Market Capitalisation Guide

Market Meditations | July 7, 2022

? Thinking Caps

Market capitalisation is a crucial weapon in your arsenal when combating the crypto market. Market capitalisation (“market cap”) is a simple way to determine a cryptocurrency’s size. There are two types of market cap:

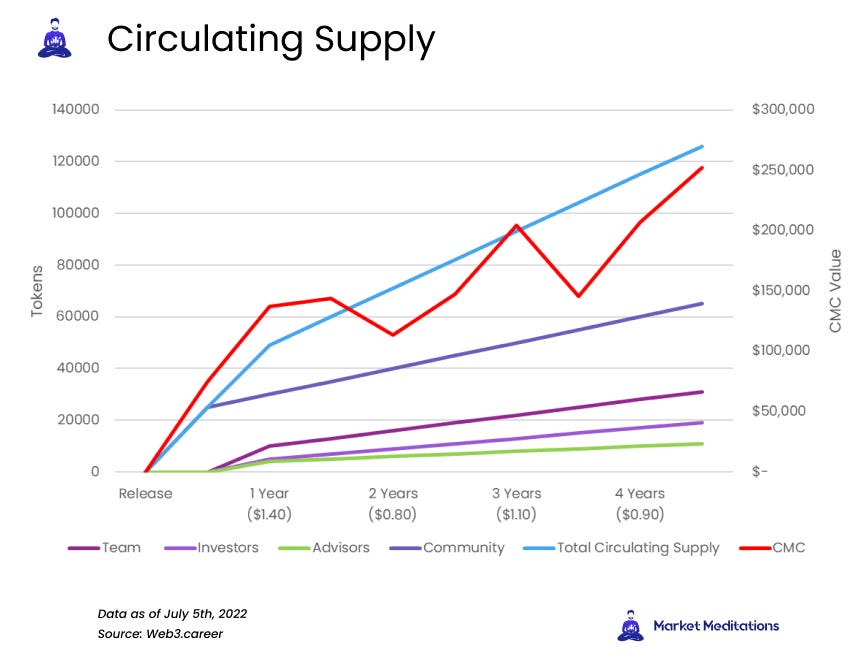

1️⃣ Circulating Market Cap (CMC) represents an individual token or coin’s market value according to the current circulating supply. CMC is calculated using: Current Price x Circulating Supply. This does not take into consideration tokens unlocked at a future date, meaning it should not be utilised in isolation.

The number of tokens in circulation increases as different groups of supporters receive emissions according to a schedule. The CMC can be calculated by multiplying the number of total tokens in circulation (the red line) by the token’s price (shown under each year).

2️⃣ Total Market Cap (TMC) represents the overall value of all cryptocurrencies. This data can easily be found on CoinMarketCap and CoinGecko alongside many other metrics for individual tokens. TMC helps form a broad macro outlook on how the cryptocurrency sector is performing.

✅ Tip: When using CMC to compare projects, be sure to dive deep into the project’s whitepaper to understand how and when more tokens will be unlocked.

Market cap is oftentimes considered alongside Fully Diluted Valuation (“FDV”).

3️⃣ Fully Diluted Valuation (FDV) represents the asset’s market cap once all future tokens are minted or unlocked. FDV is calculated using: Current Price x Maximum Supply. FDV is an important metric, as it can give investors a complete picture of the project’s future. The relevance of FDV within crypto is widely debated, but using it as a measure of confluence could support a potential investment.

✍️ Example:

At the time of writing, Dogecoin (DOGE) is currently worth $0.065536 per coin, with a circulating supply of 132.6 billion coins.

- Using our simple CMC equation from earlier, the current circulating market cap of DOGE is approximately $8.7 billion.

- Many market participants may look at the low price of DOGE and assume that it could easily climb to $1. However, this price target remains extremely unlikely.

- For DOGE to achieve $1 per coin, the market cap of DOGE would have to be approximately $132 billion, over twice the value of all USDT in existence!

- A similar theoretical calculation can also be used with FDV. Therefore, it is crucial to understand both CMC and FDV, as both can be used in different contexts.

MarketCapOf is a helpful tool to compare the market caps of different tokens and can be used to compare the market caps of similar projects.

4️⃣ Other Considerations

- Emissions refer to the speed and rate of new coins or tokens being minted. Keep these schedules in mind, as a large inflow of supply could affect the token price.

- Not all emissions result in immediate selling. Some tokens are subject to lock-up periods or vesting terms which prevent them from being accessible for periods of time.

- Burning mechanisms are designs includedto remove coins from circulation. Popular solutions include the “destruction” of a portion of transaction fees collected for activity on a network.

- Token burning acts to keep inflation under control in the case of tokens with no mint limit.

To better understand token vesting periods and gain a fuller understanding of tokenomics, study our two-part guide here: Tokenomics 101 & Tokenomics 102.