🧘♂️Bitcoin Is Down Because…

Market Meditations | May 10, 2022

Dear Meditators

There’s one big reason contributing to Bitcoin price crashing.

The UST stablecoin definitively lost its peg yesterday, after barely pausing to take notice of the Luna Foundation Guard announcing the use of its BTC reserves in an attempt to stabilize the asset. UST fell as far as down to $0.65 before rebounding to currently rest at $0.91 at the time of writing.

The de-peg was unique to TerraUSD amongst the top 5 stablecoins by market cap (USDT, USDC, BUSD, UST, and DAI).

In the face of the devaluation, Terra founder Do Kown took to Twitter yesterday to cryptically attempt to relieve investors.

It seemed to do little to mitigate fear as prices continued to fall.

Following a 20-hour period of silence, “StableKown” has returned to Twitter, stating, “Close to announcing a recovery plan for $UST. Hang tight.”

With network congestion proving problematic for deposits and withdrawals, it doesn’t look like there’s much of a choice.

Unlike $UST, there are still some constants in crypto.

The ability to assess projects and their tokens is an invaluable resource. Today we continue our look at tokenomics by covering the most important areas, crucial to success.

Today’s Meditations:

- Tokenomics Part 2

- BTC Fundamental Updates: Overview of Factors Causing Pressure

- NFTs on Meta

Read, enjoy and share with your network. Let’s all build wealth together.

⏰ Top Headlines

- Crypto Market Crash Leads to $1B in Liquidations, Majors Lose Pivotal Support

- KuCoin to launch DeFi products in 2022 with fresh $150M raise

- US Treasury Secretary Yellen points to UST slip, asks for new stablecoin legislation by the end of 2022

- Binance Restarts LUNA and UST Withdrawals After Brief Suspension

? Tokenomics 102

Time to Invest? ?

When’s payday?

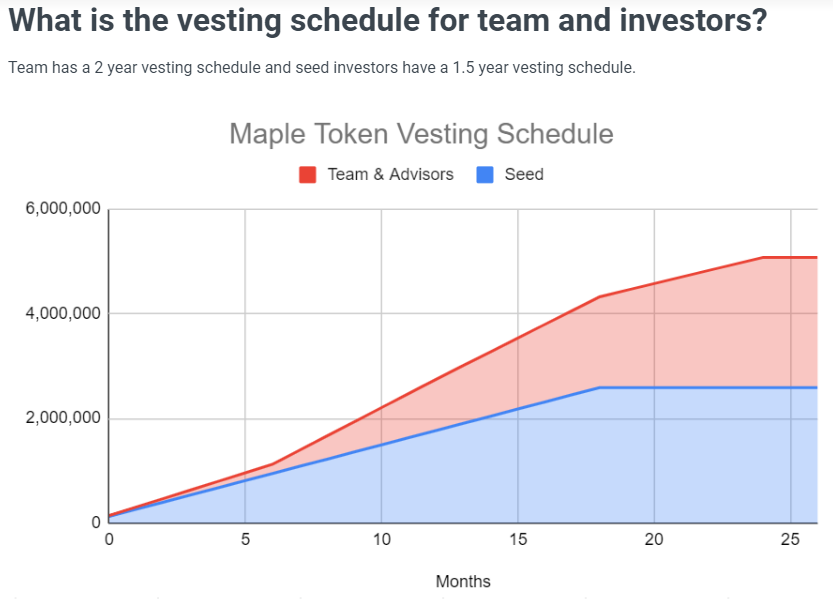

Vesting refers to how long tokens are required to be held before they can be sold. This can range from years to no requirement at all.

Functionally, this can be interpreted as an indication of how longevity-minded founders are.

If a team features no unlock of their own token allocation, there would be no mechanisms in place to prevent a huge sell-off, resulting in big profits for them, and big problems for us.

- Vesting cliffs outline the required time that must pass before tokens begin their unlock. Cliffs of a year or more usually indicate a respectable time frame.

- Vesting occurs in a number of different formats, but linear unlocking is a popular choice. This method releases a static amount of tokens regularly over a span of days, weeks or months until the group’s entire allocation is met.

- Some projects feature no vesting terms for one or more groups of investors. These should be approached with extreme caution, since there is no guarantee against founders dumping huge amounts to seize opportunity at your expense.

Maple Finance features a 2 year vesting term for its team, and a 1.5 year term for seed investors. Even with no mention of a cliff, the team will only receive their $MPL allocation linearly over 24 months. This implies founding members are less likely to be looking to make a quick buck, and more likely to concern themselves with the long-term success of their work.

Cliffs, lock-up periods and vesting schedules reveal critical information.

If you spot a project with no mechanisms in place to control how quickly early investors and developers receive payouts, it should give you pause.

Those networks and protocols with respectable release schedules usually coincide with a sincere desire to see their project succeed.

Slices of Pie?

Everybody wants a piece.

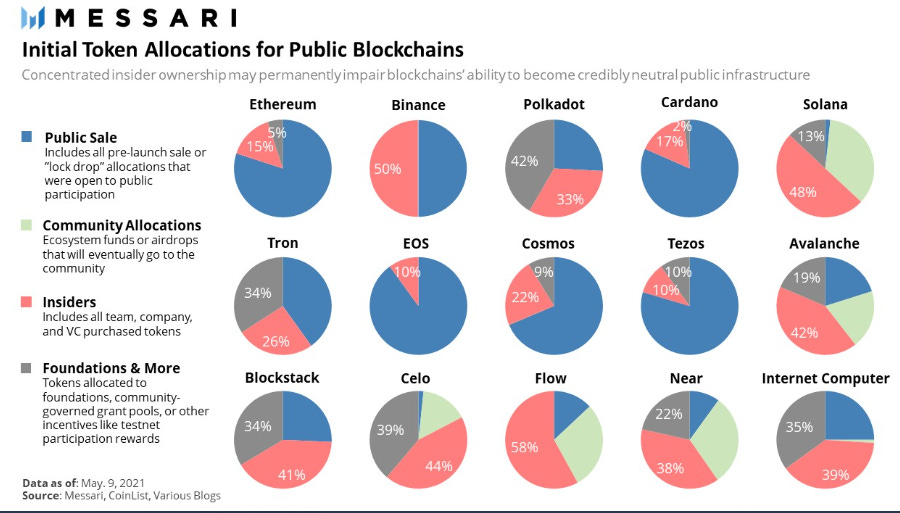

Token distribution says a lot about a project’s economy. The proportion of user and investor ownership of tokens can reveal just how fairly assets are allocated.

Proper designations for community, internal owners, early investors, foundations, marketing, development, etc, must all be considered before responsibly moving forward.

Messari published a comparison of public blockchain distributions in 2021. Looking at how each network and protocol divided its initial token supply shows that every project approaches distribution differently.

A token distribution with team members enjoying an allocation higher than 30% should be scrutinised. Though this is not always a negative signal, it does warrant a deeper look. If team members reserve the lion’s share of tokens for themselves, it’s easier to exit at the expense of others.

Follow the leader.?

Community calls.

Though not a conventional category placed within the scope of tokenomics, community followings are easily one of the most important areas to investigate.

The conviction and knowledge levels of people excited to engage the project has major implications for its token.

- Join Discord, talk in Telegram, scroll Twitter… all of these are a must. When speaking to members, make note of staff response time, depth of knowledge, and overall sentiment.

- Ask about the token. Seeing how readily answers come to you should provide a hint as to whether or not others are familiar with the project’s tokenomics.

- Make yourself at home. Sit back and people watch. If the chat is spammed with “wen token” or “MyCoin MOON!” constantly, you might be dealing with irrational mania instead of sound bullishness.

When taken into consideration, community sentiment and the following provides a potential confluence to your own assessment of a protocol or network’s tokenomics.

Though this concludes our look into tokenomics, it should only serve as the beginning of your journey toward becoming an educated investor.

As Einstein said:

“Life is like riding a bicycle. To keep your balance, you must keep moving.”

? Bit The Dust

One of the consequences of chaos is that it can be difficult to take decisive action and feel good about it. Our confused brains gravitate towards an extreme outcome rather than a sensible balance. Will Bitcoin plumb to new depths or just sweep the current floor?

- Bitcoin lost a quarter of its value in five days, diving to $30k last night.

- Of concern is the Coinbase Premium Index, which has turned negative. It measures the difference in price between BTCUSD on Coinbase and BTCUSDT on Binance.

- Coinbase is used more by institutions, who normally pay a premium for their BTC compared to the majority of retail buyers on Binance. Going negative suggests institutions are currently less interested in buying Bitcoin than retail are.

- As investors get spooked it has a knock-on effect on other ecosystems. The loss of the UST peg was followed up by the Luna Foundation Guard (LFG) loaning ~$1.5 billion of Bitcoin and UST to defend it. For more about this event, check out yesterday’s newsletter, link here.

- Bitmex Research predicted in a February blog post that Fed actions to combat rising inflation would have significant impact on equities and crypto, in “an environment where investor flow is king, rather than fundamentals or valuation ratios”.

In a related article, Arthur Hayes emphasised the importance of acting decisively on the few trading days of the year that matter. We may be programmed to prefer binary outcomes, but if you trust your system more than your current state of mind you may find yourself in the happier, less stressful middle.

?️ Two Worlds Collide

Adam Mosseri, Head of Instagram, shared a video on Monday 10th May in which he announced that support for NFTs will be coming to Meta platforms with Instagram leading the charge.

- According to Mosseri, NFT integration is starting as early as this week. Users will be able to share NFTs that they have made or brought via the main feed, stories and private messaging.

- Instagram has made it clear that they wish to start small, learn from the community and then implement large changes over time.

- Instagram will not charge users for showcasing their NFTs, unlike Twitter which required a Twitter Blue subscription at launch costing $2.99 a month in addition to a few other minor requirements.

- In the video, Mosseri stated that there is some “tension” due to the decentralised nature of NFTs and the fundamental centralised nature of Instagram.

- However, Facebook and Instagram have 2.9 billion and 1.5 billion active users respectively meaning they can still provide enormous value to the crypto community by presenting an opportunity for non-crypto natives to easily access and understand blockchain-based technologies.

Mosseri also put a particular emphasis on the importance of the creator economy, a concept we brought to our readers in a big idea back in February!

- Major crypto exchange Binance temporarily suspended the withdrawals for Terra and UST on Tuesday. Does this betray the crypto community’s inherent values of decentralization? – Cointelegraph

- UST stablecoin regains some ground as crypto sentiment improves – The Block

- The U.K. government promised new laws today as part of a bid to make the country a crypto hub, and also make it easier to seize ransomware profits. – CoinDesk

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Isambard FA, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.