🧘♂️ALERT: Price Up 145%

Market Meditations | April 1, 2022

Dear Meditators

Bitcoin has closed the quarter down 2%. One of the notable themes of the quarter was the close correlation with the S&P 500. The month of March itself closed with 9% gains.

Today’s Meditations:

- ETH, WAVES and FTM Technical Analysis

- Latest News from the EU

- Japan’s Statements on Crypto

⏰ Top Headlines

- Bored Ape Yacht Club confirms its Discord was hacked

- Citi Sees Metaverse Economy as Large as $13T by 2030

- Axie Infinity Delays Launch of ‘Origin’ Game Following Massive Hack

- OpenSea rolls out credit card payments for NFTs

? Staying Out of Goblin Town

ETH/USD

Macro Structure: Pretty big move up that has claimed the 100 Day Moving Average with little retracement.

Key Support: Invalidation level at $3k. Below this, goblin town.

Key Resistance: $3.4k and $3.6k.

Looking Forward: Potential bounce zone at the 0.382 level.

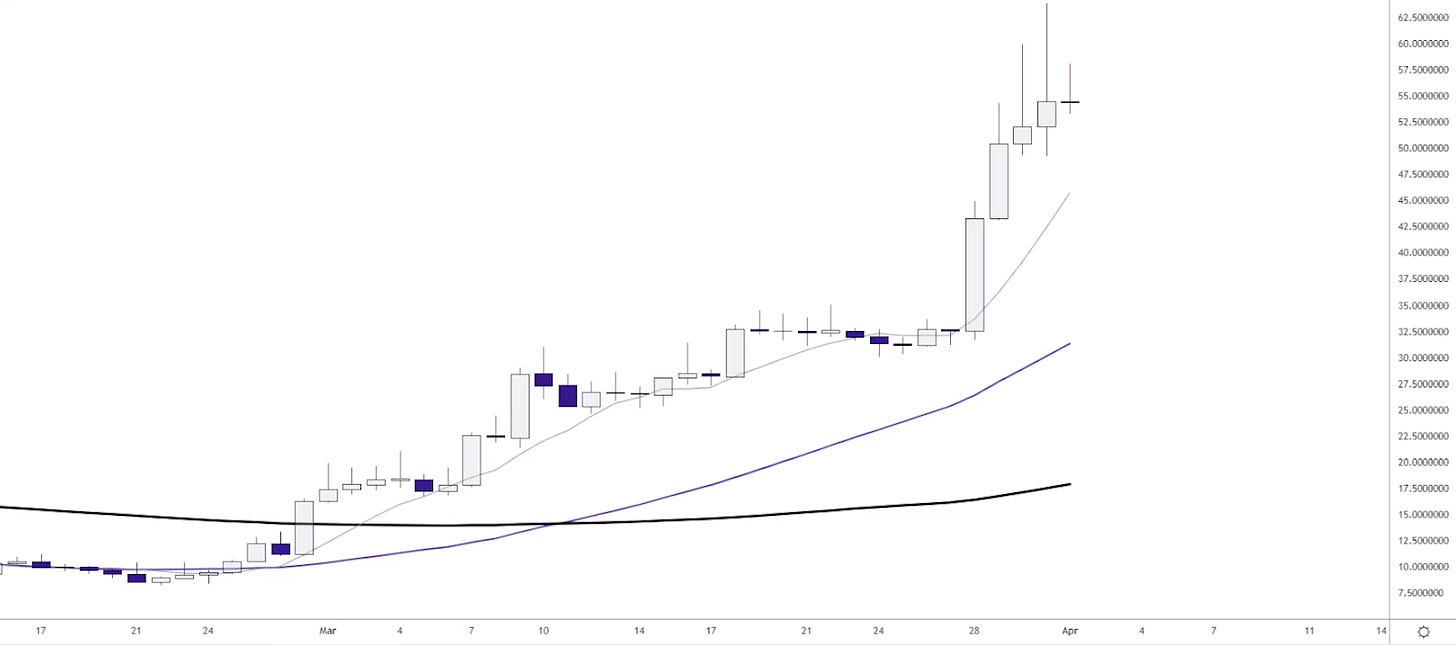

WAVES/USD

Trade Recap: On our March 11th newsletter we flagged a potential entry at the $22 level. The price is now at $54. If you made a move, congratulations.

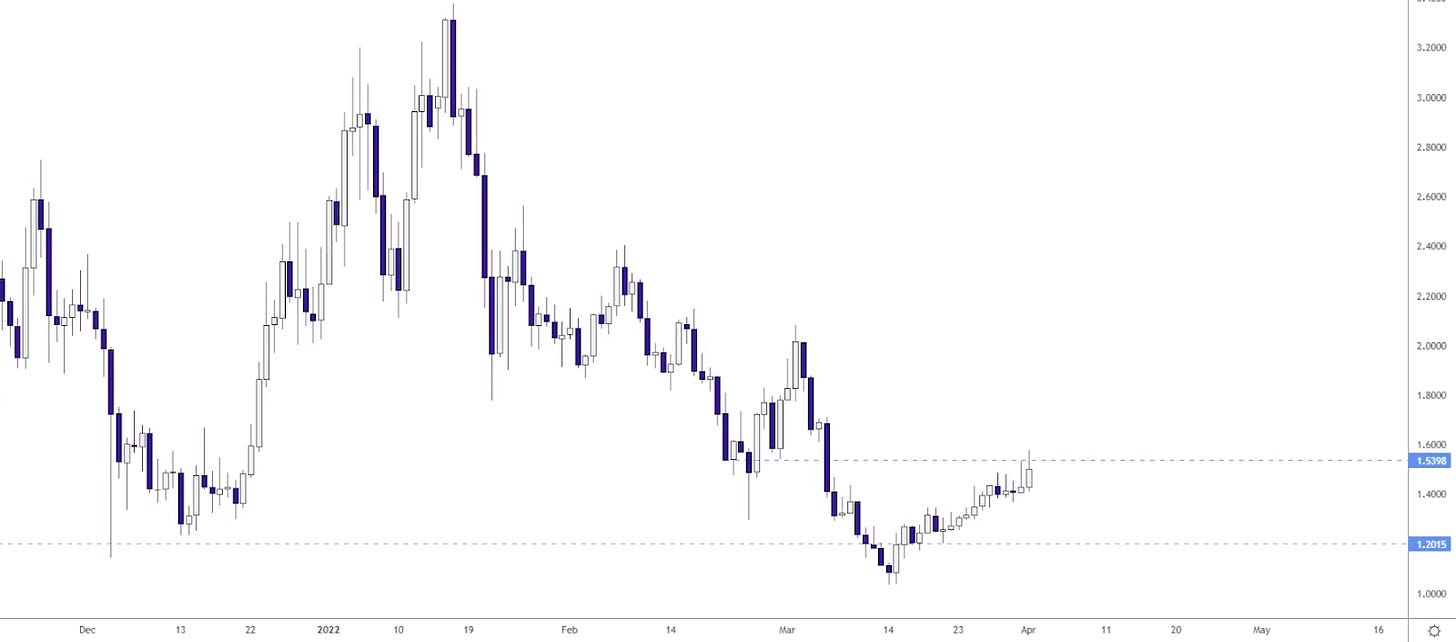

FTM/USD

Macro Structure: Previously suggested $1.2 as a potential bounce level.

Key Resistance: Testing resistance right now at $1.54.

Looking Forward: Above $1.54, the next stop maybe $2.

? Prepare to Be Doxxed

As bitcoin approached the 200-day moving average, lawmakers in the European Union swooped in to knock it down with (what they call) an anti-money laundering proposal. In the ninth hour, Brian Armstrong of Coinbase lobbied against the bill he is calling “anti-innovation, anti-privacy, & anti-law enforcement.” One complaint against the proposed legislation is that it treats crypto holders differently than fiat holders.

The biggest complaints against the legislation are:

- Transacting with more than 1000 euros of crypto must be reported to anti-money laundering authorities.

- Unhosted wallets are under much heavier scrutiny. If you want to send or receive crypto from the unhosted wallet, exchanges will be required to gather & store data about the owner of the unhosted wallet (such as Trezor, Ledger, and Metamask).

- These requirements will create “data honeypots,” both inside of private crypto companies and government agencies. The ‘data honeypots’ will be targeted by hackers. Not only will wallet holders be easily doxed, but hackers will know exactly how much crypto you have, who to phish for, and where to send their phishing attacks (both digitally and physically).

The Transfer of Funds Regulation passed in parliament with 58 votes for, 52 against, and 7 abstentions. Next up, the legislation will go to the trilogue talks between representatives of the European Parliament, European Council, and European Commission and that is where there is a small glimmer of hope.

During the trilogue talks, there will be a window for challenge and revision; as reported by The Block, the European Council and Commission should be more technically savvy and less politically motivated to move forward with this blockade against self-hosted wallets.

Bank of Japan Implores G7

Cryptocurrency regulation isn’t specific to a single country, it’s an international affair. The Bank of Japan (BOJ) has informed the G7 that a regulatory framework for cryptocurrency urgently needs to be introduced.

- The Group of Seven (G7) is an international governmental political forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. The organization brings together the world’s advanced economies to influence global trends.

- Kazushige Kamiyama, head of the Bank of Japan’s payment systems, told Reuters stablecoins make it easy to “create an individual global settlement system”, offering a way to avoid using regulated payment systems.

- Crypto has been growing in adoption for years, but has recently been thrust onto center stage as speculation and reports surrounding Russia’s potential evasion of sanctions using digital avenues.

- Kamiyama recognized that the introduction of a regulatory framework would impact the design process of Japan’s central bank digital currency (CBDC), the digital Yen, even though BOJ governor Harujiko Kuroda announced nothing is planned regarding introducing a CBDC any time soon.

It’s a perfect time to remember that regulation is a growing pain that cryptocurrencies must undergo. In the end, acceptance and regulation must come hand in hand.

- Watch our How to Get Rich Trading Crypto Course if you struggled with today’s technical section.

- Read the following Technical Analysis guides for more insight:

Today’s trending tweets are April Fool’s Day Inspired. Proceed with caution.

- Peter may be Satoshi because he does a good job pretending not to understand #bitcoin. (Apr 1) – CZ Binance

- Breaking: the Federal Reserve bought Bitcoin! – Dan Held

- We had a bitcoin joke planned for today, but we’re hodling on to it. – FTX

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Kyle F., Max P., Nick T., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.