🧘♂️ALERT: The Truth About Crypto

Market Meditations | June 3, 2022

Dear Meditators

The crypto market is full of moon boys and moon charts, but it is the demise of the moon coin that led to our recent state of market instability.

Unfortunately, Do Kwon’s plan of ‘what to do in the event of a depeg’ wasn’t as carefully thought out as we all would have liked.

Today, we consider the aftermath of the LUNA collapse.

Today’s Meditations:

- LUNA – The Aftermath

- Signals From Elon Musk?

- Another Day, Another Hack

⏰ Top Headlines

- Wealthy Coinbase clients are still ‘hodling’ Bitcoin since December 2020, data suggests

- Elon Musk says Dogecoin creator didn’t help him to fix Twitter bots

- Cardano’s ADA Spikes 25%, Leads Gains in Crypto Majors

- Optimism (OP) token to hit market today, centralized exchanges say

? Chronicles of the Luna Eclipse

After a few days of radio silence, Do Kwon tweeted out several ideas on how to redeem the UST peg, but the damage was done.

The Terra blockchain was halted to prevent governance attacks and eventually proposal 1623 was passed to revive Luna but not UST since it was their elastic relationship that led to the hyperinflation of Luna. LUNA 2.0 was rolled out as follows:

- Eligibility: Luna 2.0 was airdropped to Luna Classic stakers and holders, residual UST holders, and essential developers. Technical issues made the distribution to some bridges, chains, and exchanges difficult, but you can see the supported list here.

- Distribution: 30% – Community Pool, 35% – Pre-Attack LUNA holders, 10% – Pre-Attack aUST holders, 10% – Post Attack LUNA holders and 15% – Post Attack UST holders.

- Allocation: Wallets holding less than 10,000 Luna received 30% of their allocation of new LUNA at genesis, for more details, see our summary or the proposal.

While many developers and VC’s seemed to support Do Kwon and the Terra 2.0 plan, defi protocols Lido Finance, Figment, and Chorus One felt there was too much uncertainty regarding the future of the blockchain and prefer to wait until more information is available.

On the whole, the revival plan was unsuccessful.

Terra Devs, Will They Stay, or Will They Go?

Another cohort heavily impacted by the events was Terra developers.

Developer jobs are in hot demand, especially Terra devs. According to Up Top founder, Dan Eskow “there aren’t that many engineers who have been deep enough in DeFi to see a project scale like Terra.”

- Just one month before the depeg, Neel Somani, a 24-year-old developer, left his job at Citadel to build Terranova. He has already been contacted by Avalanche, Osmosis, and Secret.

- KADENA has launched a $10 million Terra relief fund for devs to migrate over to their chain.

- POLYGON and Binance’s BNB Chain are not limiting the funds to a specific dollar amount but are courting Terra devs as we speak.

NFT Marketplace Random Earth, DeFi project Nebula and decentralized exchange Phoenix Finance are among the projects that have announced their solidarity with Terra 2.0.

However, on the whole, both developers and projects are migrating to greener pastures.

Now, For The Cherry On Top…

Migrations and disappointments hold a certain weight but the ‘cherry on the top award’ can be claimed by legal ramifications.

Rumors of class-action lawsuits and even criminal charges against Do Kwon hang over the release of the new chain.

Having your entire legal team quit amidst the collapse of the ecosystem is certainly a red flag but proving that Do Kwon did something fraudulent as opposed to just mismanaging the fund will be difficult.

Nonetheless, this is an ongoing topic of discussion with live developments.

Final Words

The aftermath of the LUNA collapse has been failed revival plans and migrations of developers and projects. Perhaps even legal ramifications.

All one can really do is manage their personal circumstances.

If you were negatively affected by the Luna Eclipse, it’s important to assess where your failure or mismanagement was.

Our Ultimate Crypto Wealth Guide covers a variety of topics like taking profit, trading with a plan, and even insuring your crypto that can help you prepare future strategies.

➗Is It a Sign?

Elon Musk has the kind of Twitter following that can move markets. Did he just give us a secret signal that the market was due for a turnaround? Some crypto enthusiasts think (or hope) so.

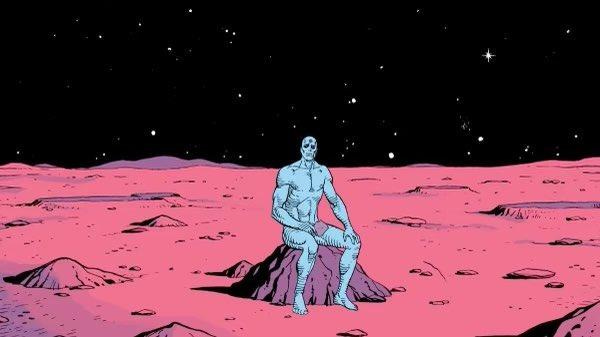

- On May 28, 2022, Musk shared this image.

- On November 13, 2021, Musk shared a similar image with the man sitting and looking in the opposite direction.

- At the time, the opposite image may not have been recognized as a signal but if you look back at your trading view chart, Bitcoin has certainly been in a downward trend since Nov 13, 2021.

- This wouldn’t be the first time that Musk was accused of signaling to his followers. The SEC has frequently taken him to court, fining him and Tesla millions of dollars for tweets that affected the price of Tesla shares.

- In December of 2020 the one-time meme coin DOGE was still trading for fractions of a penny, but his tweets sent the coin to an all-time-high of $0.73.

- After tweeting that Tesla would accept Bitcoin as payment in March of 2021, Bitcoin went on to hit the range-high just a few weeks later.

Is it possible that Musk is also a trading ninja on top of being a CEO of multiple companies, and is all-knowing when it comes to market trends? Or is the market trying to front-run what it perceives to be signals, kind of like the time he tweeted “Use Signal” and an obscure biotech company’s stock rose 5,643%? Either way, if the market does turnaround now, we might have to incorporate ‘Musk tweets’ into our future trading strategy.

If you want to know how and why the market reacts as it does to Musk tweets, our Market Sentiment Guide is a good place to start.

?️ Mirror, Mirror

There’s never a time to relax your guard in crypto. Hacks and exploits continue to roll in, no matter what the market looks like. The latest protocol to reflect this very real possibility is Mirror.

- An attack was identified yesterday that could be responsible for more than $2 million in losses so far.. In a plot twist easily confused with an Austin Powers sequel, the bug had to be fixed by 4AM EST today or all of the protocol’s tokenised assets were to become at risk.

- Mirror protocol is a platform allowing users to engage tech stocks using synthetic versions of these targeted assets. In addition to stocks, synthetic versions of other cryptocurrencies, like Bitcoin, are available.

- A community member, pseudonymously known as FatMan, told The Block his estimation of loss had already surpassed $2 million, but hesitated to give a total of the damage without additional confirmation.

- Because the remaining pools are all tied to the stock market which did not open until earlier this morning due to the holiday weekend in the United States, developers raced the clock to correct this vulnerability before further damage was dealt.

- The error was due to a faulty, outdated oracle, which returned inaccurate pricing data for the underlying versions of synthetic assets on Mirror.

There’s never a time to relax your guard in any industry. If money’s involved, bad actors will continue to find ways to filch it. Do your research before investing. This wasn’t the first time Mirror was attacked.

Get acquainted with best practices when it comes to crypto security here.

- In bear markets, it is actually easier to spot the weak projects, and founders who are money driven instead of mission driven. – CZ Binance

- Attention $LUNA airdrop recipients. We are aware that some have received less $LUNA from the airdrop than expected & are actively working on a solution. More information will be provided when we have gathered all of the data, so stay tuned. – Terra Powered By LUNA

We’re Watching

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Isambard FA, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.