🧘♂️Mystery Altcoin Strategy

Market Meditations | March 11, 2022

Dear Meditators

In what has been a highly eventful week, today Bitcoin has struggled to maintain the $40k level.

The bid pressure from Biden’s Executive Order appears to be outweighed by the European Central Bank’s contractionary monetary policy announcements and the continued escalation of the Russia-Ukraine conflict.

Today’s Meditations:

- BTC and WAVES Technical Analysis

- In the WAVES section, you will find out mystery altcoin strategy

- Latest on Polygon

- What the Department of Labor has Been Doing

⏰ Top Headlines

- SEC shoots down spot bitcoin ETF proposals from NYDIG, Global X

- Russians Looking to the UAE to Unload Billions in Crypto Assets

- Ukraine Details What Crypto Donations Are Being Spent On

- Citi’s co-head of digital assets leaves to launch crypto startup

? BTC Causing Waves?

BTC/USD

Key support: $45k

Key Resistance: $36k. If/when $36k breaks we expect continuation down to $30k.

BTC has been extremely difficult for the inexperienced trader. Volume and trading activity are going down, volatility is going up and we’re in a downtrend. This is commonly memed as the PVP market. It’s a battlefield so take care, the more experienced range traders and intraday scalpers thrive here.

One last note, the $40,000 psychological level has lost a lot of power. When key levels like this break numerous times in quick succession the market numbs to them.

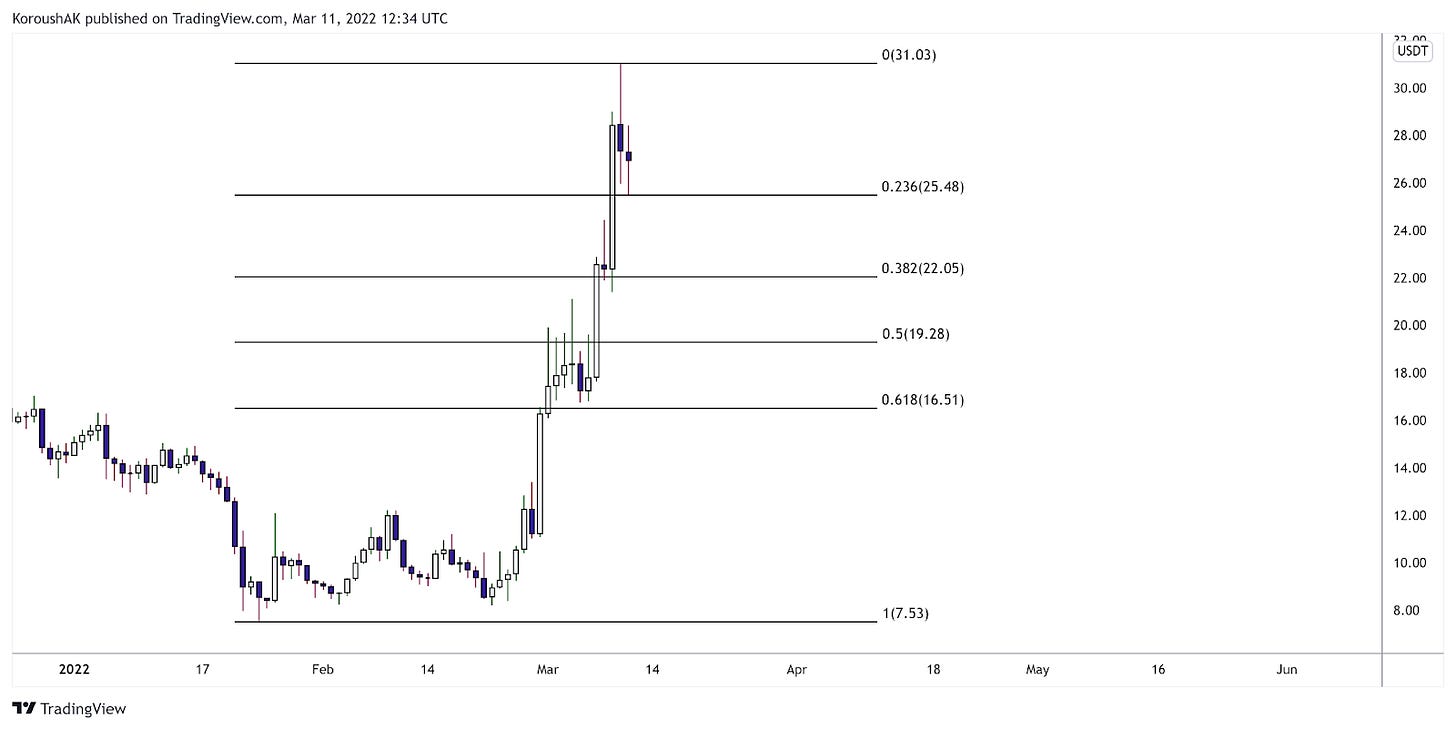

WAVES/USDT

This WAVES pump reminds us of the 2018/2019 markets. Our style was aggressive intraday scalping on lower time frames back then, though these days we’ve transitioned to longer term trades.

It made us a lot of money back then so we’ll share some tips.

High level hypothesis was as follows:

- Coins that generate a lot of hype and attention when the market is turning down seldom retrace the entire move in one go.

- They retrace slowly with big bounces from those who missed the boat FOMO’ing in, and that’s precisely where you can build an edge.

- Take advantage of the greed of others without giving into your own.

- Look for a system that catches moves at high probability points and sells quickly.

On the chart above we’d look for a bounce on the 0.382 ($22) level and/or the 0.618 ($16.5) level. This strategy works best in more bearish markets and involves exiting the position at the first sign of resistance which tends to be the fib level directly above.

? I’m Still Here!

Polygon (MATIC) is a layer 2 blockchain offering scaling and infrastructure solutions to Ethereum Virtual Machine (EVM) dApps.

- Last month, Polygon raised $450 million in a funding round involving big-name investors, including Sequoia Capital.

- DappRadar shows that on March 10th, the network addresses on Polygon which interacted with decentralized applications (dApps) grew by 5% relative to the previous month.

- To date, Polygon has reserved over $1 billion to develop DeFi applications requiring sensitive information redaction.

- Matic’s TVL has, however, drop below $4 billion; a far cry from it’s all-time high at $10.53 billion in June of last year.

One of the most likely culprits behind Polygon’s waning prices is an increase in the population of proof of stake layer 1 networks. When activity on the Ethereum network slows, the effects scale to layer 2 Ethereum solution projects.

?♂️ DOL Says No to Crypto

Yesterday, the Department of Labor released a notice that they would be launching a program aimed at investigating retirement plans which offer crypto.

- The DOL says they have seen a rise in firms marketing crypto investments for 401K plans. Due to the increase, the Employee Benefits Security Administration will conduct this investigative program.

- Defined contribution plans usually offer a menu of investment options, such as individual stocks, ETFs, bonds, and/or annuities. Crypto is increasingly being added to these menus and the DOL is not only cautioning investors and plan participants but managers of such funds as well.

- The notice warns that the promise of outsized returns may cloud investor judgment & attract inexpert investors, reminding managers that they have a fiduciary responsibility that will not be passed on to plan participants.

Due to the early stage of the digital asset space, the DOL is concerned about the volatility and speculative nature of crypto. Custody of digital assets is another area of concern, as well as valuation. Finally, they reference the evolving regulatory framework as another reason to refrain from offering crypto as an option in these plans.

- Watch our How to Get Rich Trading Crypto Course if you struggled with today’s technical section.

- Read the following Technical Analysis guides for more insight:

- The SEC won’t approve a Spot Bitcoin ETF but they’ll approve a futures ETF causing investors to get hammered by roll costs and GBTC which is trading around -30% to NAV. Nice “investor protection” – Will Clemente

- JUST IN: El Salvador could launch its #Bitcoin bond as early as next week – Reuters – Bitcoin Magazine

- The ETH 2.0 deposit contract has hit 10M $ETH staked. According to our data, at least 66% of these funds were deposited by exchanges and staking services, rather than individual stakers. The largest deposited volume comes from Lido (22%), Coinbase is runner up with 15% – Glassnode

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Kyle F., Max P., Nick T., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.