At the time of writing, Dogecoin (DOGE) is currently worth $0.065536 per coin, with a circulating supply of 132.6 billion coins.

- Using our simple CMC equation from earlier, the current circulating market cap of DOGE is approximately $8.7 billion.

- Many market participants may look at the low price of DOGE and assume that it could easily climb to $1. However, this price target remains extremely unlikely.

- For DOGE to achieve $1 per coin, the market cap of DOGE would have to be approximately $132 billion, over twice the value of all USDT in existence!

- A similar theoretical calculation can also be used with FDV. Therefore, it is crucial to understand both CMC and FDV, as both can be used in different contexts.

MarketCapOf is a helpful tool to compare the market caps of different tokens and can be used to compare the market caps of similar projects.

4️⃣ Other Considerations

- Emissions refer to the speed and rate of new coins or tokens being minted. Keep these schedules in mind, as a large inflow of supply could affect the token price.

- Not all emissions result in immediate selling. Some tokens are subject to lock-up periods or vesting terms which prevent them from being accessible for periods of time.

- Burning mechanisms are designs includedto remove coins from circulation. Popular solutions include the “destruction” of a portion of transaction fees collected for activity on a network.

- Token burning acts to keep inflation under control in the case of tokens with no mint limit.

To better understand token vesting periods and gain a fuller understanding of tokenomics, study our two-part guide here: Tokenomics 101 & Tokenomics 102.

? Dollar In, Bitcoin Out

The U.S. dollar made headlines yesterday as it outperformed a basket of other fiat currencies in the market. Why is this happening and what’s the effect on the cryptocurrency market?

- Yesterday, the U.S. dollar index (DXY) made a new 20-year high, while the British Pound suffered, and the Euro recorded a 20-year low.

- This was set against the backdrop of rising interest rates, quantitative tightening and broader fears of a recession, which has also impacted commodities, stocks and will maybe take down property too.

- There is a fairly strong correlation between BTC and DXY, represented somewhat by investors’ flight to dollar safety in a risk-off environment. Indeed, Bitcoin has just locked in one of its worst monthly price performances in its history, dropping nearly 40% in June.

- Glassnode believes that Bitcoin is in the deepest part of a bear market, with low address activity and only the hardcore HODLers remaining.

- Interestingly, exchange outflows hit a record as more and more retail and businesses looked to self-custody, which is historically unusual in a sustained downtrend.

It seems we are still some way off a positive decoupling of BTC from other markets, where the majority of people hold onto their coins in a crisis. For more now on the U.S. dollar index check out our need-to-know summary here.

⏱️ Is It Time to Start Staking Again?

Bifrost Finance was the 5th winner of a parachain auction on Kusama back in July of 2021. The liquid staking platform is seeking a 50,000 KSM loan from the Kusama treasury worth $2.5 million.

- In exchange for staking coins on Bitfrost, users receive ‘vtokens.’Thetokens can be deployed in defi protocols on PolkaDot or Kusama.

- The loan will be used for liquidity for the staked KSM derivative called vKSM (similar to stETH). If approved, the loan will allow Bifrost to incentivize vKSM utilization across both chains.

- The proposal requests the loan for one year, offering a generous 19% interest rate.

- Bifrost plans to split the loan between Solarbeam, a decentralized exchange on Moonriver, and Taiga Protocol, a derivatives protocol similar to Synthetix. Each protocol will receive 25,000 KSM to provide liquidity for the KSM/vKSM trading pair.

The loan has not yet been approved, but can currently be voted on by the Council, the Polkadot and Kusama governing body, and the general community. Given the recent climate in centralised finance, it will be interesting to see what incentives are given to stakers, and whether those incentives will bring the volume and TV that they have in the past for other chains.

This article is brought to you crypto.com, the world’s fastest growing crypto app.

- ? Join 500+ users buying and selling 250+ cryptocurrencies at true cost

- ? Spend with the crypto.com Visa Card and get up to 5% back

- ✅ Grow your portfolio by receiving rewards up to 14.5% on your crypto assets

You can use our link to download the crypto.com app.

✍️ Study

- Study Tokenomics 101 & Tokenomics 102

? Explore

- Check out CoinMarketCap and CoinGecko to find data on every cryptocurrency.

- Use MarketCapOf to compare the market caps of two different projects easily.

?♂️This Says It ALL! Crypto Recovery Incoming!

For today’s top headlines, head over to the Market Meditations YouTube where you can watch our Market Update Video.

- Africa is primed for crypto adoption. 10-20% banked. Need financial access and inclusion. Blockchain provides that with a smart phone. – CZ Binance

- Crypto ‘The Biggest Ponzi Scheme In Human History’ – China Blockchain Execs Back Bill Gates And Warren Buffett After Huge Bitcoin Price Crash – Forbes Crypto

- Count down to the FOMC minutes in just under 7hrs. Will we see anything in there that pumps or dumps the markets? – AlphaBTC

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Isambard FA, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.