Big Mistakes – Michael Batnick

Market Meditations | February 11, 2021

There are many things we have been genetically coded for throughout the process of evolution. Unsurprisingly, trading and investing is not one of them.

Our psychology does not provide us with the type of emotional discipline that is necessary for success in the markets.

? As a consequence, we are prone to making big trading mistakes. Even the greatest traders and investors in the world are not immune.

In this letter, we summarise Big Mistakes by Michael Batnick (@michaelbatnick) who is vocal on Twitter regarding his support of cryptocurrencies ?

We cannot change our human nature. And so, today’s focus will be less so on eradicating the possibility of any mistakes. Rather, our purpose is to understand how we can stay resilient despite our mistakes and not lose sight of our long term goals.

The Law of Holes

The Law of Holes is an exceptionally simple one on the face of it. However, it is a lot more difficult when it comes to application. The law is as follows:

When you find yourself in a hole. Stop digging.

To illustrate the point, Batnick uses the investment strategy of Mark Twain.

? Mark Twain? Isn’t he an author? Indeed he is. Probably best known for the adventures of Tom Sawyer and Huckleberry Finn. Unfortunately, he was a less successful investor.

In 1880, Twain invested in a typesetting machine. His fundamental analysis led him to believe that this new machine would replace a similar human operated machine. It was almost immediately an unsuccessful venture. However, Twain kept throwing money at it. At one point, he even offered to pay $7,000 a year until the machine could bring a profit.

?He was holding onto a loser rather than obeying The Law of Holes and cutting his losses. Our pride can often lead us into doing this.

The best way to avoid this mistake is to decide beforehand how much you are willing to lose in a trade or investment. This is defined as a stop loss. We recommended this practise in our ? Trading Journal Guide ? and we also created a stop loss video explanation ?

Cutting losers is what the majority of successful traders have in common. It means you can live to fight another day. You simply have to swallow your pride and admit defeat before it is too late. After all, you need only be successful 6/10 times to be a profitable trader.

✅ Remember, the purpose of investing is to make money, not to be proven right.

“The world is always changing, but our views usually don’t evolve alongside it. Even when we’re presented with evidence that disconfirms our previous views, straying far from our original feelings is too painful for most to bear. This is so deeply ingrained in the fabric of our DNA that there is a name for this natural mental malfunction; it’s called cognitive dissonance.”

? Tip to Market Meditators: reconsider publicly announcing your positions on Twitter (or amongst your network, family or friends) if it will cause you to disobey The Law of Holes. Our pride comes into play even more if we think it will impact how we are perceived.

Other risk considerations including security. For more on protecting your capital, check out our ? Essential Crypto Security Guide ?

The Availability Heuristic

As many Market Meditators will know, Warren Buffet, founder of Berkshire Hathaway, is one of the greatest stock investors of all time. That is not to say that his path to success was without hiccups.

In 1991, Buffet bought the shoe company H.H. Brown through Berkshire Hathaway. This was a huge success, leading to his purchase of another shoe company in 1992. This time, Lowell Shoe. Again, almost immediately successful. In 1993, he went ahead and purchased Dexter Shoe.

? This time, Buffet fell for one of the gravest errors when it comes to trading and investing: the availability heuristic.

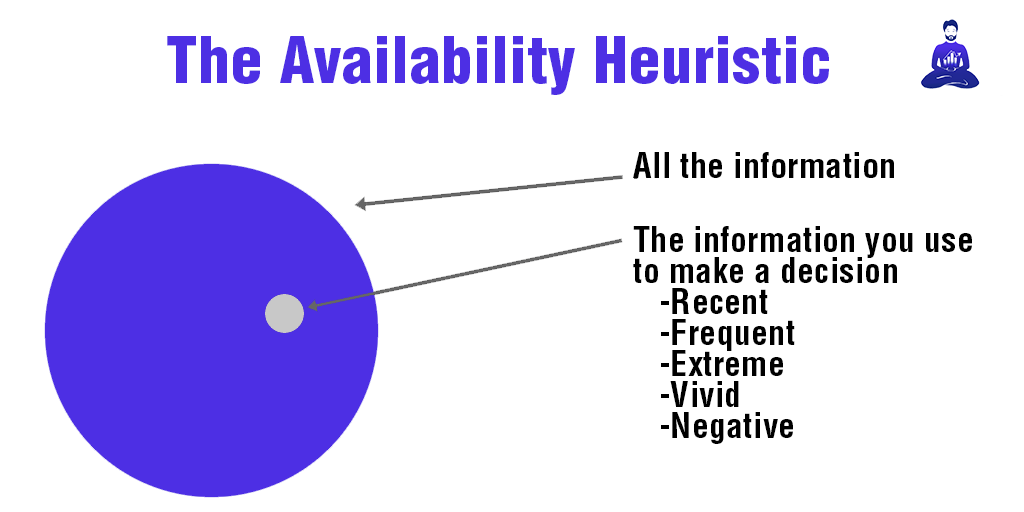

The availability heuristic describes our tendency to use information that comes to mind quickly and easily when making decisions about the future.

Nassim Taleb argues that it is one of the downfalls of human psychology that leads to the existence of Black Swan events. If you haven’t heard of this concept check out our free letter on ? Black Swans and our ? Barbell Investing Strategy.

Because Buffet had previously been successful in the industry, he thought it would be a good purchase. Well, it ended up getting crushed by low-priced competitors from countries like China. Buffet had to eventually deem the company worthless.

✅ The lesson is to be careful when trading or investing in a coin that appears to be similar to a previously successful investment you have made.

Let’s imagine you are trading blue chip DeFi coins. Just because you had an awesome trading strategy for $UNI does not mean you will have similar success for $AAVE or $YFI. Each should have their own independent thought process that is not biased by previous successes. We also have a letter on trading ? Blue Chip Coins. To complement that, we also have Technical Analysis and Leveraged Trading video guides ?

Conclusion

When it comes to trading, at the heart of the matter, success is down to survival. Survival is achieved by avoiding big trading mistakes. These include ‘The Law of Holes’ and ‘The Availability Heuristic’ which you will now be familiar with. Cut losers firmly and unapologetically. Do not rely on previous successes in trading to guarantee future ones.