Intro to AMM’s and Liquidity

Market Meditations | December 16, 2021

? DeFi-ying Expectation

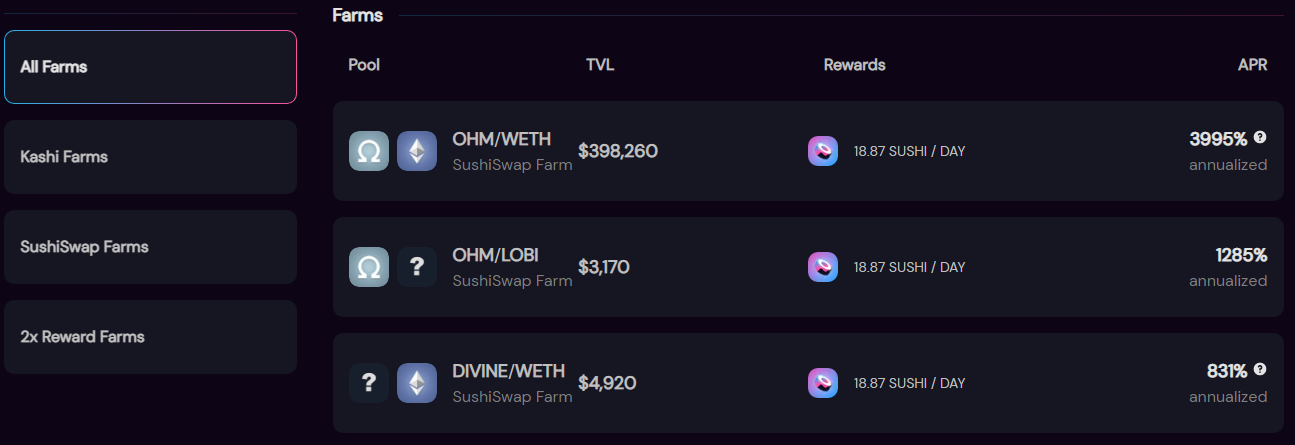

With around $3 billion Total Value Locked (TVL), SushiSwap is well-established in the world of decentralised finance, using its AMM to facilitate competitive rates.

- SushiSwap offers rewards to liquidity providers in its native governance token, SUSHI.

- Holders of SUSHI tokens are entitled to participate in voting on platform developments and proposals.

- When providing liquidity to a pool, investors are rewarded with Liquidity Provider (LP) tokens, which can then be put to work yield farming.

❓AMMs are DeFi’s answer to the conventional order matching system used by centralised exchanges. Instead of matching buyers with sellers, liquidity is pooled into a smart contract which automatically matches supply to demand.

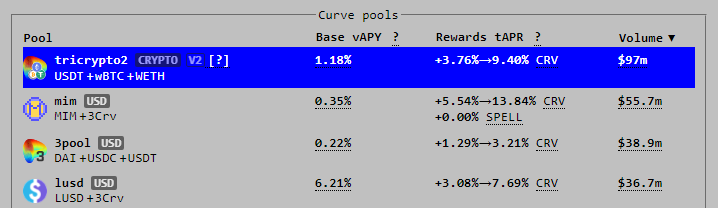

Curve is a decentralised exchange with the main goal of enabling users and other decentralised protocols to exchange stablecoins while offering low fees and slippage.

Investors deposit crypto assets into liquidity pools in exchange for earning yields on these investments.

- Curve offers revolving bonuses to base APYs as the desired balance of each liquidity pool is maintained.

- Some pools are “incentivised”, which offer rewards to people providing liquidity to specific pools with certain coins.

- Curve reliably offers lower fees than some competing exchanges, like UniSwap.

❓Liquidity Pools are pools of coins or tokens which are locked in smart contracts and used to facilitate trades between these assets. Liquidity providers earn rewards for depositing assets, while traders pay fees to use the underlying funds.

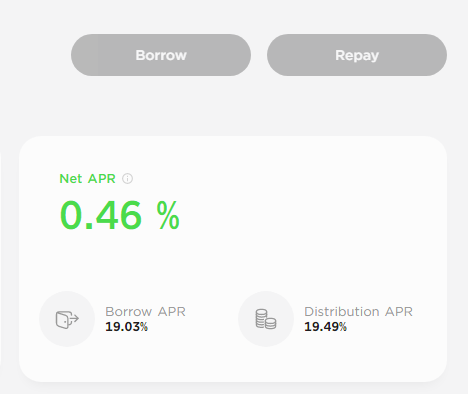

Finally, Anchor takes a slightly different approach to earning returns using Terra stablecoins.

It offers attractive yields for those depositing into the protocol, and some surprising interest rates for loans.

- The current APY yield for stablecoin deposits on Anchor is almost 20%.

- Anchor offers collateralized loans, giving a potential solution to unlocking otherwise inaccessible liquidity.

- When borrowing assets on Anchor protocol, sometimes the rewards for taking a loan can outweigh the interest to be paid, resulting in a net positive “cost” of borrowing.

❓ Slippage happens when price changes in between the time of an order being placed and resolved. High slippage can easily result in heavy losses.

DeFi is complicated and ever evolving. Properly understood and implemented it can be used to garner some remarkable profits. As always, high reward comes with high risk, so should you choose to become a DeFi degen, do your homework before showing up to class.

Keep missing pumps and opportunities? Consider becoming a FREE subscriber to stay ahead of the crypto market.