🧘♂️ALERT: What Next for Bitcoin?!

Market Meditations | February 24, 2022

Dear Meditators

War has broken out between Russia and Ukraine as Russian President. Vladimir Putin launched a ‘special military operation’ within the Ukrainian Donbas region. Europe and the U.S. have already begun sanctions on Russia and are threatening further sanctions should the war escalate.

War destroys lives and negatively impacts financial markets. Today, we assess the impact on crypto markets and look ahead to useful tools and metrics for the future of Bitcoin.

Today’s Meditations:

- Russia-Ukraine Conflict: What it Means for Crypto

- Look out for the Whalemap Chart that helps show the future of Bitcoin

- Powerful Crypto Tool: Mining, Hash Rates and Bitcoin Price

- Latest Solana Project

⚔️ War Never Changes

Since Russia officially invaded Ukraine at 5 am local time, crypto markets have suffered. Bitcoin (BTC) and Ethereum (ETH) have fallen 9.3% and 13.3% respectively in the last 24 hours. At the same time frame, XAU/USD (Gold) has increased 3.42%, now hovering near eight-month highs.

- Amongst crypto natives, BTC is often referred to as digital gold. However, in reality, it is doing the opposite of what we might expect from a ‘safe haven’ asset such as gold.

- This is because, during economic turmoil such as war, traders tend to favor less risky assets.

- Despite crypto’s boom in popularity, BTC is still widely regarded as a high-risk asset and recent events highlight its vulnerability to macroeconomic shocks.

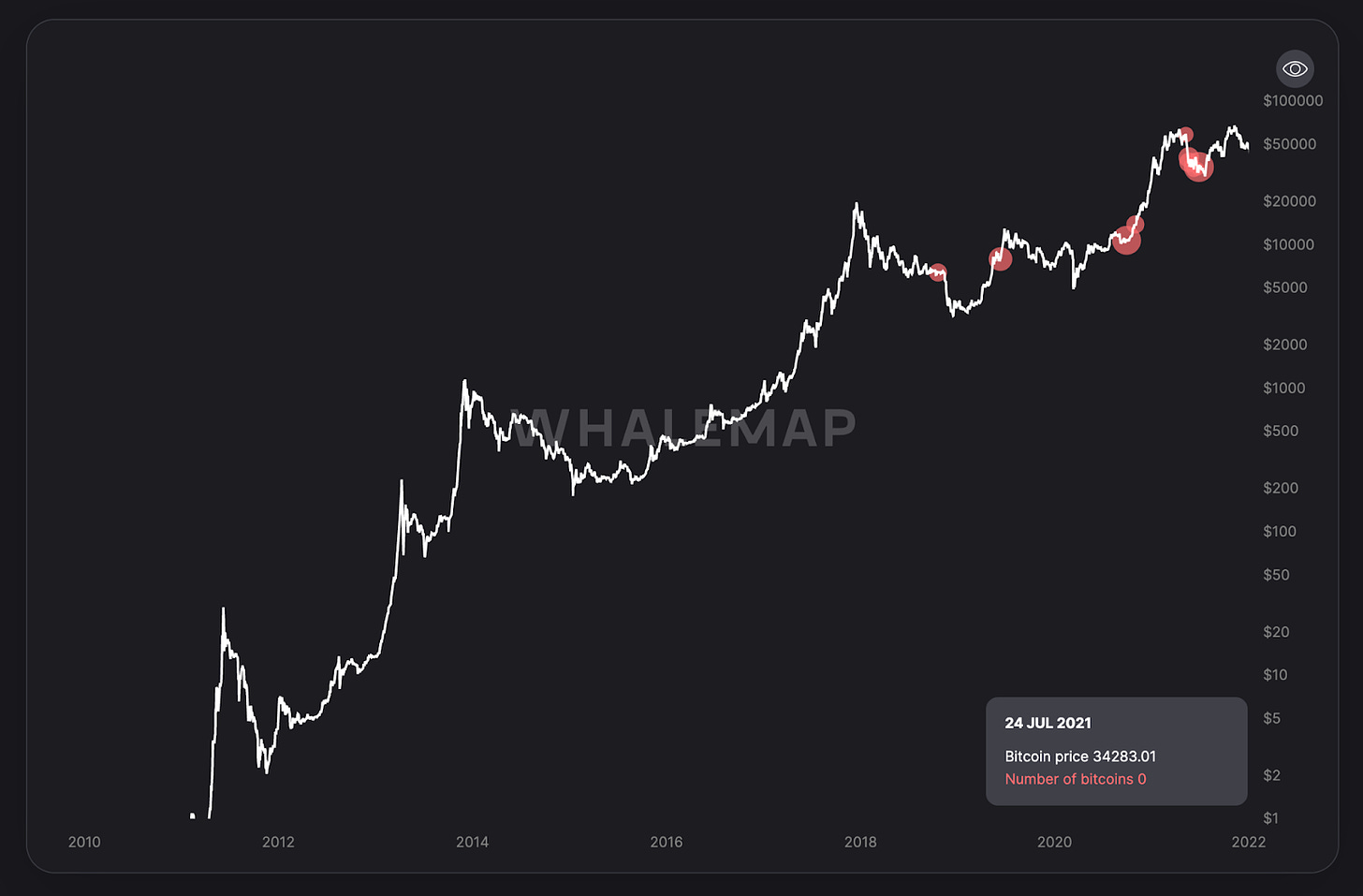

Despite obvious fear in the markets, we can study on-chain analytics using Whalemap to understand how BTC holders are reacting to the news.

Source: Whalemap

What Next For Bitcoin?

HODLer Outflow shows original acquisition prices of HODLers that were moving BTC on the date specified by the slider. The larger the bubble the more bitcoins a HODLer has moved from that location.

Today, we are experiencing low HODLer activity. In other words, very few are moving BTC. This tends to be a good sign that the majority of HODlers’ long term convictions remain unphased by recent news.

⛏️ Mined Over Matter

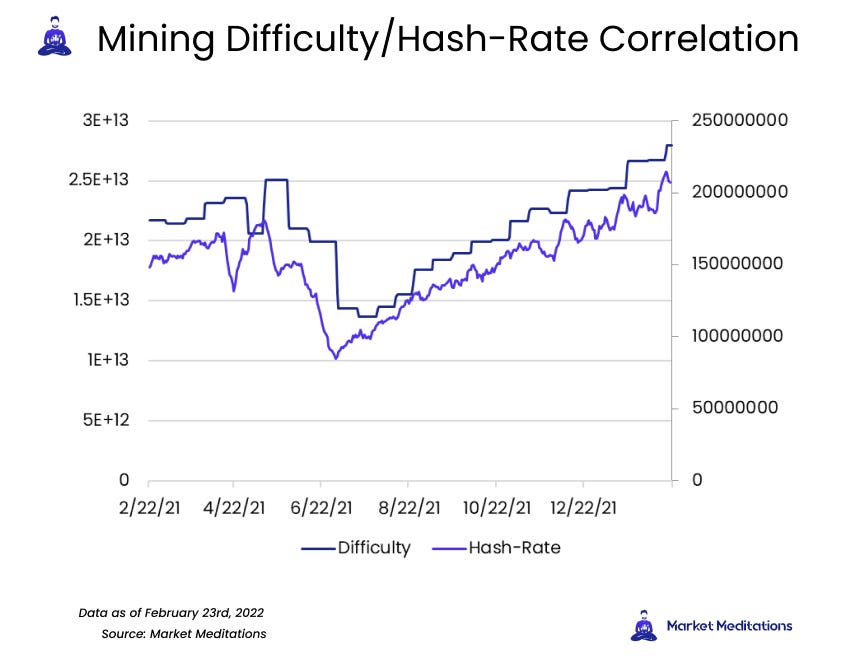

Bitcoin miners are out to make money just like everyone else. When calculating profitability, miners have two key considerations: energy costs and the BTC price. The data below shows that hash rate and mining difficulty go hand in hand. The more machines mining Bitcoin, the more difficult mining becomes.

As the hash rate rises, more computing power is being designated to the Bitcoin network. As a result, the security and difficulty of processing the transactions required to conduct business on the Bitcoin blockchain increases.

- The BTC hash rate is the measure of computational power being used to verify transactions and contribute to the blockchain in Proof of Work networks.

- Mining Difficulty is a unit of measurement which indicates how difficult the cryptography currently is to process blocks on the BTC network.

- Miner Capitulation occurs when less-efficient miners are forced to sell holdings in order to pay for operational costs. This event is usually galvanized by a sharp, sustained fall in BTC price and can contribute to cascading downward pressure.

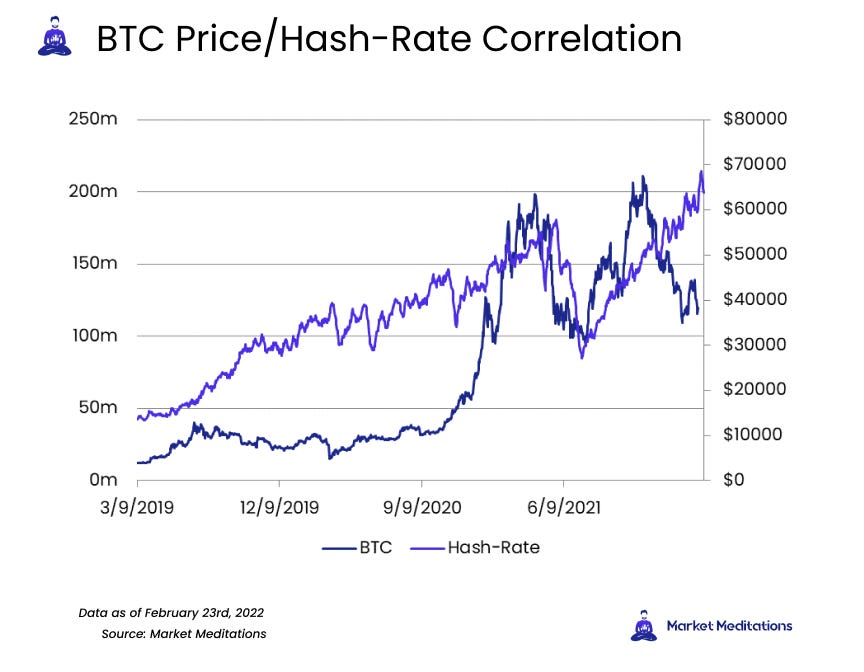

The chart above shows that hash rate and price do enjoy a relatively close relation. However, at the end of the year these began to diverge. Data indicates that even during periods of extended price stagnation or short-lived unexpected dumps, miners continue to invest because they see long-term profit potential.

Some traders have drawn correlations between the extended hash rate trend and the Bitcoin price. Most of us take for granted the inevitable growth of the largest cryptocurrency, but having data to back up ideas enables us to justify such comforting thoughts.

Blood in the streets is the time for buying and hash rate correlation lends some proof in the pudding.

Get Plugged In!

- The higher the hash rate, the healthier the network. When miners recognize or anticipate BTC’s price as being profitable, they continue to join the network. Monitor the state of the hash rate here.

- Keep track of the global distribution of mining operations. If these organizations are fleeing countries because of steep energy costs, it could be a consequence of price action.

- Energy costs around the world play a key role in determining miners’ profitability. Monitoring worldwide energy price indexes can have implications for miners.

- Monitoring legislation often provides insight into the future of crypto. When mining legislation is discussed or implemented, it can have a major impact.

Understanding the technology behind Bitcoin is an important step in becoming an educated investor. Mining operations continue popping up around the world and the BTC network continues expanding, regardless of bumps in the road.

? Zebec – The Future of Payroll Processing

Zebec is a Solana payment processor that recently raised $15 million! Let’s take a closer look to find out what Zebec is.

- Zebec is a tax compliant, on-chain payroll processor that can pay employees via USDC or other stablecoins.

- During this venture round, Zebec raised $15 million for their proof-of-stake protocol.

- Within a few months of launch, the protocol has over 250 projects built on the blockchain.

- Zebec has plans to launch a debit card that will support fiat-to-crypto conversions.

Why is Zebec useful? Employees that are curious about the crypto world may now have easy access to crypto. Not only will they be taking on little to no risk with stablecoins, but this money will also be taken directly from their paychecks and not have to be transferred via traditional methods.

Remember to look in the macro. The Zebec protocol is making it easier to send and receive payments on an ongoing basis. While current events will make prices fluctuate in the micro, this exciting news will have a lasting impact.

Delighted to say this article is brought to you by crypto.com, the world’s fastest growing crypto app. Our favorite features:

- ? Earn Interest. Grow your portfolio by earning up to 14% interest on your crypto assets.

- ? Crypto.com Visa Card. Spend with the crypto.com Visa Card and get up to 8% back.

- ✅ Buy and Sell Cryptos. Join 10m+ users buying and selling 100+ cryptocurrencies at true cost.

You can use our link to download the crypto.com app.

- Some thoughts on crypto, Ukraine, and stocks (Thread) – SBF

- Agreed. No significant on-chain activities during this war crisis. 1/ Institutions who bought $BTC via on-chain txns seem not sold their holdings yet. 2/ Institutions running algorithmic trading bots think BTC is a tech stock. I’d rather stay until @saylor sells #Bitcoin – Ki Young Ju in Response to SBF Thread (Shared Above)

- #Bitcoin down, gold up. Seems most investors see bitcoin as a tech stock like Google or meme stock, not as a commodity / digital gold (Chart) – PlanB

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.