🧘♂️Guide to Ethereum Staking

Market Meditations | June 2, 2022

Dear Meditators

Decentralised finance saw a meteoric rise in both popularity and investments last year, but it hasn’t stood the test of time very well. One positive takeaway is that with so much attention focused on this emerging market, innovation was accelerated. The gold rush might be paused, but luckily for us, prospectors have left their tools behind.

With so many heading for the hills, is there still a reason to stake your claim?

Today’s Meditations:

- All About Staking

- Solana Halted Again

- Let’s Talk About SHIB

Nexo offers a simple, secure way to build your crypto portfolio.

It’s one of the best places to begin your staking journey as well.

Sign up Now & Get $100 in BTC!

⏰ Top Headlines

- Crypto exchange Gemini slashes about 10% of its work force

- A16z and Coinbase execs back new crypto VC fund Canonical

- US energy company opens crypto mining facility in Middle East to use stranded natural gas

- South Korean government becomes an early investor in metaverse

? What’s At Stake?

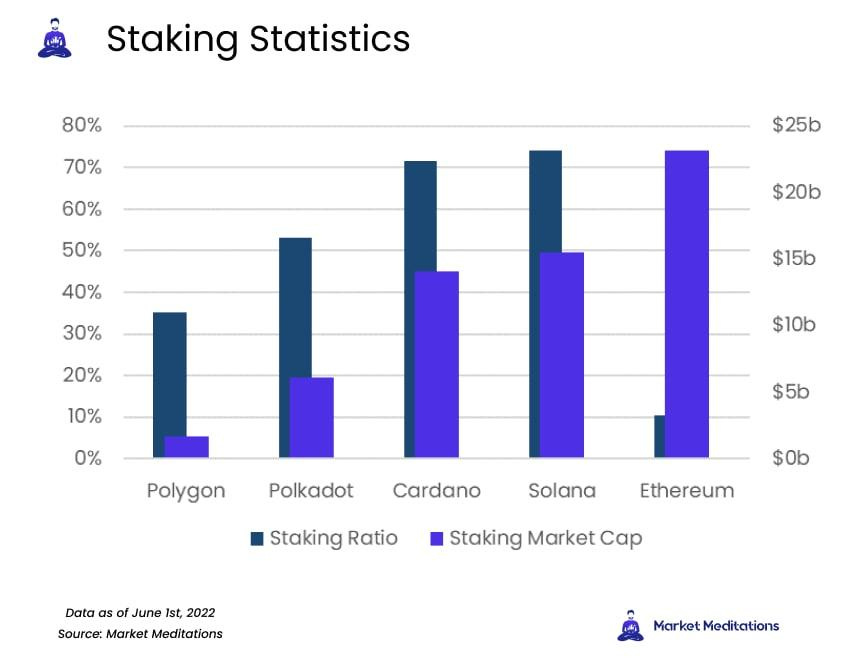

If you refer to the figure below, across five of the most popular networks, both the percentage and market cap of staked assets remain high, suggesting there is still reasonable incentive. Even with Ethereum having the lowest staking ratio, it still has more than $23 billion currently staked.

What Is Staking?

Staking is so much more than a fun way to handle that vampire lurking around the neighborhood. Networks are ready and willing to compensate users for locking up their funds.

- Staking offers a way for holders to earn passive income as they HODL. Proof-of-Stake consensus mechanisms rely on validators to verify transactions and strengthen their networks.

- PoS networks generally operate based partially on how many coins or tokens are held by wallets as a means of awarding blocks (which come with rewards) to validators.

- Validators often operate pools, aggregating individual user’s funds to wield large amounts in return for sharing some of the profits with pool investors.

- Staking is sometimes viewed as a safer option than other strategies like liquidity mining. Sometimes the returns aren’t as high, but neither is the risk.

- Some staking opportunities require lock-up or unlocking periods. If seeking short-term play, make sure to identify these mechanisms.

For those looking to get a little more out of holding Ethereum than confused looks at family dinners, DeFiLlama and Coindix should be household names.

- To get started identifying staking opportunities on Coindix, head to the home page here.

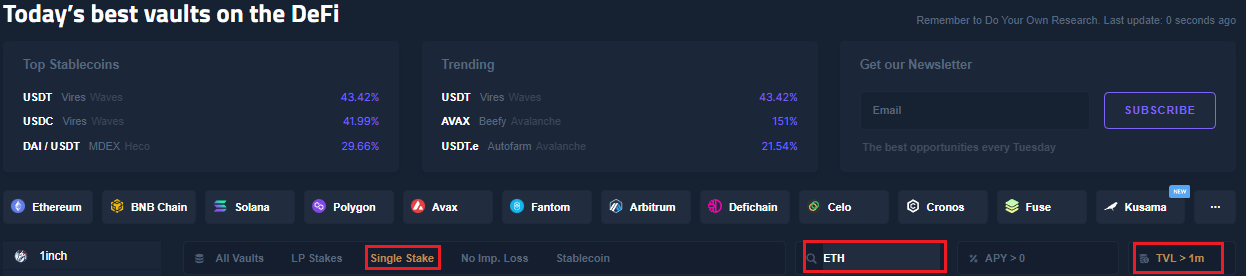

Coindix.com: 02/06/2022 – Home page, Today’s best vaults on the DeFi

- At the top of the page, the categories depicted above in boxes define filters for which opportunities to be returned. Users seeking safer options should choose a minimum TVL of $1 million or higher. Selecting Single Stake, ETH and TVL>1m returns a list of protocols offering returns for locking up Ethereum.

Coindix.com: 02/06/2022 – Home page filtered by TVL>$1 million, Single Stake

- Clicking the pop-out icon for any entry in the list will direct prospective investors to the specific page for the opportunity.

Steps will vary from protocol to protocol, but if something is too difficult to figure out, don’t rush it. Also, remember that resources like Coindix are only a way to identify potential, not a whitelist for aping into something while hoping to get rich quick.

Tools of the Trade

- DeFiLlama can be used to investigate metrics like TVL and performance history.

- StakingRewards effortlessly ranks crypto assets by staked value on their home page.

- Centralised Exchanges like Nexo offer competitive staking rates on the big boys like ETH and BTC… and often come with much more robust security. Remember, if you sign up using our link, you can receive a $100 BTC welcome bonus.

- Stelareum aggregates data from across staking protocols, and also displays a number of valuable data ranges for many popular projects.

When seeking out ways to earn passive income, the first consideration should ALWAYS be risk, not rates. The tools covered above are only starting points.

As always, rewards only come with risks. Make sure to research each and every protocol or network before clicking “Stake”. Bad actors never rest, neither should you. If you don’t understand an investment from start to finish, learn until you do.

There will always be seconds at the stake buffet.

Want to learn more? Lido is one of the most popular ways to stake Ethereum, check out our guide here.

? Solana Halted Again

Today, Solana suffered their second network outage in the last month. Let’s take a closer look to find out what caused this outage and to see whether or not it has been fixed.

- On Wednesday, Solana experienced 4 hours of downtime caused by a bug. As of late Wednesday, Solana’s price is down 12.6% in the last 24 hours.

- Validators were able to restart the network after 4 hours of downtime by disabling the “durable nonce transactions.”

- Durable nonce transactions are a niche type of transaction that is designed for offline-use cases, aka cold storage transactions.

- For now, these transactions will remain disabled until developers are able to find and patch the bug in these transactions.

- The ramifications come to any crypto custodian who uses these types of transactions for offline tasks. This could freeze funds for some people until the patch is in place.

- Surprisingly enough, this is not a new bug to Solana operators. Laine from Stakewiz said in a tweet that the bug was being fixed but it had not been triggered up until this point.

Though Solana is back online, until this patch is in place some Solana funds may be tied up. As of Wednesday, exchanges such as Binance, Coinbase, and Crypto.com were all experiencing problems with Solana deposits and withdrawals.

? Where In The World Is Waldo Ryoshi?

Shiba Inu or SHIB was created in 2020 and initially touted as the DogeCoin killer on Ethereum. SHIB amassed a huge following due to its low entry price and meme coin status. Ryoshi, the anonymous founder, has recently gone missing in action.

- His last post was in May of 2021, in which he stated “I am not that important and one day I will be gone without notice. Take the Shiba and journey upward frens.”

- Just one year later, he has deleted all tweets and blogs, including the one that started it all, “all hail the Shiba.” His four Medium blogs about SHIB now take you to an error message.

- His Twitter bio previously read “SHIB and LEASH founder. We do it for teh ppl” but is now empty. He has changed his profile pic to a picture of a famous Tibetan poet and his header pic to a half-moon sitting above the clouds.

- The official Twitter account for SHIB has only addressed the absence of their founder by sharing this article in a tweet.

- The founder urged the lead developer Shytoshi Kusama to focus on the ecosystem, which he plans to do, tweeting that the project will move forward.

SHIB calls itself an ‘experiment in decentralized autonomous community‘ and often refers to followers as the SHIB Army. Although it is peculiar that the founder has deleted much of his social media, he did foretell of his upcoming departure and was not known to tweet or blog often. Perhaps the best way to gauge the success of a decentralized autonomous community would be to continue onward, with or without the founder’s presence and oversight.

- Don’t believe the FUD! There’s been a lot of speculation about a new disclosure in our recent 10Q and it’s created some understandable confusion. Let’s clear a few things up … – Coinbase

- ICYMI: Bitcoin mining stock report: Wednesday, June 1 – The Block

? Read

? Explore

- Get started on DeFiLlama

- Check rates on Nexo

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.