🧘♂️How to Predict Breakouts

Market Meditations | March 6, 2022

Dear Meditators

Almost seems like we got out of the frying pan and landed in the oven…

Just as we thought the worst of the COVID-19 Pandemic was behind us, we are now experiencing the aftermath of the Russia-Ukraine conflict.

Oil prices are soaring to all time highs, Gold is looking primed for a breakout and of course, Crypto is experiencing volatility as a result of the constantly developing and unfolding situation.

If that wasn’t enough, recent events have also shaken DeFi and the Fantom Ecosystem!

Today’s Meditations:

- BTC, FTM and GOLD Technical Analysis

- Look out for the GOLD Technical Analysis, where we share one of our favourite strategies for predicting breakouts ?♂️

- Key Developer Exits FTM; DeFi Takes a Hit

- Mastercard and Visa Suspend Transactions in Russia

- Our Crypto Calendar of the Week

Delighted to say this article is brought to you by crypto.com, the world’s fastest growing crypto app. Our favourite features:

- ? Earn Interest. Grow your portfolio by earning up to 14% interest on your crypto assets.

- ? Crypto.com Visa Card. Spend with the crypto.com Visa Card and get up to 8% back.

- ✅ Buy and Sell Cryptos. Join 10m+ users buying and selling 100+ cryptocurrencies at true cost.

You can use our link to download the crypto.com app.

⏰ Top Headlines

- Ukraine Is Buying Bulletproof Vests and Night-Vision Goggles Using Crypto

- Crypto exchange FTX announces push into Europe

- Energy prices rally as US considers ban on Russian oil imports

- NFT Layer 2 startup Immutable raises $200 million, now valued at $2.5 billion

⚜️ Is It Still Fool’s Gold?

1️⃣ BTC/USD

Macro Structure: Seems we were wise to have stayed relatively bearish during this time period.

Key Support: Just lost $40k support which is quite bearish.

Looking Forward: With $40k lost, it wouldn’t be surprising to see further downside to test the $35k level. Below $35k, we find ourselves in a heavy danger zone between $30k and $31k. In this danger zone, we may have to start taking very bearish scenarios into consideration.

2️⃣ FTM/USD

Macro Structure: FTM has taken a big hit following fundamental events (read more about it in the next section?). From a technical point of view, things could be worse. That is, FTM does not find itself too out of sync with the rest of the market. Similar to Bitcoin, the price rose, faced the 100 Day Moving Average, then headed back down. May even be the case that the panic is narrative fitting the price action rather than price action as a result of the narrative.

Key Support: Potential bounce at $1.2. If we lose this level, we are likely to see a test of the $1 level.

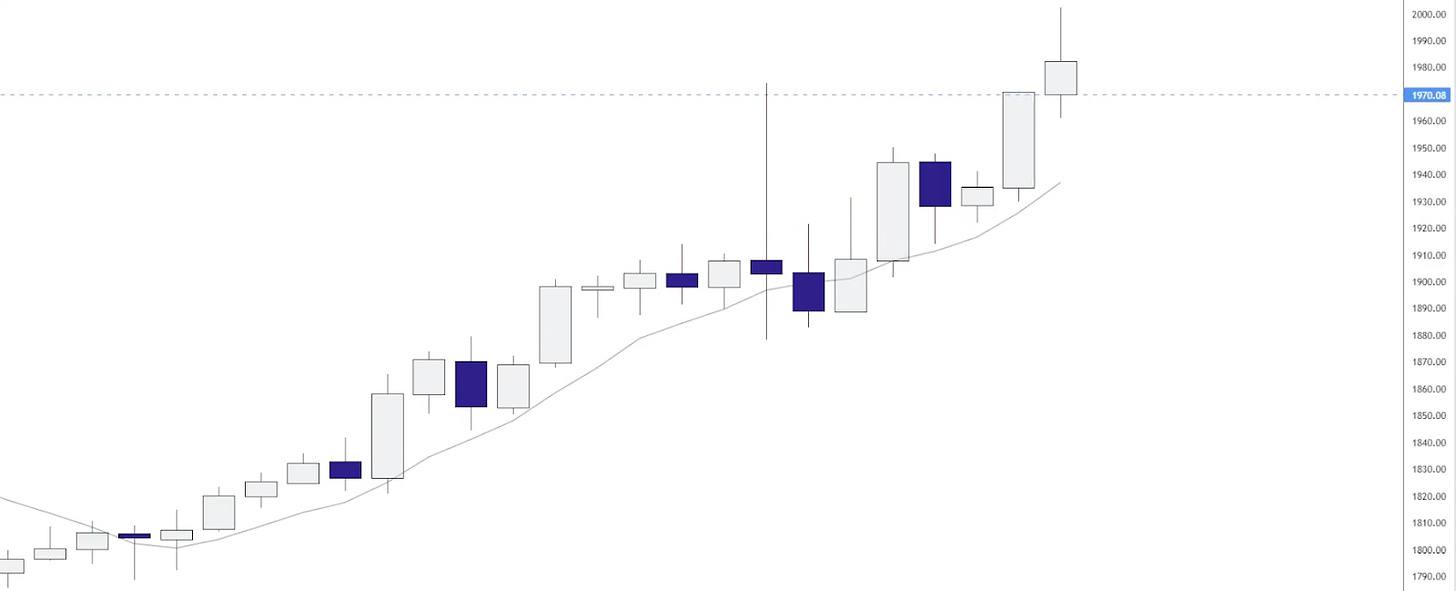

3️⃣ GOLD (US$/OZ)

Macro Structure: Gold could be primed for a breakout. Of course, the fundamental narrative of gold as a safe-haven asset bodes well with the current risk-off environment (as a consequence of the Ukraine-Russia conflict).

Looking Forward: One of our favorite ways to look for confirmation is to focus on the One Day. Looking for a break of the One Day with the 7 Day Moving Average. So when the 7 Day Moving Average closes above 1970 level.

?Vanishing Act

Andre Cronje, one of DeFi’s most prolific developers, has bid adieu to the world of cryptocurrency.The Twitter announcement was made by Anton Nell, a frequent colleague of Cronje in the DeFi space.Falling prices dominated some of the decentralized finance sector In the wake of his departure.

- Cronje is best known for creating Yearn Finance and Keep3rV1. With 20 years of experience and a resume including work on Hegic, Pickle, Cream V2, Sushiswap to name a few, his exit from the blockchain industry is making waves.

- The move away shouldn’t come as a surprise to anyone. Cronje recently deleted his Twitter account and changed his LinkedIn to remove his association with Fantom as an advisor.

- Tokens in the Fantom ecosystem suffered significant losses as well, with Spookyswap (Boo) down 19%, LiquidDriver (LQDR) 17%, Tomb (TOMB) 22% and Geist Finance (GEIST) 15% even though Cronje was not verified to be highly involved in any of their development.

Few projects and protocols will see an impact from the departure since they were deployed months or years ago. Some websites will be shutting down, but these serve only as frontends to connect users to autonomous contracts and are relatively easy to replace.

✋ Visa and Mastercard Suspend Transactions in Russia

We know that the conflicts in Ukraine are leading to many changes in price and the news that is ensuing is important to know the direction of crypto in the short term. On Saturday, Visa and Mastercard joined Paypal in suspending their Russian operations. Suspension of Visa and Mastercard operations came after Russia sent military forces into Ukraine.

- Ukraine has asked major exchanges (e.g., Coinbase, Binance, Huobi, KuCoin, Bybit, Gate.io, Whitebit, and Kuna) to freeze any accounts belonging to Russians.

- A Coinbase spokesperson said that they would not comply with the requested ban citing “economic freedom.”

- Binance also refused the request saying that crypto is supposed to “provide greater financial freedom” and to ban people’s access would go against the very reason crypto exists.

- KuCoin, Kraken, and other exchanges have refused to freeze Russian accounts.

During these times of conflict, it is extremely important to stay up-to-date on news. Breaking news can often have effects on the crypto markets in the short term.

Monday, 7 March

- ? Prism Farm Launch

The Prism Farm event begins, offering $PRISM rewards for locking up Luna in a promotional 12-month event for Prism protocol.

Tuesday, 8 March

- ? Synapse Network Onramp

Synapse network introduction of stablecoin and other cryptocurrencies directly purchasable using fiat currency.

- ?️ Kava Network

Kava Network Alpha release. Kava is a layer 1 blockchain aimed at combining Ethereum and Cosmos ecosystems using Tendermint.

Wednesday, 9 March

- ? Crypto World Expo

Cryptocurrency World Expo kicks off 9-10 March in Poland. PPV and live attendance tickets available.

Thursday, 10 March

- ? CPI Report

The February 2022 Consumer Price Index will be released Thursday. With the crisis in Ukraine in full-swing, energy prices have been driven even higher. Sign up to receive email notifications for CPI reports here.

Friday, 11 March

- ? SCB Open House

Celebrating the debut of SCB 10X’s virtual headquarter in The Sandbox, global metaverse leaders will gather to share insights and perspectives in chats and workshop sessions.

- Watch our How to Get Rich Trading Crypto Course if you struggled with today’s technical section.

- Read the following Technical Analysis guides for more insight:

- A History of the Meme Economy. 1/ For years, it was nothing more than a game played by millions of aspiring meme traders on r/memeeconomy… (Thread) – Dank Bank

- I personally don’t own any gold, but this is one of the best chart setups out there right now. (Chart) – Will Clemente

- I want to clarify a lot of misinformation going around, and share some upcoming Fantom news.(Thread) – Michael Kong

Looking for crypto analysis and insights you can trust? Consider becoming a FREE subscriber to stay ahead of the crypto market.

? Free subscribers get full access to:

- ✅ Our Daily Crypto Newsletter

- ✅ Bitcoin Reports and Ethereum Deep Dives

- ✅ Altcoin Analysis and Crypto Project Coverage

- ✅ Regular Technical Analysis

- ✅ Podcasts With Crypto Leaders

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Kyle F., Misael Calleja, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.