Intro to CBDC’s

Market Meditations | May 17, 2022

❓Is CBDC-eason Around the Corner?

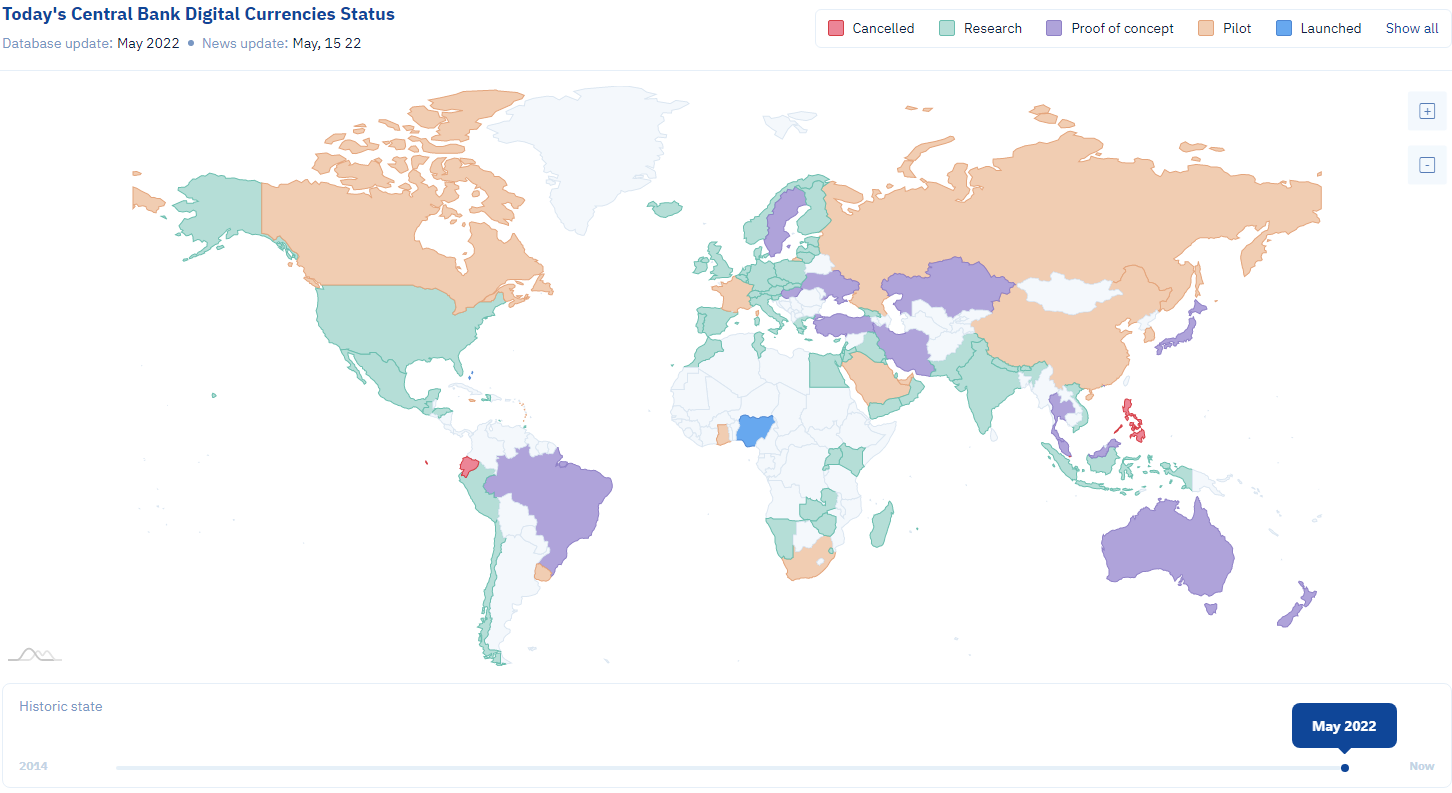

Data according to CBDCtracker.org shows a plethora of countries exploring the development of CBDCs in various stages of development. While few have launched, research is invariably leading to proofs of concept around the world, identifying valid government interests.

Central Bank Digital Currency (CBDC)

As the name implies, CBDCs are issued by a central bank instead of a private organization. The Federal Reserve (The Fed) and the Bank of England are examples of central banks. CBDCs are government-issued, and regulated by a central authority. As such, they are much more easily regulated and controlled. The upside is that CBDCs will almost certainly be insured and backed by governments, ostensibly increasing stability and security of holders.

Stablecoins

By now, most of us are familiar with these mainstays of the crypto space.

- These coins and tokens derive their moniker from being pegged (directly linked) to an asset, often fiat currencies such as the U.S. dollar or Japanese Yen.

- They are issued by non-governmental organisations, like Centre in the case of USD Coin(USDC) or MakerDAO in the case of DAI.

It might seem like these are two sides of the same coin, and they are – but with some key differences:

- Centralisation is the most important difference between these two contenders. Some stablecoins, like Dai, are decentralised. CBDCs are not.

- CBDCs are issued by governments, with no mechanism controlling their genesis. Stablecoins are dependent upon the supply of the asset to which they are pegged.

✅ Tip: Central banks, also known as reserve banks or monetary authorities, are institutions charged with managing currency and monetary policy for a state or country. These banks are controlled by governments and implement legislation and monetary policy.

What Does This Mean for Crypto Users?

The issuance of CBDCs will introduce competition to the stablecoin market. Many institutions hesitate to invest in cryptocurrency because of a lack of regulation and oversight. But those valuing decentralisation above security are likely to be more reluctant to go all-in on a government currency.

Moreover, cryptocurrency projects aren’t likely to integrate CBDCs before they’re in circulation. Even then, there may be philosophical reasons to hold off on welcoming these assets with open arms.

Development is picking up momentum around the globe as governments come to terms with the future of digital currencies.

What Does the Future HODL?

Regulation is likely, especially following UST’s collapse. CBDCs may hedge out stablecoins, impacting their price action. Frankly, it’s impossible to know, but staying abreast of this emerging topic will be advantageous no matter what happens.

The outcome rests on people like us. Institutions and governments undoubtedly control the trajectory of monetary digitisation, but the king of the hill is ultimately chosen by the people willing to use it.

Don’t want to be caught off guard? Check out Earnst & Young’s recommendation for banks and read the Fed’s publications on CBDCs.