How to Create a Trading Journal and Why

Market Meditations | January 7, 2021

For Tuesday’s education letter, we explored some of the common denominators drawn from interviews with 17 of the greatest traders of all time. Check it out ? here if you missed it.

We noted how, contrary to the type of click bait the media portrays, some of the main themes amongst these brilliant individuals were discipline, risk management and prudence.

These may not seem like the most exciting areas of trading education but I suppose you might change your mind when you see the number of your profit making trades increase significantly… ?

It’s important to recognise that trading is not just screen time.

Whether it is because you want to explore new trading ideas or monitor your progress, it’s extremely worthwhile to maintain a trading journal.

Creating Your Trading Journal

Your trading journal can be electronic or, if you are so inclined, you can have a notebook.

If you prefer the electronic medium, Microsoft Excel is a handy package to use. It is good for collecting data and also for analysis. For instance, you can easily sum your daily / weekly / monthly profit and loss accounts.

There are also more sophisticated software packages out there such as Edgewonk.

Whatever the medium, the content you are recording is key.

In this example, we use excel: it should take you about 5 minutes to set up your journal on excel. Then, you can build and improve on it or add your own personal touches.

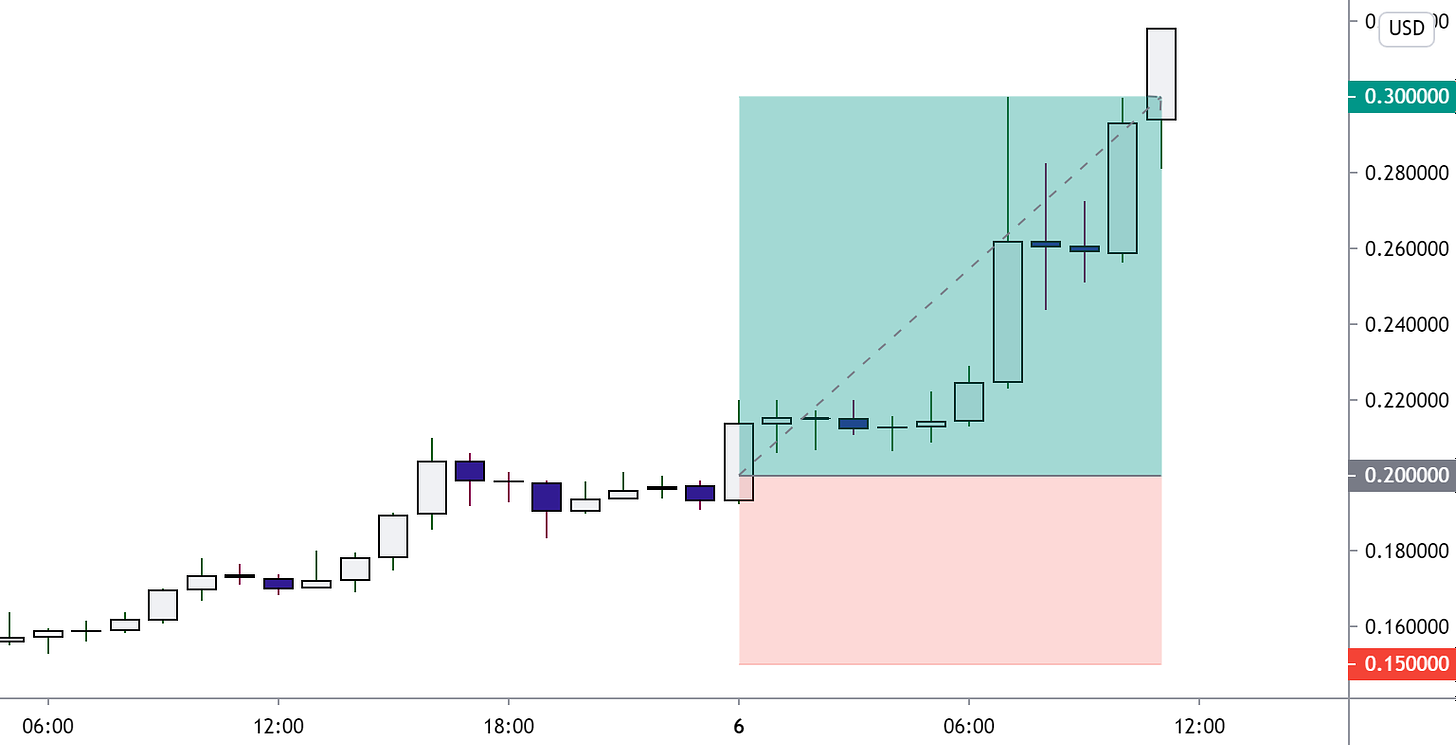

Let’s start with the numerical/factual aspects of your journal using a worked example.

Our Trading Analysis

Our Trading Journal

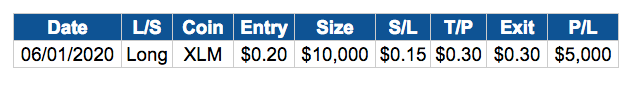

Running through each column starting from the left and ending at the right.

- Date. Document your date to be able to analyse your performance over your preferred time frame.

- Trade Direction. Take note of whether you are long / short.

- Coin. Jot down the coin or security you are trading.

- Entry Price. The price you entered the trade at.

- Position Size. The amount of capital in the trade.

- Stop Loss Price. Determine the price at which you will cut your losses.

- Take Profit Price. Set the price at which you will take money from the market.

- Exit Price. Document the price you end up closing the trade at.

- Closed Profit/Loss. Solve for your profit or loss: use the position size, trade direction and the difference between your entry and exit price.

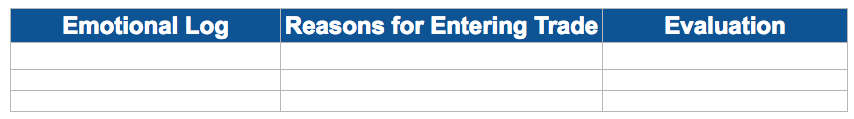

Then there are the more subjective/word based elements to your journal. Just add these 3 columns next to the numerical/factual aspects.

- Emotional Log. An opportunity to have an honest conversation with yourself about how you managed your emotions during the trade. This is your trading journal. Did you stick to your stop-loss and take-profit levels? Perhaps you panicked at the slightest downtrend and exited the trade. Or, seeing your trading strategy bear fruit, you decided not to close your position at the take profit level. Often leading to losing part (or in some cases all) of your profit. Identify lapses of judgement and their triggers.

- Reasons For Entering Trade. Reflect on your reasons for entering the trade. In hindsight, they might seem very sensible or maybe a bit nonsensical. Either way, at the end of the trade, it should be easier to test the validity of your reasons and to draw lessons for next time.

- Evaluation. An overall evaluation of your trade. The very last stage for the key lessons. You should be asking yourself questions such as: was the position size good enough to match risk and reward scenarios? Was your entry timed correctly? Was your take profit realistic or a finger in the air? Use the answers to refine your position size, entry level and orders going forward.

Once you set up a trading journal similar to the one above you will be amazed by how much you learn about your own trading style, strengths and weaknesses. More importantly, you will be able to draw lessons to improve your trading.

Get in the habit, keep it up and reap the rewards. Let’s explore the use cases of a trading journal a bit further.

Monitoring Performance and Exploring New Strategies

1️⃣Trading Journal to Monitor Performance

All traders can benefit from a trading journal. Whether you did your first trading this morning or have been trading longer than the Market Meditations team has been alive.

Trading is a speculative endeavour. A fancy way of saying:

The best traders will learn from their mistakes (notice we didn’t say never make mistakes) and try to avoid repeating them in the future.

On the other hand, bad traders will make the same mistakes all over again. Until, they either give up in frustration or the market forces them to give up because they have run out of money.

Documenting your successful trades will convey the strengths of your trading strategies and the merits of your psychological responses when the trade was open.

Likewise, documenting your weaker trades will identify your shortcomings. You don’t want to continue with a trading style that doesn’t work for you. Either technically, fundamentally or emotionally.

2️⃣Trading Journal to Explore New Trading Strategies

If you are a complete novice to trading / looking to trade with a different strategy / a different type of coin, you might not want to put skin in the game straight away.

For some inspiration on new coins to trade, check out our recent article on ? How to Profit from DeFi Blue Chips.

You can use your trading journal for ‘paper trading’. Trading without actually putting cash into the market. You can still fill in every single column of your journal and solve for a hypothetical profit and loss. You can repeat this process until you feel prepared to put your capital at risk and enter the market with real money.

There are many benefits to paper trading before using real money:

- Start trading real market conditions without fear of losing money

- Experiment with different trading strategies

- Gain experience managing open positions

- Improve your understanding of how leverage works

- Start to analyse different charts and technical indicators

There is a caveat to all this of course. You are trading without a key hurdle: the psychological implications of having money at stake. Your emotions come alive when real money is on the line.

It’s not perfect and it wont stimulate real trading completely but it will allow you to explore new ideas and try different strategies without suffering the consequences of participating in the market with other real traders who know the aforementioned strategies far better than you. Well, for now at least.

Conclusion

And thus concludes how to create a trading journal and the many benefits. Remember, it is these small measures, routines and practises that generate compound returns. The type of returns, we imagine, that got some of the world’s greatest traders where they are today ?