Battle of The Roll Ups

Market Meditations | August 31, 2022

One profitable narrative during the last bull market was native tokens for blockchains that were considered faster and cheaper than Ethereum. Today we compare layer 2 solutions that use ZK roll ups to achieve exactly this.

Optimism

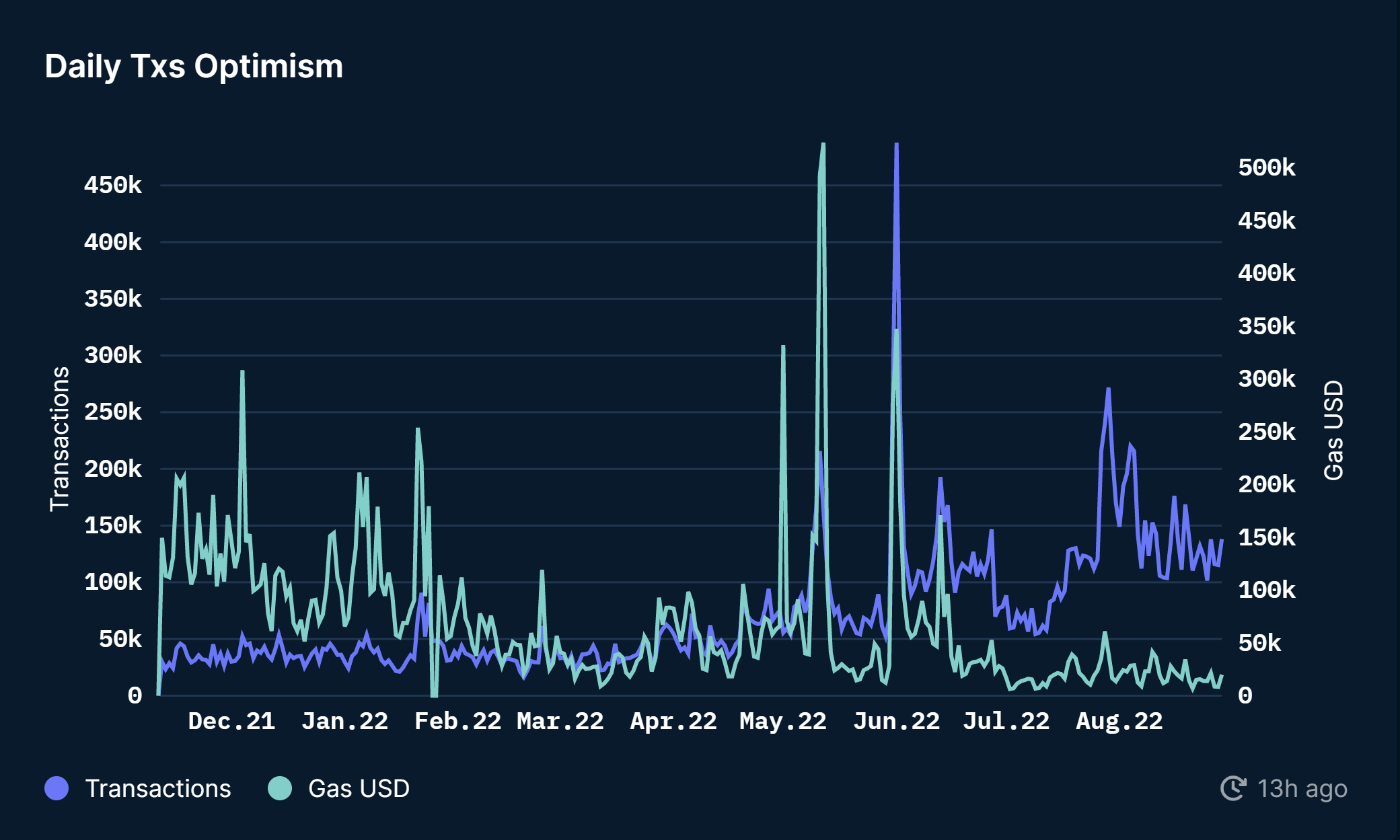

Nansen.ai: 31/08/2022: Number of Daily Transactions – Optimism

- The number of daily transactions has been decreasing since it reached 272,000 in July 2022.

- However there is a long term upwards trend showing that adoption is increasing, despite difficult market conditions.

Arbitrum

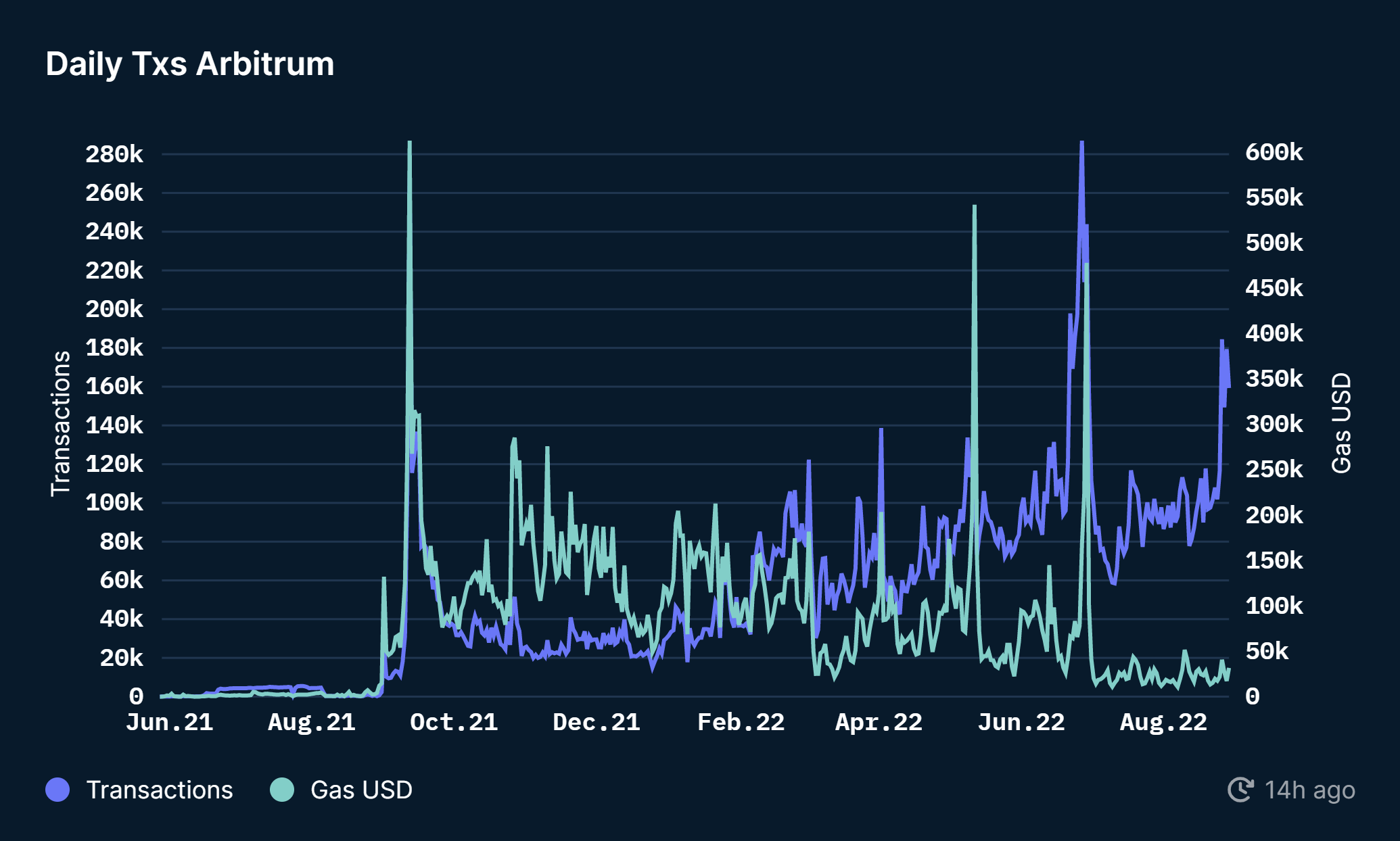

Nansen.ai: 31/08/2022: Number of Daily Transactions – Arbitrum

- The number of transactions reached all time highs in June 2022. Whilst there was a periods of downwards trajectory, they have recently spiked. This could be due to blockchain upgrade or anticipation of a native token launch.

- Similarly to Optimism we can see adoption increasing over the long term.

How Can I Take Advantage of This Data?

1️⃣Use these blockchains to save costs. Both blockchains are seeing long term adoption. This demonstrates the market continually uses these ecosystems, likely because they cost less. Interact with protocols on these chains rather than Ethereum and you can lower your costs.

2️⃣ Use Arbitrum to farm a potential a token launch. There has been a spike in transaction activity in recent days. This could be in anticipation for a token launch with individuals looking to secure airdrop allocation.

3️⃣ Look out for ecosystem rewards. Emerging ecosystems often incentivise users in the form of supplementing chosen protocol yields. Whilst these incentives are not long term, they provide strong opportunities for yield in the short term.

4️⃣ Dive into top projects within these ecosystems. When a blockchain thrives, so do its top protocols. Research which protocols are most used within the ecosystem to better understand any opportunities.