Funding Rates

Market Meditations | May 24, 2021

What Are Funding Rates?

QUICK ANSWER. Funding rates are periodic payments to long or short traders based on the difference between perpetual contract markets and spot prices.

IN ENGLISH. To understand the statement above, you need a basic understanding of traditional futures contracts.

? A traditional futures contract is an agreement to buy or sell a commodity, currency, or another instrument at a predetermined price at a specified time in the future.

In traditional futures contracts, settlements occur on a monthly or quarterly basis – depending on the contract specifications. At settlement, the contract price converges with the spot price, and all open positions expire.

FACT CHECK. If you’d like a further understanding of futures contracts check out our Cryptocurrency Options Guide.

? Perpetual contracts (as the name suggests) never settle in the traditional sense. However, exchanges still need a mechanism to ensure that futures prices and index prices converge on a regular basis. This mechanism is known as the Funding Rate.

What Does a Positive or Negative Funding Rate Mean?

Funding rates are periodic payments to long or short traders based on the difference between perpetual contract markets and spot prices. Therefore, depending on open positions, traders will either pay or receive funding.

REMEMBER. Funding rates prevent lasting divergence in the price of both markets.

The funding rate is a small fee paid by one side of the contract to the other.

? When the funding rate is positive, the price of the perpetual contract is higher than the market price, thus, traders who are long pay funding to short traders.

? When the funding rate is negative, the price of the perpetual contract is below the market price, which means that shorts positions pay for longs.

How to Use Funding Rates?

LEVERAGE IMPLICATIONS. As funding calculations consider the amount of leverage used, funding rates may have a big impact on one’s profit and losses. With high leverage, a trader that pays for funding may suffer losses and get liquidated even in low volatility markets.

MARKET SENTIMENT. Funding rates represent traders’ sentiment of which position they bet on in the perpetual swaps market. Funding rates tend to correlate with market sentiment:

- Positive funding rates imply traders are bullish and long traders pay funding to short traders.

- Whereas negative funding rates imply many trades are bearish and short traders pay funding to long traders.

“When pricing is trending up (buyers in control) and the funding rate remains positive, then there are more buyers than sellers (in the simplest terms). If sellers/shorts attempt to hit the bids heavily and push the price down, in a uptrending market the drop in funding rate, if it stays positive, is just another buying opportunity for bulls, and thus the price continues to rise” – The CryptDex Report

Funding rates can be used as confluence with your technical analysis and indicators to help create a trading strategy:

- Since shorts pay longs when funding rate is negative, if price action and your set of indicators suggest a good potential long setup, you may consider entering, since those who are short are essentially paying you to be long.

- On the contrary, because longs pay shorts when funding rate is positive, entering a long position when funding is high means you will be subject to paying anybody who is short.

- This is money out of your pocket. Thus, you may consider taking profit quickly to reduce the amount of funding you pay.

As you can see, you can use funding rates as simply another data point to take on high probability setups.

REAL TIME. To access real time funding rates, you can use crypto exchanges such as FTX. Remember you can use our referral link for a 10% discount. Based in the U.S? Here’s a discount link for you: FTX.US.

Either type ‘funding rates’ and hit enter on the search bar or use the Futures tab to navigate to a specific contract. The full list will look something like this:

Source: FTX (taken at 15:20 BST)

Note the BTC contract in the above screenshot is positive. Reflective of the current relief rally and somewhat more positive / bullish temporary sentiment.

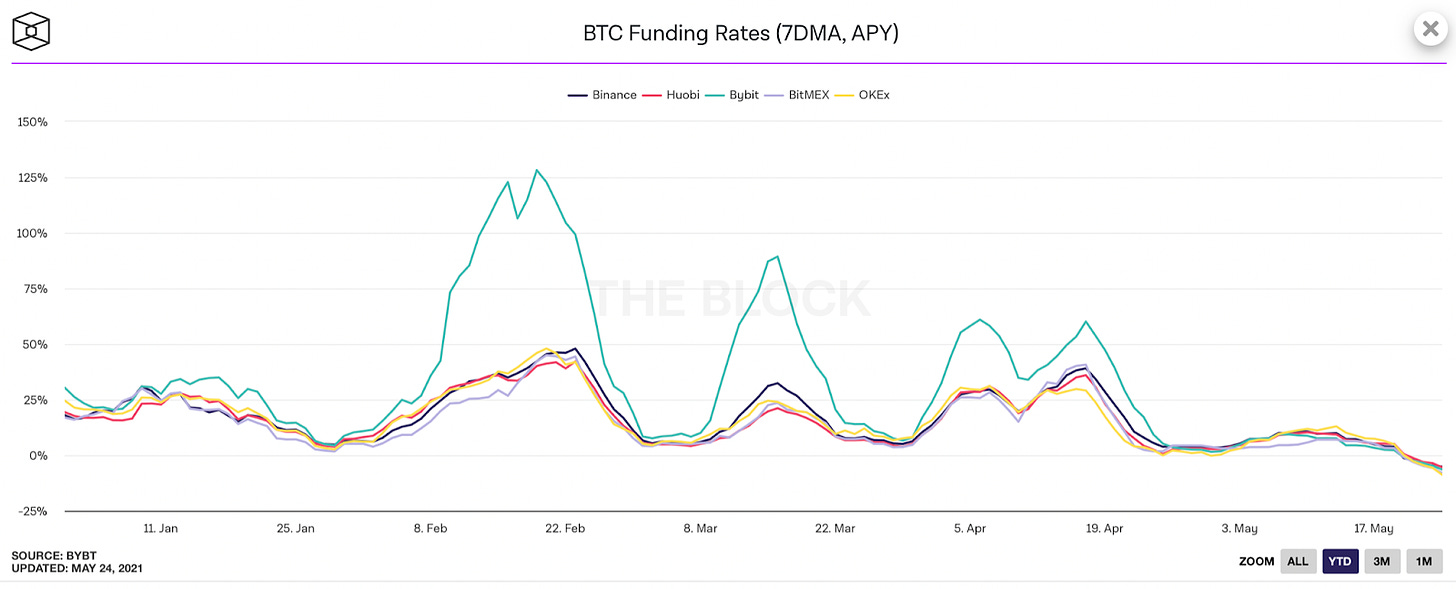

HISTORIC. On-Chain Analytics data providers use historical funding rates to convey changes in market sentiment over time. Notice in the chart below that for the first time this year, funding rates turned negative in the recent dip.

Source: The Block

Glassnode and Cryptoquant provide a paid service whereby you can access Perpetual Funding Rate charts amongst a range of other on-chain analytics.

In terms of free services, The Block provides some basic analytics here and the CEO of Cryptoquant runs a Twitter account that regularly shares On-Chain Analytics, sometimes including Funding Rates: @ki_young_ju

Glassnode also shares a free weekly newsletter that you can sign up for here. Finally and as per the example above, The Block provides a series of basic free on-chain analytics charts.

FACT CHECK. For a high level overview of various On-Chain tools, check out our On-Chain Analytics guide.