DeFi 101

Market Meditations | February 11, 2021

DeFi 101

If you’ve been active in the crypto markets recently, it’s likely that an article, YouTube video, or Tweet with the phrase “DeFi” in gigantic bold font has at one point or another popped up across your screen.

✅ Although the phrase itself sounds like a futuristic spaceship of sorts (or is that just us?), in this article of Market Meditations, we’ll break down the basics of DeFi and help you interpret what it means for your trading and investing journey.

We will use Chainlink fundamental and technical analysis for our DeFi case study.

De-What Now?

Before we understand what DeFi is, we must understand exactly that which it was designed to improve: CeFi.

- CeFi stands for Centralized Finance. It is the financial system as you know it that requires centralized mechanisms such as governments, banks, and middlemen to survive.

- Decentralized Finance (DeFi) is a movement leveraging blockchain technology and smart contracts to decentralize traditional centralized financial systems such as bank accounts, brokerages, lending, payments, and more (we’ll dive into a few examples later!).

With DeFi, you trust smart contracts not central authorities. You can think of a smart contract as computer code that has a set of rules that cannot be changed.

For example, let’s say your grandmother wants to send you $100 for your birthday every year. With traditional finance, she’d have to wire you money through a bank, complete direct deposit or send you a check (all options are expensive, slow, and rely on a bank).

She could instead leverage a smart contract someone else has written (unless your grandmother is secretly a coding ninja) that stipulates that every year on the same date at the same time, $100 are to be removed from her account and sent to your account automatically.

That’s it. No middlemen. No bank. Just the internet and a bit of sound computer code.

For more on protecting your capital, check out our ? Essential Crypto Security Guide ?

Here is a quick summary of why DeFi is stronger than CeFi:

1️⃣Permissionless: anybody is allowed to create and use a smart contract.

2️⃣Transparency: anyone with access to the internet can review the computer code that governs the smart contract. This is beneficial not only for people who want to review the public ledger of transactions, but also for developers who want to study existing smart contracts.

3️⃣Global Access: According to this report from 2017, 31% of global adults or 1.7 billion people don’t have access to a bank. DeFi democratizes access to financial systems. All you need is a connection to the internet.

4️⃣Interoperability: whilst you cannot alter an existing smart contract, anyone is allowed to take a part of an existing smart contract and build upon it. The benefits of DeFi, therefore, compound overtime, once more people get involved and more projects are built.

Chainlink’s Role in DeFi

Some of you maybe have tuned in on yesterday’s Chainlink Youtube video, if you didn’t check it out ? here ?.

One big limitation of DeFi revolves around an issue with smart contracts that Chainlink is trying to solve.

As we know, DeFi is centered around a smart contract.

? One issue with smart contracts, however, is that in order to flawlessly execute the set of rules written out in code, they rely on information stored off the blockchain, known as “off-chain data.”

In order to bridge the gap between off-chain data and the blockchain, we need something called an “oracle” which is an intermediary link between information in the real world and the blockchain.

Rather than using one centralized “oracle” (which would have created the same problem as CeFi), Chainlink is a decentralized network of independent nodes that collect and supply information to the blockchain in a language it understands.

? Stated simply, Chainlink is a bunch of non-connected computers that individually validate and translate real world information for the blockchain. Now, let’s dive into some technical analysis on $LINK.

More DeFi Use Cases

1️⃣Decentralized Exchanges (DEX)

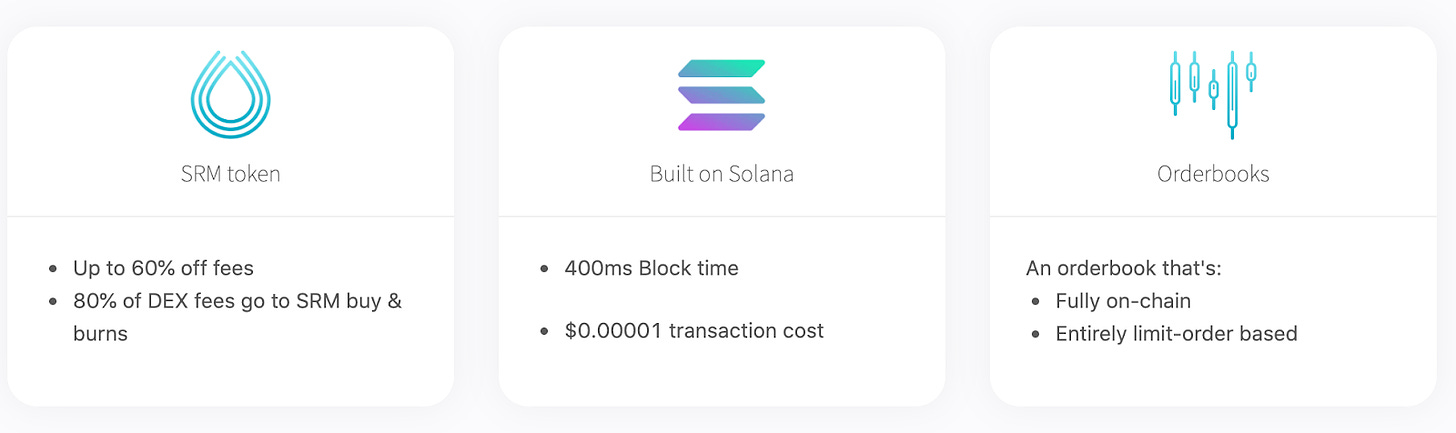

With a traditional brokerage, you rely on a central authority (e.g., Robinhood, eToro, etc) to secure and exchange your funds. A DEX replaces this middleman with the blockchain, connecting you directly with other users and giving you control over your assets. Project Serum by FTX, for example, is a DEX bringing “unprecedented speed and low transaction costs to decentralized finance. It is built on Solana and is completely permissionless.” Benefits of Serum include:

- On-chain orderbooks (sleek and familiar user interface)

- Speed (sub second trading and settlement)

- Cost (relatively lower transaction costs)

If you want to buy Serum you can do so on FTX. Use our ? link to get a discount ?

2️⃣Lending and Borrowing

Banks take the money sitting in your savings account and lend it out multiple times, collecting interest. They pay you a microscopic portion of that interest for the right to lend out your funds. Just like this, there are dApps that allow you to deposit, store, and “stake” your crypto, earning interest as a reward. APY differs depending on the crypto you deposit and dApp you use but can range anywhere from 8% to 30% APY. Similarly, if you would like to take out a loan by borrowing against crypto as a collateral, you may do so. Please remember to do your own research.

3️⃣Payments

The ability to exchange cryptocurrency between two parties directly and securely without the need for an intermediary like a bank, government, or other financial institution. This is often cited as the very fundamental use case of DeFi—to fix otherwise inequitable, unfair, and corrupt financial mechanisms.

Conclusion

DeFi is unstoppable. The dissatisfaction with centralised finance is growing at pace and is accelerated by sagas like GameStop vs. Robinhood. DeFi increasingly finds product market fit. Having covered the fundamentals and using Chainlink as a case study, we have provided the foundation for you to get started with DeFi investing and trading. Enjoy the journey and don’t drive without a seatbelt (supplement our article with your own research). Good luck.