Guide to Staking

Market Meditations | June 28, 2022

? What’s At Stake?

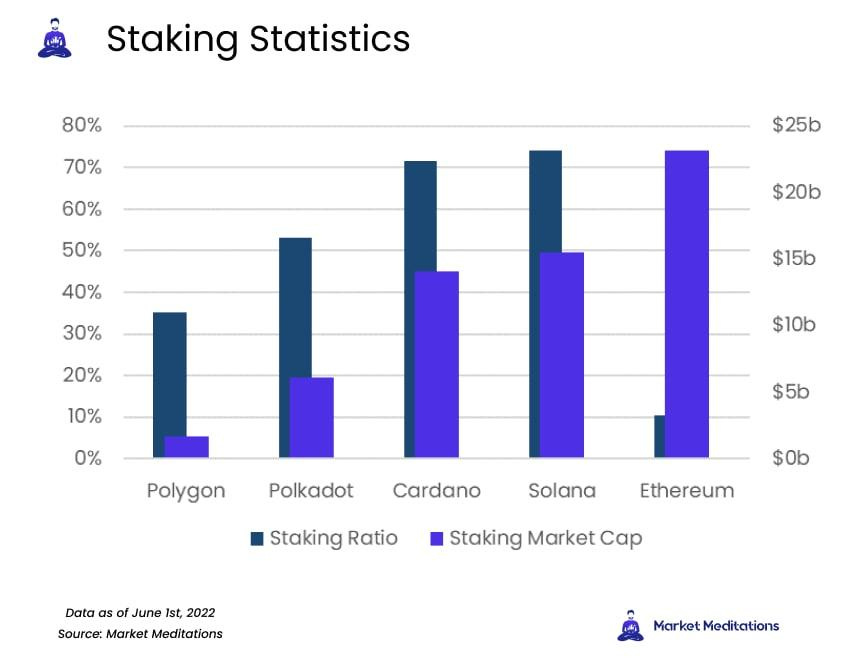

If you refer to the figure below, across five of the most popular networks, both the percentage and market cap of staked assets remain high, suggesting there is still reasonable incentive. Even with Ethereum having the lowest staking ratio, it still has more than $23 billion currently staked.

What Is Staking?

Staking is so much more than a fun way to handle that vampire lurking around the neighborhood. Networks are ready and willing to compensate users for locking up their funds.

- Staking offers a way for holders to earn passive income as they HODL. Proof-of-Stake consensus mechanisms rely on validators to verify transactions and strengthen their networks.

- PoS networks generally operate based partially on how many coins or tokens are held by wallets as a means of awarding blocks (which come with rewards) to validators.

- Validators often operate pools, aggregating individual user’s funds to wield large amounts in return for sharing some of the profits with pool investors.

- Staking is sometimes viewed as a safer option than other strategies like liquidity mining. Sometimes the returns aren’t as high, but neither is the risk.

- Some staking opportunities require lock-up or unlocking periods. If seeking short-term play, make sure to identify these mechanisms.

For those looking to get a little more out of holding Ethereum than confused looks at family dinners, DeFiLlama and Coindix should be household names.

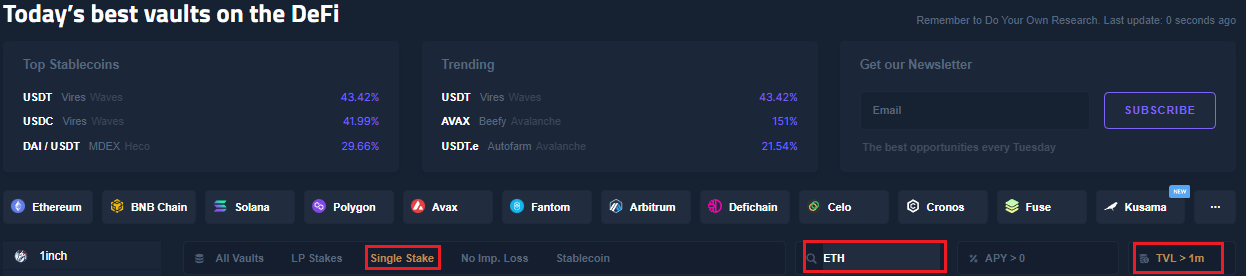

- To get started identifying staking opportunities on Coindix, head to the home page here.

Coindix.com: 02/06/2022 – Home page, Today’s best vaults on the DeFi

- At the top of the page, the categories depicted above in boxes define filters for which opportunities to be returned. Users seeking safer options should choose a minimum TVL of $1 million or higher. Selecting Single Stake, ETH and TVL>1m returns a list of protocols offering returns for locking up Ethereum.

Coindix.com: 02/06/2022 – Home page filtered by TVL>$1 million, Single Stake

- Clicking the pop-out icon for any entry in the list will direct prospective investors to the specific page for the opportunity.

Steps will vary from protocol to protocol, but if something is too difficult to figure out, don’t rush it. Also, remember that resources like Coindix are only a way to identify potential, not a whitelist for aping into something while hoping to get rich quick.

Tools of the Trade

- DeFiLlama can be used to investigate metrics like TVL and performance history.

- StakingRewards effortlessly ranks crypto assets by staked value on their home page.

- Centralised Exchanges like Nexo offer competitive staking rates on the big boys like ETH and BTC… and often come with much more robust security. Remember, if you sign up using our link, you can receive a $100 BTC welcome bonus.

- Stelareum aggregates data from across staking protocols, and also displays a number of valuable data ranges for many popular projects.

When seeking out ways to earn passive income, the first consideration should ALWAYS be risk, not rates. The tools covered above are only starting points.

As always, rewards only come with risks. Make sure to research each and every protocol or network before clicking “Stake”. Bad actors never rest, neither should you. If you don’t understand an investment from start to finish, learn until you do.

There will always be seconds at the stake buffet.

Want to learn more? Lido is one of the most popular ways to stake Ethereum, check out our guide here.