Comparing Gold and Bitcoin

Market Meditations | March 3, 2022

Gold and Bitcoin have shared a narrative since BTC’s popularity began to trend upward back in 2016. Some say the world’s largest cryptocurrency is digital gold, while others view it as a risk asset.

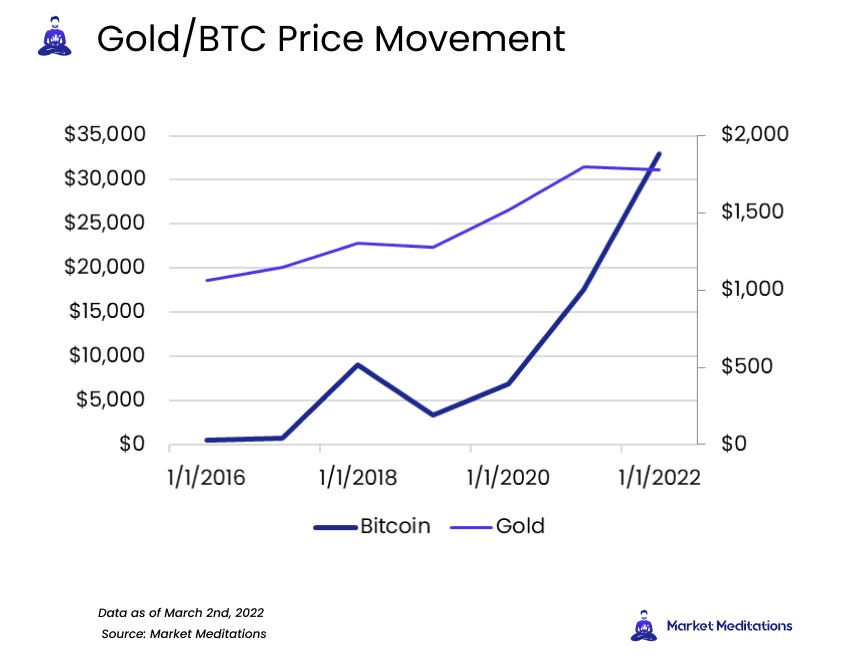

The chart below shows periods of correlation between the price action of gold and Bitcoin.

- 2019 featured a reversal in both the price of Bitcoin and gold. The pandemic had spread rapidly by the end of the year, and people began seeking out ways to shelter their capital from the storm.

- This trend did support the argument for Bitcoin as an inflation hedge. Precious metals are known for their rising prices in the face of events like increasing inflation, economic uncertainty, and crises.

- In the second half of 2021, gold began coming back down, while BTC accelerated its uptrend. This data suggests investors aren’t likely viewing Bitcoin as purely an inflation hedge.

Is Bitcoin still a hedge against inflation?

Some of the time.

From 2019 to 2021, the data looks like the world’s largest cryptocurrency was, indeed, perceived as an inflation hedge – and a far superior one to gold. Governments scrambled to assist plummeting economies. The United States took quantitative easing measures to mitigate worsening poverty levels in the face of mandated shutdowns.

But as we look at the second half of 2021 to present, the correlation has decoupled.

- Some have compared BTC to tech stocks, saying the digital asset bears more resemblance to these risk assets than gold.

- Anticipation of interest rate hikes on the horizon might be responsible for the lowering price of gold as investors turn to higher-yielding investments even though traditional stocks typically suffer the largest outflow of capital in the face of rising interest rates.

- The crisis in Ukraine has been saturated with headlines regarding Russians and Ukrainians alike turning to cryptocurrency as a method of avoiding the risks of holding fiat currency in an unstable political climate.

Even ignoring the practical technological use-cases of Bitcoin, its intrinsic differences from gold make it appealing for a broad array of reasons. Gold has clearly taken a seat as an inflation hedge, with little appeal elsewhere. Bitcoin continues seeing demand grow.