Intro to Avalanche

Market Meditations | January 5, 2022

Step 1: Establishing the Strength of the Layer 1 Chain

Nansen’s multichain dashboards (free for anyone to use) give us access to key indicators that we can use to assess the strength of a layer 1 blockchain.

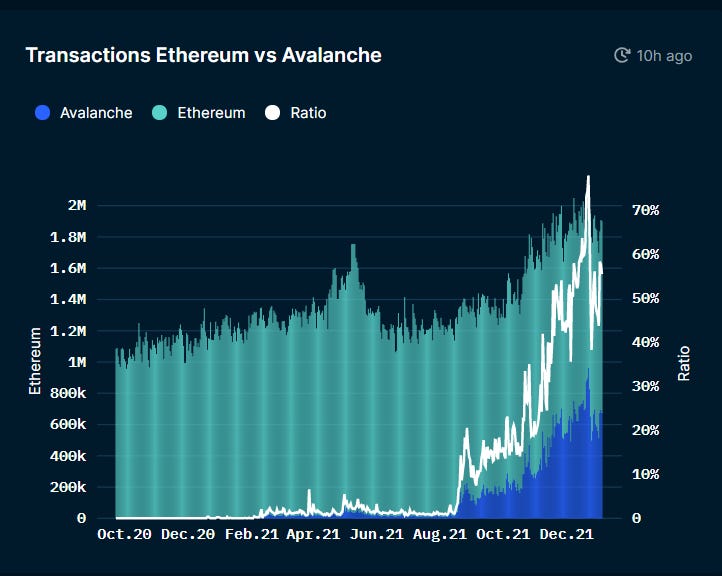

(1) Transactions vs Ethereum

One of Ethereum’s biggest problems has been its ability to scale due to expensive transaction fees. Comparing Avalanche’s transaction numbers to those on Ethereum can show us how much activity is happening on the blockchain and how well it has managed to scale.

Nansen.ai: 05/01/2022 Avalanche Transactions vs Ethereum

- We can see that adoption (shown by number of transactions), has grown exponentially since August 2021 with Avalanche processing around 60% of the number that Ethereum is currently achieving.

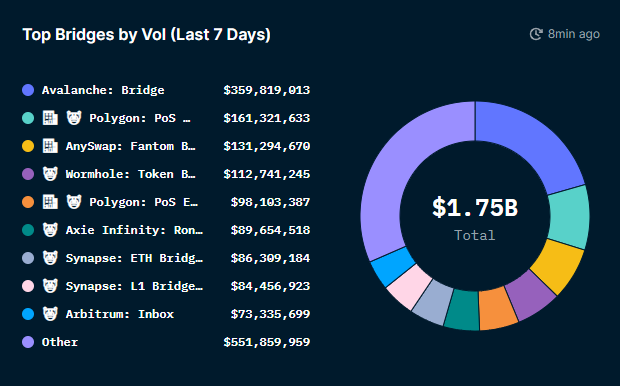

(2) Top Bridges by Volume

To start using another layer 1 blockchain – you must first move assets onto that blockchain and avalanche has an official bridge that allows you to do so. We can compare the volumes being transacted through the bridge to other layer 1s to illustrate where capital is flowing right now.

Nansen.ai: 05/01/2022: Top Bridges by Volume

- The Avalanche bridge has had almost $360m of volume in the last 7 days. This is the most of any bridge by over $200m – showing that a large amount of capital is flowing into the ecosystem.

Step 2: Diving Deep into Opportunities within Avalanche

The key indicators in step 1 have clearly shown that there is a huge amount of network adoption for Avalanche – being one of the hottest layer 1 chains. We can now dive deeper into the opportunities within the ecosystem, allowing us to generate insights that could lead to profit.

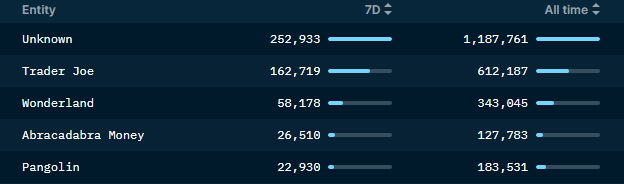

Most Used Protocols

Nansen.ai: 05/01/2022: Most used protocols on Avalanche by number of users

- Trader Joe: This currently has the most number of users on any protocol on Avalanche. It is a decentralized exchange that allows you trade crypto assets and a lending protocol.

- Wonderland: This is a reserve currency protocol aimed at making a non-dollar denominated stable asset and is part of a growing narrative referred to as DeFi2.0.

- Abracadabra Money: This protocol has received a lot of attention as is also affiliated with the DeFi2.0 narrative.

- Pangolin: This is a decentralized exchange – similar in functionality to Trader Joe.

✅ Tip: We can use Nansen’s hot contract feature to dive into the hottest opportunities right now. The feature allows us to see which smart contracts are receiving the most amount of capital and how many smart money wallets are interacting with that contract. Of course these kinds of projects have a huge amount of risk and we do not endorse interacting with such projects without a large amount of due diligence.

Conclusion

Alternate layer 1 blockchains have already caused major disruption to the crypto space – with huge price increases for native tokens and huge gains for those that caught the trend early. Using Nansen, we are able to understand not only how adoption is progressing but the exact protocols within the ecosystem to pay attention to.

This week we have dove into Avalanche, one of the hottest layer 1’s right now. For the next 3 weeks we will be doing the same for other top layer 1 blockchains – so you can understand where to find the next big opportunity.