How to Stake

Market Meditations | May 5, 2021

Staking can be considered a less resource-intensive alternative to mining. It involves holding funds in a cryptocurrency wallet to support the security and operations of a blockchain network. To understand staking, we must understand Proof of Stake (PoS) and Proof of Work (PoW). Let’s address them one at a time.

Proof of Work

- PoW is the mechanism that allows transactions to be gathered into blocks. These blocks are linked together to create the blockchain. More specifically, miners compete to solve a complex mathematical puzzle, and whoever solves it first gets the right to add the next block to the blockchain.

- ✅ Advantages? PoW has proven to be a very robust mechanism to facilitate consensus in a decentralised manner.

- ❌ Disadvantages? It involves a lot of arbitrary competition. The puzzle the miners are competing to solve serves no purpose other than keeping the network secure.

Proof of Stake

- The main idea is that participants can lock coins (their ‘stake’) and at particular intervals, the protocol randomly assigns the right to one of them to validate the next block. The probability of being chosen tends to be proportional to the amount of coins: the more coins locked up, the higher the chances.

- ✅ Advantages? Some argue that the production of blocks through staking enables a higher degree of scalability for blockchains (what determines which participants create a block isn’t based on their ability to solve hash challenges as it is with PoW). This is one of the reasons the Ethereum network is planned to migrate from PoW to PoS in a set of technical upgrades collectively referred to as ETH 2.0.

- ❌ Disadvantages? Locking up funds in a smart contract is prone to bugs, so it’s always important to use high quality wallets or exchanges.

For more on the Proof of Stake technology, check out this paper: Peer-to-Peer Crypto-Curreny with Proof-of-Stake and this article.

What does Staking Mean For an Investor

If you are not interested in the technological perspective, it is sufficient to think of staking as the act of locking cryptocurrencies to receive rewards. Or, if you like, the equivalent of opening a savings account on the blockchain. Like a savings account, your balance will accrue additional income. While each Proof of Stake blockchain has its particular staking currency, some networks adopt a two-token system where the rewards are paid in a second token. Each blockchain network may use a different way of calculating staking rewards.

For some other networks, staking rewards are determined as a fixed percentage. A predictable reward schedule rather than a probabilistic chance of receiving a block reward may look favourable to some. And since this is public information, it may incentivise participants to get involved in staking.

Risks of Staking

- Market Risk: even if you’re earning 25% APY, if the price of the asset you’re staking decreases significantly, you will have still lost money

- Liquidity Risk: if the asset you’re staking is illiquid, converting it back to stablecoins or Bitcoin could present a challenge

- Lockup Periods: occasionally, a requirement for staking is locking up your crypto for a fixed period of time anywhere from 24 hours to a few years. If you’re unable to sell your crypto due to the lockup period, you could lose money.

- Validator Risks: if you’re running your own validator node, this is a highly technical (and costly) process. Make sure to take this into account.

Get Started with Your First Staking Investment Today

In most cases, you’ll be able to stake your coins directly from your crypto wallet, such as your Exodus wallet. On the other hand, many exchanges (such as FTX) offer staking services to their users. Note you are not directly involved in staking but rather, you are contributing to a staking pool: a staking pool is a group of coin holders merging their resources to increase their chances of validating blocks and receiving rewards. Many pool providers charge a fee from the staking rewards that are distributed to participants.

1️⃣ Staking With Your Crypto Wallet

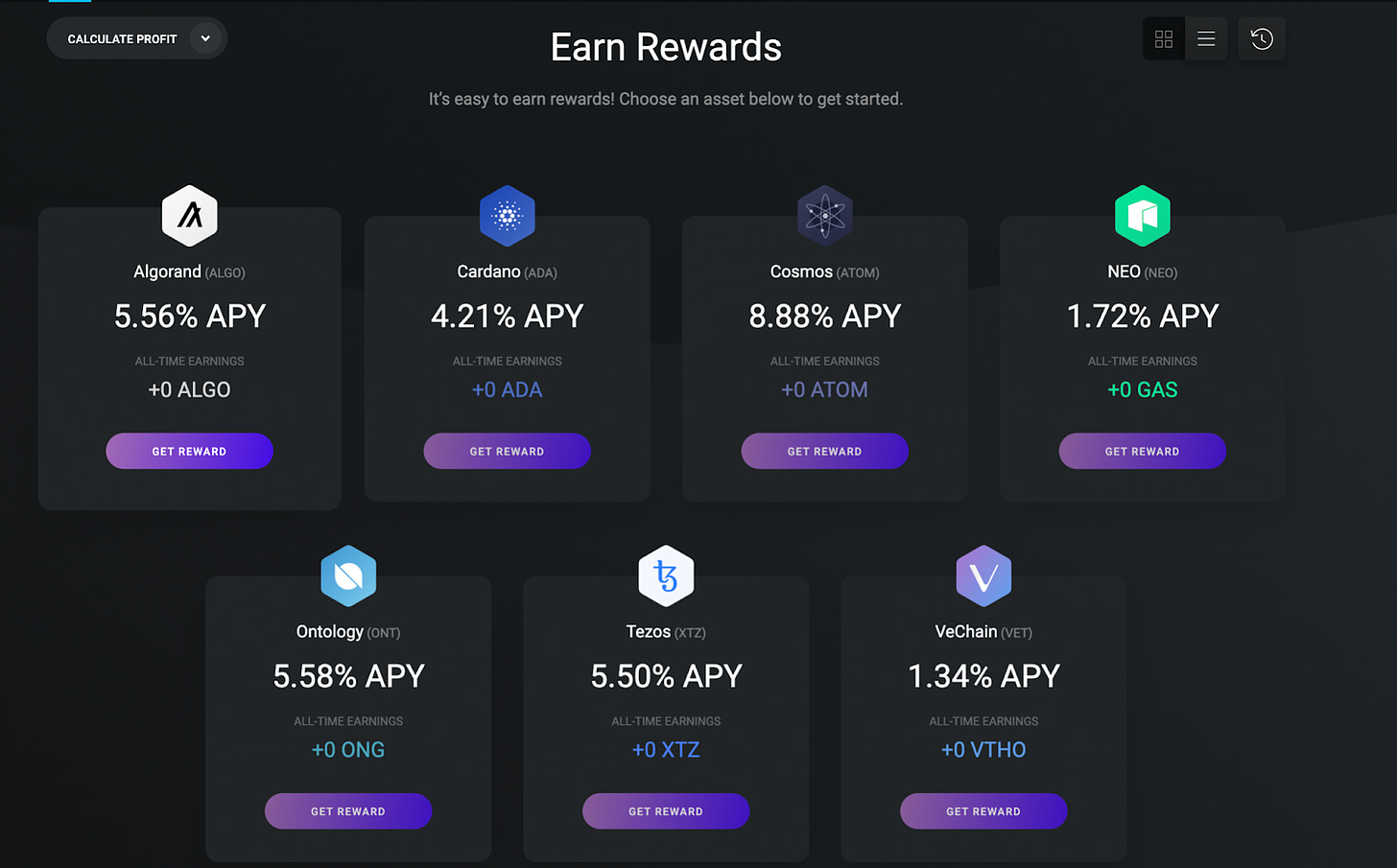

Staking inside of Exodus is as simple as finding the crypto you want to stake and start earning rewards. Cryptos you can stake on Exodus: Algorand, Cardano, Cosmos, NEO/GAS, ONT/ONG, Solana, Tezos and VET/VTHO. Exodus provides a video guide on how to start staking both on your mobile or desktop.

Step 1 – If you don’t already have Exodus on your mobile or desktop, begin by deciding where you want to download it.

Step 2 – Once you have downloaded Exodus, click on settings and navigate to the Apps tab, where you will want to select the ‘Rewards’ option.

Step 3 – You’ll then see the cryptos that have earning potential and their APY rates. Each crypto asset has its own rules which are revealed when you click ‘Get Rewards’.

2️⃣ Staking With Your Crypto Exchange

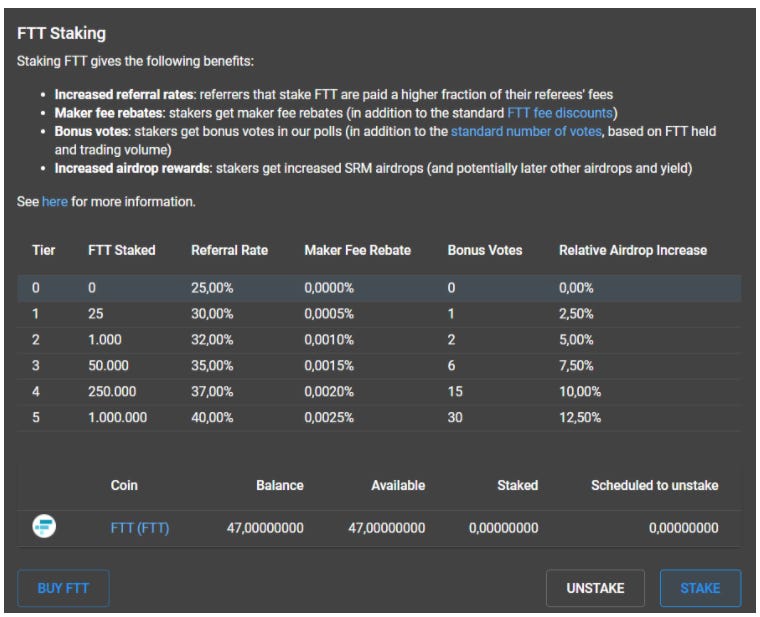

Using FTX as an example, you can use the exchange to stake FTT (their native token).

Note that if you click on our referral link, you will be eligible to receive a discount.

FTX provide a 4 step guide on getting started:

Step 1 – Go to https://ftx.com/markets and pick your FTT pair

Step 2 – Go to the FTT page (https://ftx.com/ftt) or click “FTT” on the top bar

Step 3 – Scroll down to “FTT Staking” and click “Stake”

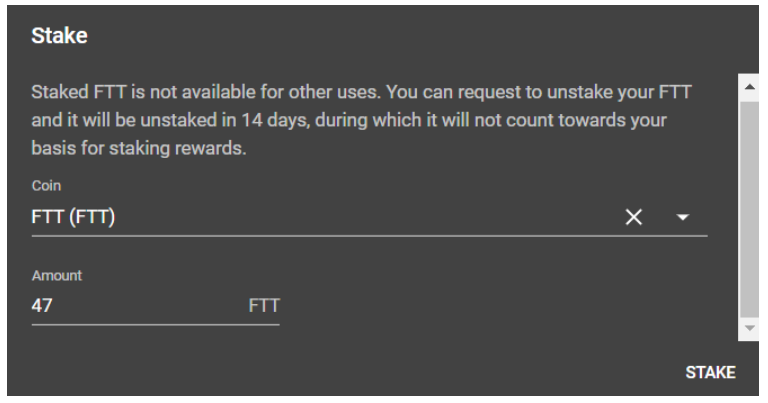

Step 4 – Put in the amount and click “Stake”

And thus concludes our staking guide.