Antifragile: Things That Gain From Disorder – Nassim Taleb

Market Meditations | January 26, 2021

In a previous letter, we covered the key takeaways from Nassim Taleb’s (@nntaleb) ? The Black Swan. In a sentence, we explored how low probability, high impact events can have a huge implication on traders and investors.

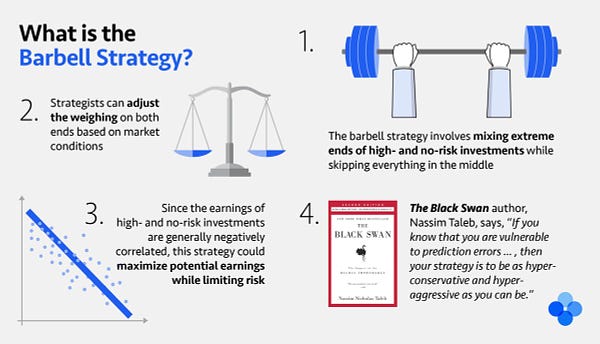

In today’s letter, we take a look at another Taleb book. This time: Antifragile: Things That Gain From Disorder. Specifically, we investigate his ‘Barbell Strategy’ as a portfolio allocation method.

This topic was inspired by the responses to our ✏️ thread, where we asked the Market Meditations community what their portfolio allocation strategy was.

It is worth noting that this strategy served Taleb particularly well during the 2008 Global Financial Crisis. He thrived while many fellow traders and investors went bankrupt. We always enjoy watching Taleb interviews, if you too enjoy the one below, you can also check out his iconic ? Commencement Speech ?

Traditional Theory of Portfolio Allocation

Many traditional theories of portfolio allocation are based on the thesis of risk tolerance, which is usually linked to age. For instance, this is the theory explored in Malkiel’s A Random Walk Down Wall Street.

Risk tolerance determines the proportion of low, medium and high risk investments an individual makes. Examples of each:

- Low risk = government bonds and bank certificates of deposit

- Medium risk = blue chip stocks

- High risk = speculative stocks such as initial public offerings (IPOs), cryptocurrencies or small biotechnology companies

The young investor might put 40% in speculative stocks (high risk), 40% in blue-chip stocks (medium risk) and just 20% in government bonds (low risk).

On the other end of the spectrum, the old retiree might keep 80% in bonds (low risk) and 20% in blue-chip stocks (medium risk).

? Followers of Taleb’s barbell strategy would argue that the middle of the risk spectrum should be ignored altogether.

Barbell Theory of Portfolio Allocation

Taleb argues that an effective risk-taking strategy should strive to be ‘antifragile’: fully protected from total ruin while being exposed to the occasional unlimited upside.

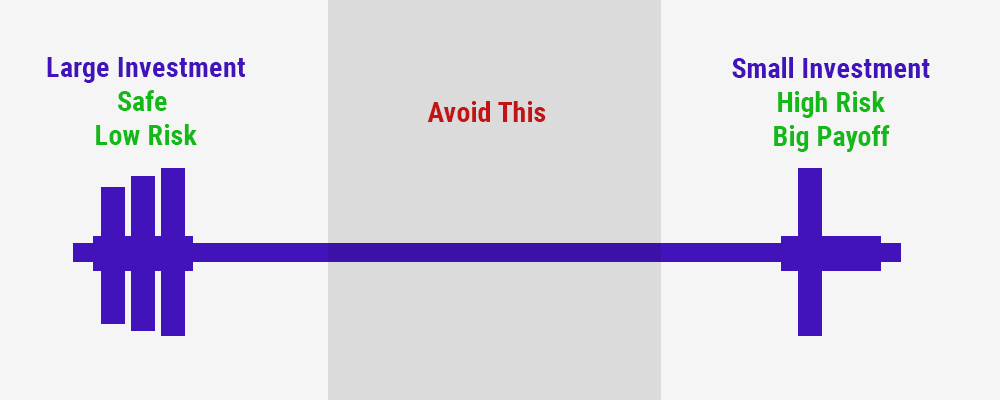

From this, he forms what is called the barbell strategy. You can imagine a physical barbell.

- A real life barbell has weights on each end and a bar in the middle to connect them.

- With an investing barbell, on one side you have a small proportion of investments that are high risk but have high reward potential.

- On the other side, you have a larger proportion of investments that are low risk and low reward potential.

- No investments are held in the middle, or in other words, nothing medium risk or “average” is held in the portfolio. As Taleb puts it:

“I initially used the image of the barbell to describe a dual attitude of playing it safe in some areas and taking a lot of small risks in others, hence achieving antifragility. That is extreme risk aversion on one side and extreme risk loving on the other, rather than just the “medium” or the beastly “moderate” risk attitude that in fact is a sucker game (because medium risks can be subjected to huge measurement errors). But the barbell also results, because of its construction, in the reduction of downside risk — the elimination of the risk of ruin.”

Eliminating the Risk of Ruin

When it comes to portfolio allocation, Taleb believed that a lot of professionals misunderstood how to make profits over the long run. They believe that the focus should always be on coming up with bets that make them a lot of money.

? But what’s most important is something different. The difference appears minor but it is not. What’s most important is NOT to lose money.

A large proportion of low risk, safe investments has the critical benefit of protecting investors from the risk of ruin. As we have written many times, when it comes to trading and investing, survival is key. It’s not just us and Taleb who think so. Warren Buffett famously said:

“The first rule of investing is: never lose money. The second rule of investing is: never forget rule number one.”

And if you don’t take Buffett’s word for it, consider Ray Dalio’s advice:

“Make sure that the probability of the unacceptable (going bust) is nil.”

In a barbell strategy, the large chunk of investments are in hyperconservative investments thus eliminating the risk of ruin.

The Unbalanced Middle

To all the risk-averse #crypto investors out there looking to maximize earnings and minimize risk, here’s an investment strategy @nntaleb approves of: the BARBELL STRATEGY ?️ Learn more ? bit.ly/379BJzX

The middle is unbalanced due to the risk reward trade off. Being in the middle gives you risk and limitations, while you’re not even exposed to the maximum upside.

What’s more, the occurrence of ‘Black Swan’ events means that the risk is incomputable. Sometimes, there are particularly special and rare events that leave such a profound impact that move markets in a severe and unpredictable way. We categorize these events as “Black Swan” events.

“Someone with 100 percent in so-called “medium” risk securities has a risk of total ruin from the miscomputation of risks. This barbell technique remedies the problem that risks of rare events are incomputable and fragile to estimation error; here the financial barbell has a maximum known loss.”

?Being in the middle gives the illusion of safety, but it’s actually the worst of both worlds: you’re still exposed to being wiped out by a black swan, while also having no opportunity to tap into the colossal gains that can swirl out of the same chaos.

In a recent CNN interview ?, Anthony Scaramucci noted how if you had a dollar, and kept 99 cents in cash and the other penny in bitcoin, over 10 years, it would have outperformed putting the dollar in the S&P 500. You can consider the S&P 500 to be the medium risk example here, with bitcoin being the high risk and cash the low risk. His comment is an indirect affirmation of the barbell strategy.

Maintaining Exposure to Large Potential Upside

A small proportion of your portfolio in hyper-aggressive investments maintains exposure to large potential upside. High risk investments have the potential to get you obscene wins, sometimes even greater than 100x return. Taleb refers to these events as positive Black Swans and uses the convex function to illustrate the nature of positive Black Swan occurrences.

? The key: taking some big risks to have a chance at the big wins whilst protecting yourself from total ruin. Taleb eloquently sums this up with a simple balance of 90/10:

“If you put 90 percent of your funds in boring cash (assuming you are protected from inflation) or something called a “numeraire repository of value,” and 10 percent in very risky, maximally risky, securities, you cannot possibly lose more than 10 percent, while you are exposed to massive upside.

An example would be 90% of your net worth in a cash savings account with the other 10% in cryptocurrency, say Bitcoin. The worst that could happen? Bitcoin goes to zero and you lose 10% of your net worth. You have capped your downside. The best that could happen? Your Bitcoin bet could return 1000%.

The numbers are guidelines, not rules. But the point remains:

1️⃣Protect yourself from total ruin

2️⃣Avoid the unbalanced middle

3️⃣Go for a few high risk high reward bets

“For antifragility is the combination of aggressiveness plus paranoia — clip your downside, protect yourself from extreme harm, and let the upside, the positive Black Swans, take care of itself…

Conclusion

And there we have it, Taleb’s Barbell Strategy. Extremely risk averse on the one side and extremely risk loving on the other, generally avoiding the middle. Which decreases the chances of risk of ruin while potentially increasing upside with very speculative but small bets. How you set your portfolio allocation strategy is down to you and your own preferences. All we aim to do at Market Meditations is share with you some of the best resources we have come across in the wealth of literature around trading and investing. We provide the tools and then you build whatever it is that suits you.