Arbis – They Have The ETH

Market Meditations | September 13, 2022

Arbitrum has seen its fair share of media attention over the past few months. The layer 2 scaling solution has remained more than relevant for a good reason. As it continues to build, everything from network upgrades to NFT treasure hunts is getting a chance to shine. The Tech The Tech

|

|

Arbitrum already had significant momentum as one of the most promising projects, but on the heels of its successful Nitro upgrade deployment (which quadrupled its transactions), there’s even more reason to keep an eye out for new protocols integrating and building on the network.  Getting Involved Getting Involved

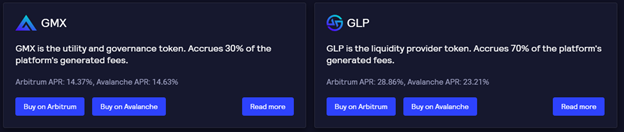

For believers with appropriate risk appetite, investing in Arbitrum-native protocols may provide a hearty return on investment. Even as an extremely popular destination for decentralized traders, GMX offers other ways for users to earn. All that volume generates a ton of transaction fees, most of which are paid out to stakers of the protocol’s native tokens. |

|

Vesta Finance is another Arbitrum project with promise. Though not as flashy as the network leader GMX, this lending protocol allows users to collateralize many different assets to secure loans, including tokens like $GMX. Vesta Finance is another Arbitrum project with promise. Though not as flashy as the network leader GMX, this lending protocol allows users to collateralize many different assets to secure loans, including tokens like $GMX. Airdrop the Beat. With Arbitrum’s use-case growing and TVL seemingly increasing unabated, exploring the ecosystem could have a two-fold effect. Airdrop the Beat. With Arbitrum’s use-case growing and TVL seemingly increasing unabated, exploring the ecosystem could have a two-fold effect.

Ethereum’s Merge has many investors wondering what the future holds for layer 2 solutions in a proof-of-stake world, but even Vitalik Buterin maintains that scaling solutions will complement Ethereum in its final form, ensuring that it will remain scalable in the face of widespread mainstream adoption. Every investment opportunity and earning strategy carries risk. Speculation on any asset comes with exposure to the possibility of total loss from any number of events, including but not limited to: exploits, rug pulls, complete devaluation, etc. Assess your risk tolerance before responsibly investing. |

The Hype

The Hype