Nansen NFT Tutorial

Market Meditations | September 29, 2021

When it comes to technical analysis, our approach is to use TradingView to generate macro and micro insights. We gauge the big picture, then we deep dive. Profiting from NFTs can be difficult in the absence of such data, however with Nansen, we can recreate the macro-micro approach for the NFT market.

Step 1️⃣: Asses the Macro Picture

There are two key tools to carry out this macro analysis, both found in the NFT Paradise Dashboard; Market Cap and Volume.

Market Cap

We can use this data to establish market leaders and if we click on the top 5 projects, price and volume trends. In this instance:

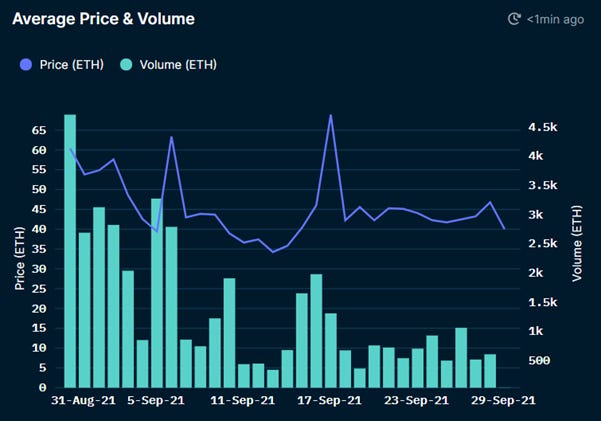

- Price data indicates that after a drop for the largest NFT projects, price has now started to stabilise. To showcase this trend, consider the price data for Bored Ape Yacht Club, the 4th Largest Project.

Price and Volume: BoredApeYachtClub: Nansen.ai

- Axie Infinity has 1.9 million active wallets, completely eclipsing the next highest number of wallets, CryptoKitties with 108,000 – highlight the strength of Axie and the play to earn narrative.

- Other elements of this data that can help us generate insights include change in position, number of transactions and further price data, all of which can be found on Nansen.

Volume

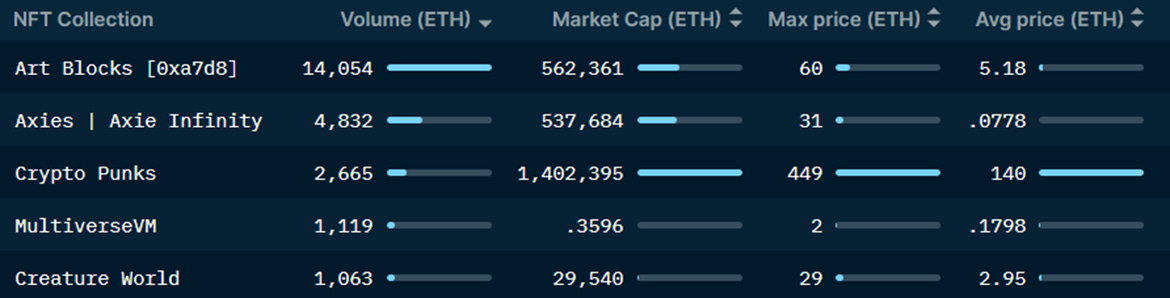

Hottest NFT Projects (Top 5 by Transaction Volume): Nansen.ai

Volume can be used to establish what narratives and projects are currently trending:

- Whilst the top 3 are established, well known projects, the top 4-10 are all new (released within the last month). This indicates that participants are happy to speculate on new projects, another sign that the NFT market is stabilising.

- Artblocks have traded $40m of NFTs in the last 24 hours. As we noted last week, generative art (where all the NFT data is stored on-chain) is a strong narrative and continues to show strength.

- 3 of the top 5 projects are related to NFT gaming and the metaverse, including 2 new projects. This highlights another strong macro narrative that you can take advantage of.

Market cap and volume allow you to understand the macro environment of the NFT space helping you ascertain whether there are any strong narratives and whether the wider NFT space matches your risk appetite. If you can identify these narratives and it does match your risk appetite, we can move onto step 2.

Step 2️⃣: Asses the Micro picture

Now we have a framework from which to operate, we are able to dive deeper into individual trends and projects. We like to start by finding new projects that have been outperforming the market. Using the same market cap and volume data as shown above we scan the column for contract date (found in the full data in Nansen), picking up on anything created in the last 7 days. This highlights an interesting project, Galactic Apes – the hottest project created in the last week.

Galactic Apes

We can then dive even deeper. Using Nansen and by simply googling the project to find its social media channels we can ascertain:

- Release occurred 3 days ago however the project already has a market cap of 12,866 eth ($37m+) and a 24 hour trading volume of 817 eth ($2m).

- It has taken advantage of the popular ape narrative, created by Bored Ape Yacht Club (the 4th largest project).

- It is aiming to launch its own universe where you can run missions and interact with your apes in the metaverse, taking advantage of the play to earn narrative we have already established.

- It has 100 notable owners (those in the top 0.1% of ERC-721 token transactions or smart money).

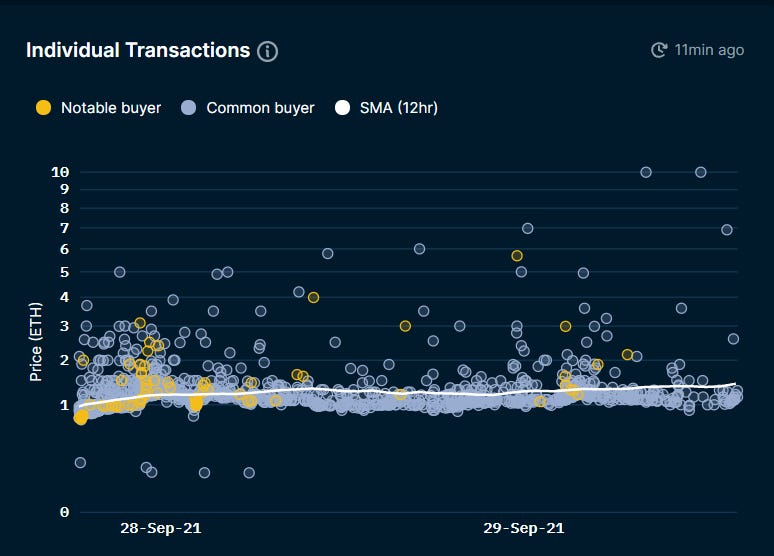

- We can even see the kind of prices these notable buyers are paying and dive into the portfolios of individual buyers to ascertain whether they are successful NFT traders using the below graph (each dot represents a transaction and can be clicked on for more info).

Individual Transactions: Galactic Apes: Nansen.ai

Step 3️⃣: The Overall Picture

We have now produced a top down analysis of the NFT market, establishing market leaders, trending narratives and detailed actionable insights into individual projects. What next?

The key here is to remember that Nansen is a tool that should compliment your overall portfolio system. Just as with trading any asset, other factors will heavily influence your profitability.

- Risk Management: NFTs can be a highly volatile, illiquid asset class which means you may not be able to recoup any of your initial investment. Ensure you allocate an appropriate % of your portfolio to NFTs and do not only invest in new, speculative NFTs that you may never be able to re-sell.

- Psychology: A poor mental approach may completely destroy any potential for profitability. Having a predetermined plan for any NFT investment will help and for tips to stick to your plan, check your our Masterclass on Improving Trading Psychology ?

Conclusion

By using Nansen to dissect the NFT market – you will be able to regularly generate alpha that allows you to outperform other NFT traders. Using this process we have shown that metaverse friendly projects are currently trending and generated insights into the hot project, Galactic Apes, that you can use to inform your strategy. Remember to use this as a tool to compliment your wider investing framework, and you can become a profitable NFT trader.