Nansen DeFi Tutorial: Identifying Hot Narratives

Market Meditations | October 27, 2021

Step 1️⃣: Assess the Macro Picture

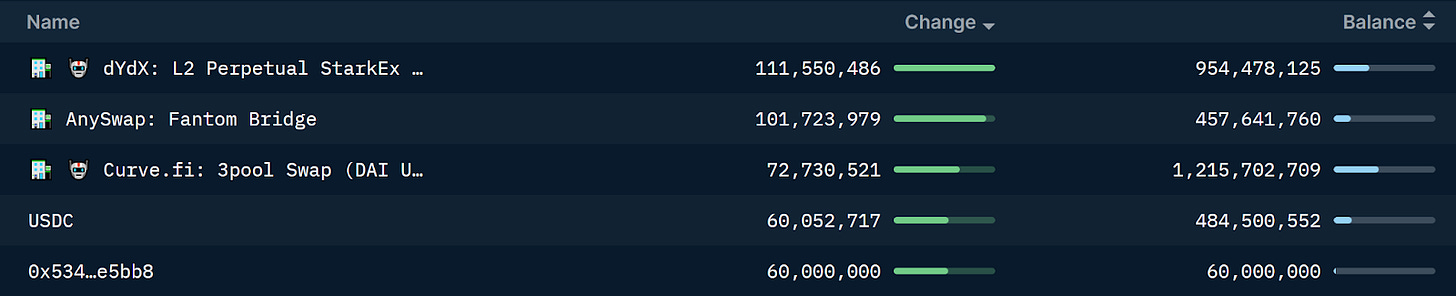

Tracking Flows of Largest Assets

Huge amounts of crypto flows through DeFi every day. Breaking this down for key assets such as USDC, wBTC and wETH can show exactly where these flows are occurring.

Nansen.ai: USDC flows on Ethereum Blockchain 27/10/2021

- Over $111m has been deposited into dYdX’s USDC staking pool over the last 7 days. This could be a sign of a trending narrative: decentralized derivative platforms.

- Over $100m has been bridged over to the Fantom chain showcasing increased adoption.

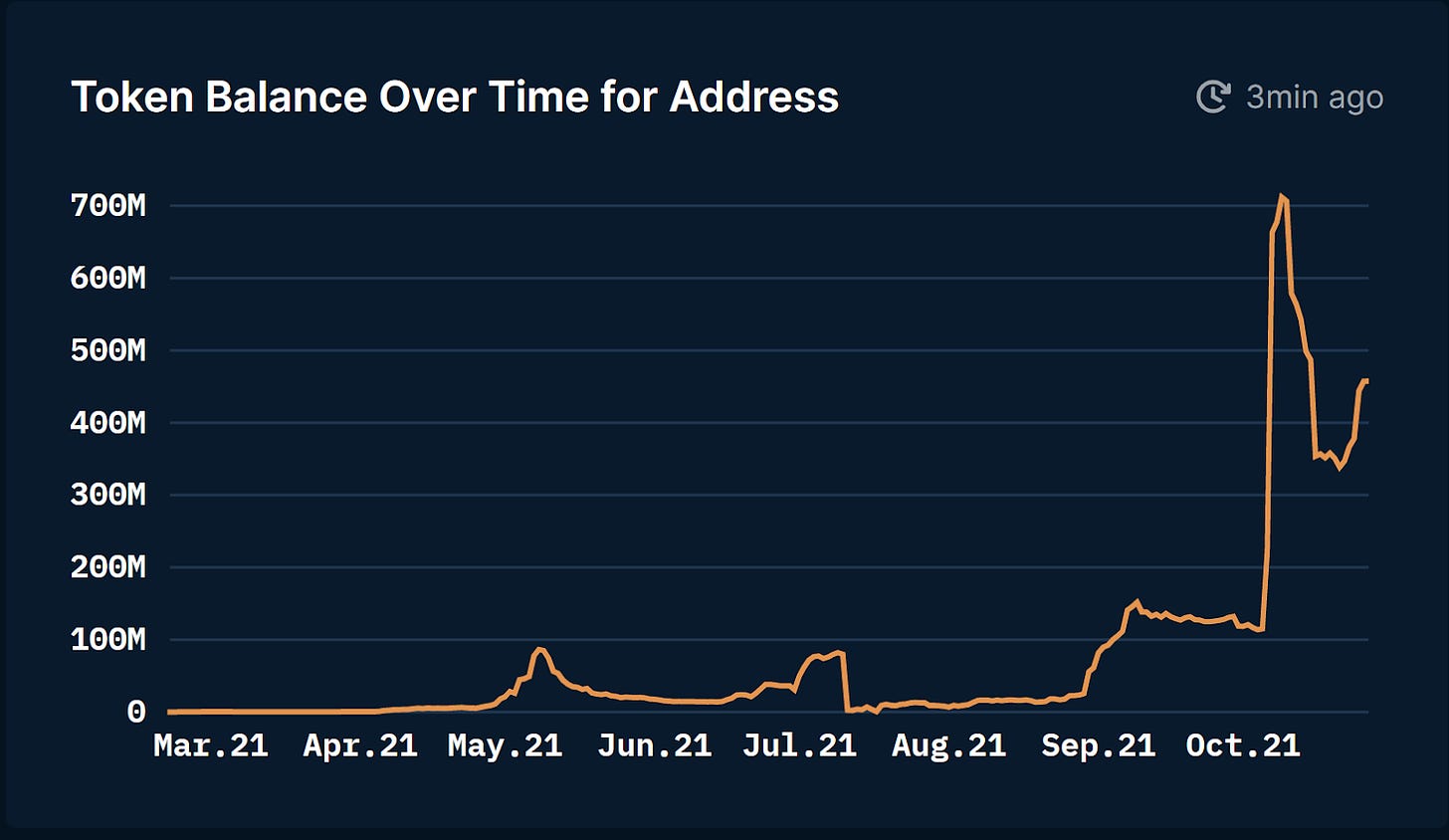

Considering Off-Chain Bridges

Activity on the Ethereum blockchain can also highlight opportunities on other ecosystems. By considering flows of a specific asset into these bridges, we are able to spot which ecosystems are trending.

Nansen.ai: USDC flows into Fantom Bridge (Using Wallet Profiler Feature)

- Flows of stablecoins have started to return to Fantom after large withdrawals

- Interestingly wBTC and wETH have not seen the same magnitude of recovery and are flowing more heavily into Avalanche. One explanation is that stablecoins are making their way to Fantom in order to purchase ecosystem altcoins

Understanding such macro trends allows us to identify narratives, such as decentralized derivative platforms and capital inflows to alternate layer 1s such as Fantom and Avalanche.

Step 2️⃣: Assess the Micro Picture

Now that we understand these macro narratives, we can use Nansen to dive even deeper.

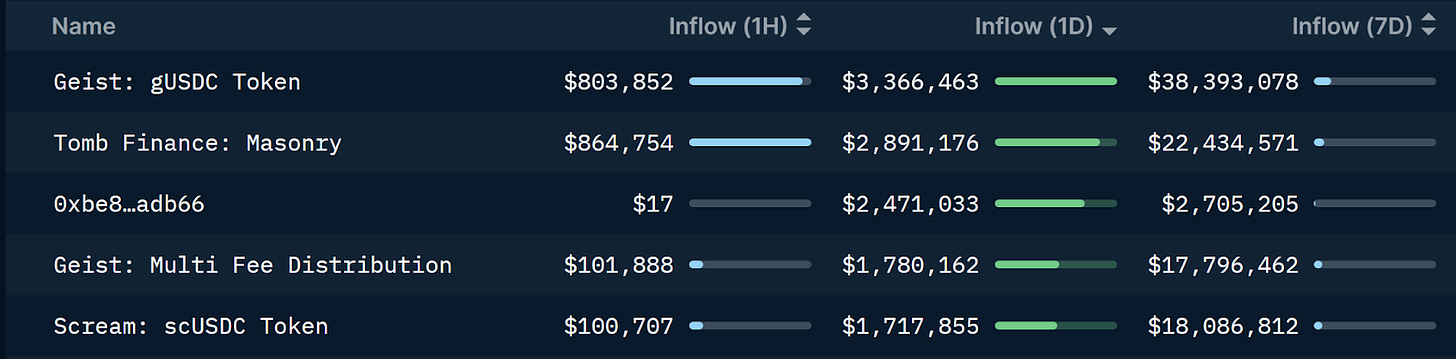

Hot Contracts

Nansen allows us to track smart contracts in specific sectors so that we are able to see not just which ecosystems are receiving inflows, but exactly which smart contracts and which protocols.

Nansen.ai: Hot Contracts for Fantom sorted by largest daily inflow

- Geist: This has seen a return of USDC following the introduction of a rewards program on Curve.Finance

- Tomb finance: New incentive program has lead to large capital inflow

Step 3️⃣: Confluence

As ever in crypto, one indicator is never enough and must be built as part of a wider system. Using DeFi resources such as DeFi Llama (on chain metrics) and Zapper (to track your DeFi activity) we are able to find data to achieve confluence and aid our decision making.

Additionally we must not forget technical analysis (whilst trading), keeping up to date with the news (using platforms like Market Meditations), risk management and psychology.

Conclusion

As crypto develops, we are seeing that the market no longer moves as one sector. We have DeFi, NFTs, DAOs and others, and each of these can have their own sector market cycle. To remain profitable, we must be able to break down individual sectors and understand if they are trending alongside their key narratives. Using Nansen to consider money flows across DeFi, we can do exactly this.