Crypto Insurance Guide

Market Meditations | September 30, 2021

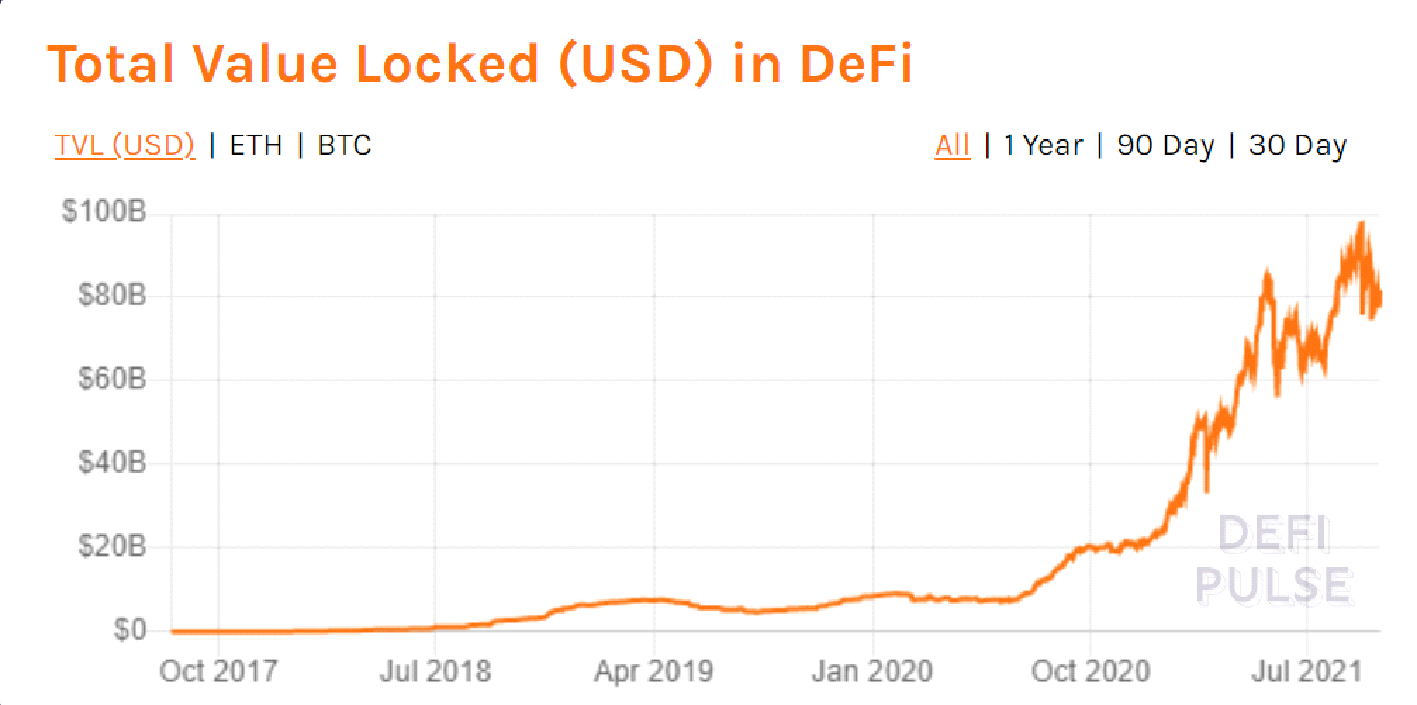

The explosive growth of DeFi protocols has been accompanied by an equally significant growth in funds being lost or stolen via hacks, scam developers or just poorly written smart contracts. The total value locked in DeFi roughly tripled in 2020 to 24 billion, but 120 million of that was reportedly stolen in 15 hacks. This trend has continued into 2021 with a Yearn vault exploit and an infinite mint attack on PAID token.

1️⃣ Under Cover

There are three main types of coverage that crypto insurance protocols are starting to offer:

- Yield-bearing token or stablecoin depegging – e.g. if the value of 1 USDC can only purchase <0.9 USD

- Smart contract failure – e.g. if the contract permanently locks in funds or excessively mints due to an error in the code

- Exchange hacks – e.g. if your assets value drops significantly or withdrawals are frozen for an extended period

? IMPORTANT! There are a number of events that are typically excluded from coverage! This includes rugpulls, phishing, malware, loss of keys and sometimes oracle failures. This also means the responsibility for auditing and checking contracts for malicious loopholes falls on others.

2️⃣ Mutual Trust

The traditional insurance world can also suffer cyber-attacks and human error, but the risk of this is accepted via a trusting relationship with the provider. In the decentralised world there is a debate as to whether the individuals should take out cover or whether the protocols should.

If you see a protocol with the word ‘mutual’ in it, it means that it is entirely owned by its policyholders. The community deposits funds into a pool to cover for future events and community governance votes on whether to pay claims or not. The more tokens staked, the cheaper the coverage. And liquidity providers are rewarded with native tokens if they have voted ‘fairly’. For an idea of how they work, this link compares Nexus Mutual to Bridge Mutual.

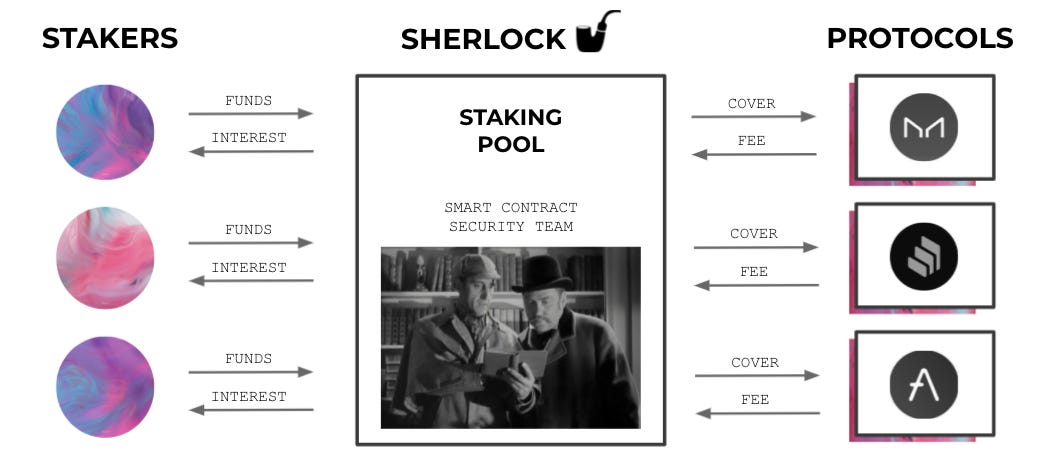

Conversely, Sherlock.xyz asks protocols to partner with them instead. The three main participants are:

- Protocols – that insure themselves for a certain value

- Stakers – that earn premium fees, interest from lending and native token rewards

- Security Team – that evaluate smart contracts and price the coverage (but is noticeably centralised)

3️⃣ Adoption and Optimisation

As with all sectors there is value to be gained in optimisation. There are now insurance protocols that either act as aggregators or offer a hybrid staking model to increase coverage and lower premiums. But mass adoption is the first key hurdle for the DeFi insurance space along with some proof points that the system works. Watch this space.