🧘♂️How To Find Hot Cryptos

Market Meditations | May 4, 2022

Dear Meditators

In part 1 of our yield farming series, we looked at how to narrow down the search for the best yields in DeFi.

Today, in part 2, we are going to dive deeper, illustrating how to find specific protocols that offer strong opportunities for profit.

Today’s Meditations:

- Finding Hot Protocols with Nansen

- Latest from MicroStrategy

- Race for Defi Adoption

With Nansen’s On-Chain data, you get an edge over everyone else by tracking the behaviour and on-chain activity of prominent wallet addresses.

- Exciting New Opportunities. Follow Smart Money, identify new projects, and trace transactions down to the most granular level.

- Perform Due Diligence. Get more information on projects or tokens before you invest.

- Defend Your Positions. Create real-time custom alerts and get notified when and where a wallet has been moving its funds.

- Track The Biggest NFT Traders. See what the most profitable NFT wallets are investing in.

⏰ Top Headlines

- Terra to Provide UST Liquidity on Polygon-Based SynFutures

- Elon Musk swaps Twitter avatar for a horde of Bored Apes, BAYC floor price surges 10 ETH

- Polkadot now lets you natively send tokens across parachains

- Valkyrie launches new trust holding AVAX

? It’s Getting Hot In Here

Hot Smart Contracts

DeFi is built using smart contracts – a computer program which automatically executes specific actions based on a pre-defined trigger. For example an agreement between a borrower and a lender that dictates the terms for repayment.

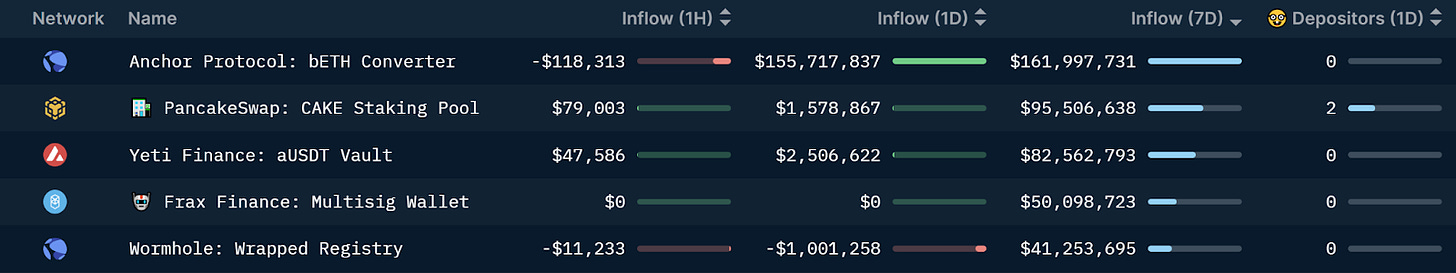

Using Nansen, we are able to see the see exactly how much money is flowing into individual smart contracts, allowing us to spot the hottest protocols and opportunities:

Nansen: 04/05/2022 – Hot Multichain Contracts sorted by 7 day inflow

- The biggest inflows have been into Anchor Protocol’s bETH converter. Anchor is the largest protocol on Terra and bETH represents stETH (staked ETH on Lido) on the Terra blockchain. This indicates that the market is taking advantage of opportunities on bETH.

- The second largest inflow has been into PancakeSwap, specifically staking their native token CAKE, an opportunity currently offering up to 160% APY.

✅ Tip: We can filter the data by Smart Money depositors to see exactly which hot contracts have received the most deposits from the top performing wallets in crypto.

Tracking the Activity of Top Wallets

Now we have identified protocols that are receiving large inflows, we can use Nansen to further inform our profit strategies. Let’s use the PancakeSwap staking pool as an example.

By using the Top Depositors feature demonstrated in part 1 we are able to identify who is currently involved in the opportunity and can see that one of the most well known personalities in crypto currently farming the pool, Justin Sun. From there we can find his exact activity regarding the pool:

Nansen: 04/05/2022 – Wallet Pair Profiler – Justin Sun and PancakeSwap CAKE staking pool

- 13 days ago, Justin Sun deposited 303k CAKE ($2.3m) into the pool and has not made any other transactions since, showing he is still taking advantage of the opportunity.

Conclusion

The DeFi ecosystem is constantly shifting and protocols which offer the highest yields change quicker than anyone can keep track of, without the correct tools. Using Nansen, we are able to quickly find the hottest protocols, signposting potential opportunities for profit.

? Take A Hike

The Federal Open Market Committee (FOMC) concludes its two-day meeting today, with many analysts aligned on what to expect from them. But what will be the impact on the markets? Let’s take a look through the lens of a company with a lot at stake:

- MicroStrategy issued its Q1 report yesterday, showing that on March 31st they owned 129,218 BTC, with a carrying value of ~$2.9 billion.

- This reflects an impairment loss of just over $1 billion compared to current market value, suggesting a change in accounting method after a SEC warning.

- About 90% is held by subsidiary MacroStrategy, which recently took out a $205 million loan from Silvergate to buy more Bitcoin, using 19,466 BTC as collateral.

- Most analysts are expecting the FOMC to announce a 50 basis point (or 0.5%) increase in interest rates and balance sheet reduction actions to combat soaring inflation.

- However views differ on how markets will react, with some saying the decision looks baked in already, and others saying that deteriorating sentiment will trigger a BTC drop to $28,000.

MicroStrategy’s Loan-to-Value (LTV) ratio has jumped 5% since the deal and will start to approach 40% if Bitcoin does drop below $30,000. If you’ve got crypto-backed loans open, make sure you’ve got a good safety buffer between your LTV ratio and liquidation point.

? Institutions Race to DeFi

Waiting for the FOMC meeting, the crypto markets, and almost every other market, has been looking bleak. Bitcoin is in a downward trend and alts seem to have lost their way altogether, but all hope is not lost. Institutions are coming and legitimizing the space where “we buy memes and farm them for more memes,” known as Decentralized Finance.

- On April 26, Fireblocks, the platform for institutions in DeFi, released support for DeFi on Terra. An early access program saw $500 million in volume flow into Terra.

- Katherine Molnar, the Chief Investment Officer of the Fairfax County Police Retirement System, made an announcement at the Milken Lot Global Conference in Los Angeles Tuesday, that they are considering yield farming with pension funds. They were also one of the first counties in the US to put pension funds into crypto linked investments back in 2019.

- Jane Street Capital, one of the world’s largest market makers plans to borrow $25 million USDC through Clearpool, marking the first major Wall Street institution to borrow through a DeFi protocol. Depending on market conditions, they may increase their position to $50 million.

Now is a great time to familiarize yourself with tokenomics, yield farming, or some other niche in the crypto space to give you an edge when the market turns back to ‘up only.’

- There were 4.5 million people who quit their job in the month of March. This is the highest monthly number ever recorded. – Pomp

- It’s Fed day, and while many are expecting a relief rally after the central bank hikes by 50 (or maybe 75) basis points, what if we haven’t yet hit peak hawkishness? – CoinDesk

Next week we will demonstrate how to find the best yields on specific assets that you hold whether this is a stablecoin, or an altcoin you are looking to build a position in.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Isambard FA, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.