Intro to Yield Farming

Market Meditations | April 27, 2022

? You Reap What You Sow

There has never been more choice when it comes to finding returns in DeFi. However, with so many new chains and protocols, it can be impossible to keep up with the highest returns.

For part 1 of our yield farming series (click here for a course breakdown) we will show how, using Nansen, we can track money flows across DeFi to see where both smart and retail money is flowing in real-time.

Identifying Hot Ecosystems

In order to use a blockchain, you must first transfer assets to that blockchain in a process known as bridging. Nansen allows us to track the smart contracts that facilitate this bridging showing how many top crypto investors are transferring their funds to a specific blockchain:

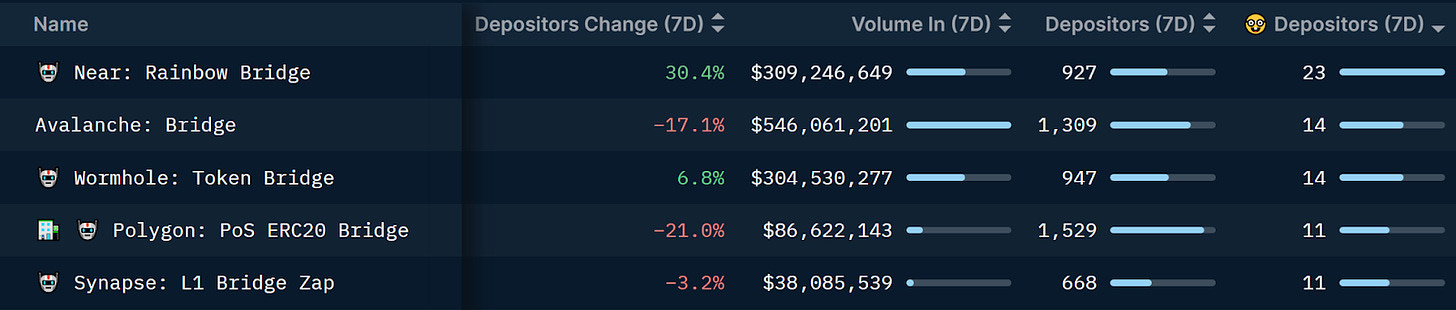

Nansen: 20/04/2022 – Bridge Builder sorted by number of Smart Money Depositors

- The Near blockchain has received the most number of smart money depositors indicating that there may be a number of opportunities on that chain.

- Avalanche is the second favourite chain amongst smart money. Whilst there are a large number of smart money depositors, total depositors have decreased over the last week, indicating there may be opportunities that less informed participants are not aware of.

Tracking the Smart Money

Now we have identified hot ecosystems, we can dive deeper into the smart money depositing assets into these ecosystems. Using Nansen we can see the top depositors of USDC (one of the most common assets used in DeFi) into the Avalanche Ecosystem:

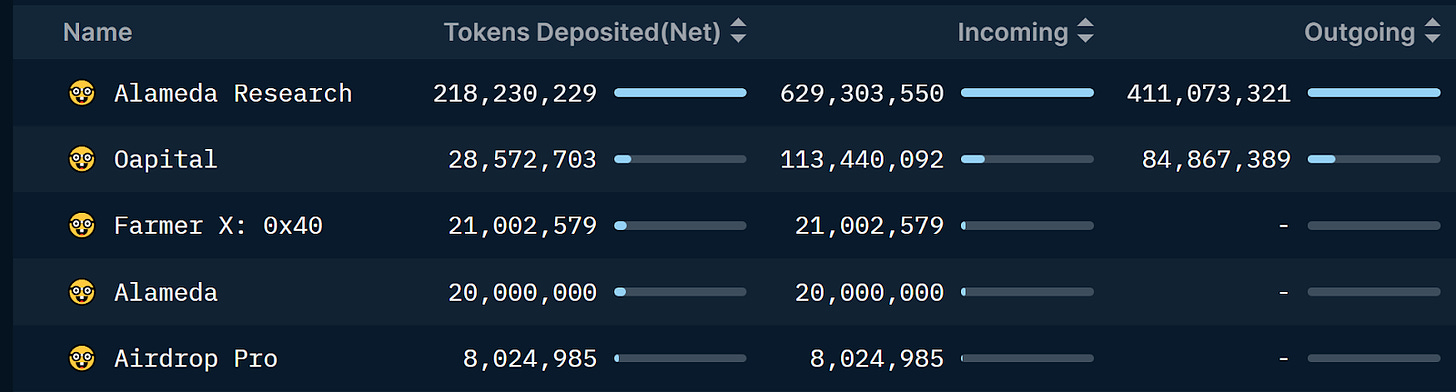

Nansen: 27/04/2022 – Top Depositors of USDC into the Avalanche Bridge, filtered by Smart Money

- Tokens Deposited (Net) is an indication of the number of USDC tokens currently deposited into the ecosystem by individual wallets and reveals the investors that are taking advantage of opportunities on the blockchain.

- Most notable on this list are Alameda Research which have over $218m currently on the chain.

✅ Tip: With Nansen we are also able to dive deeper into the individual wallets, seeing exactly how notable investors such as Alameda are producing profits.

Conclusion

Yield farming has been a major source of profits for many top crypto investors in the last few years however is becoming increasingly difficult to keep track of. Using Nansen we are able to find the hottest ecosystems that are currently offering the best opportunities.

As with any indicator, one piece of data cannot be used in isolation and should be used in the context of a wider system. To understand all the risks involved check out the intro to our yield farming course and to build your own system, keep following the 5-part series. Next week, we demonstrate how you can find the hottest protocols identifying exactly where you are able to generate the highest returns.