Intro to Ethereum

Market Meditations | January 26, 2022

Step 1: Establishing the Strength of the Layer 1 Chain

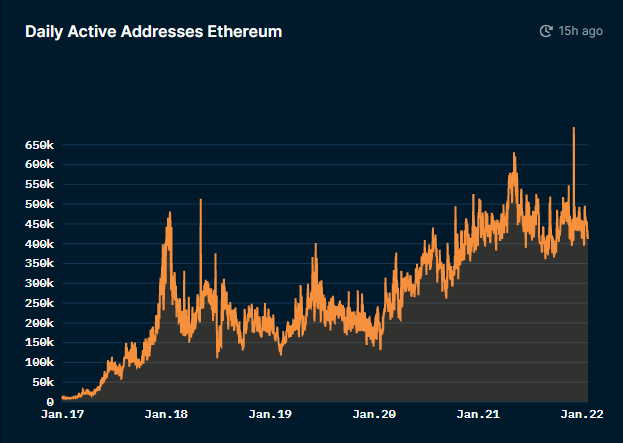

(1) Daily Active Addresses on Ethereum

Daily active addresses measure the number of wallets that carry out a transaction, on a blockchain, on any given day. Whilst many users have more than one wallet, we can use this measure to show how the number of users changes through time.

Nansen.ai: 19/01/2022 – Ethereum Active Addresses

- Daily active addresses peaked at 650,000 at the end of 2021 but have since fallen to around 400,000, a lower number than we saw even at the peak of 2017.

- We need to take into account however that Ethereum is significantly more expensive to use than in 2017. So whilst there are the same number of users, the amount of fees generated by the network is significantly higher.

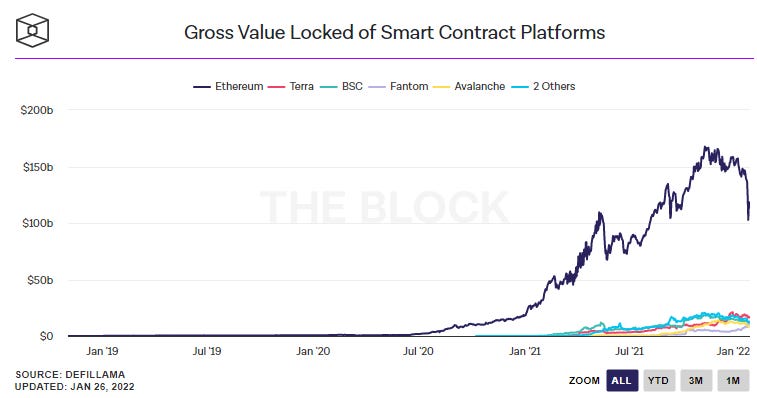

(2) TVL Compared to Other Smart Contract Platforms

Total value locked (TVL) is simply the number of assets currently being staked on a network or protocol. It can be used to show how much money is currently taking advantage of a system.

The Block: 26/01/2022 – Gross Value Locked of Smart Contract Platforms

- Whilst the dollar value locked in Ethereum has reduced dramatically in recent months (mostly due to price decreases across crypto), it remains significantly higher than any of the other layer 1 platforms.

- This shows that whilst other layer 1s are gaining adoption, those with the most capital are still using Ethereum. This is likely due to its focus on decentralization and security over low cost, fast transactions adopted by some of its competitors such as Fantom.

Step 2: Diving Deep into Opportunities within Ethereum

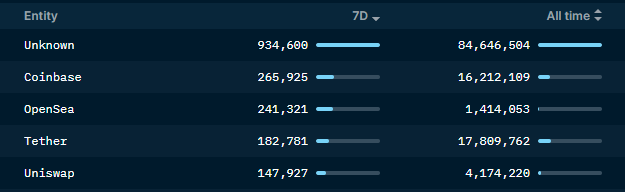

Most Used Protocols over 7 days

Nansen.ai: 26/01/2022 – Most Used Protocols on Ethereum by Number of Users

- Unknown: The fact that so many protocols remain unlabelled is an indication of how much opportunity there is still on the network.

- Opensea: This is the biggest NFT trading platform on Ethereum and, notably, is ahead of Uniswap (the largest decentralized exchange) showing a high level of interest in the NFT space when compared to DeFi.

- Uniswap: This is the largest decentralized exchange on Ethereum and facilitates trading of assets alongside yield opportunities through liquidity providing.

✅ Tip: Nansen’s hot contract feature allows us to find the hottest opportunities in real time by showing which smart contracts are receiving the most amount of capital. Currently the top 5 all relate to NFTs – another indication of its current popularity on the network.

Conclusion

Ethereum’s growth has certainly slowed down in recent months, and the number of daily users is now lower than even it’s peak in 2017. There is also no doubt that fast, low-cost smart contract networks have taken market share from Etheruem, especially when considering the number of users as the metric.

However, the $100 billion TVL shows how strong the ecosystem continues to be. Not only is this a vast sum of money, but it eclipses all other layer 1s indicating that those with the highest value of assets are looking for the network with the most security. As of today this is Ethereum, and no other network seems set to change this in the near future. Long term however, we will be keeping a close eye on how the layer 1 race develops.