🧘♂️ALERT: Crypto Giant Going Down

Market Meditations | July 1, 2022

Dear Meditators

First Celsius was in the hot seat, then Three Arrows Capital felt the heat. Now, some whales are rumored to be sharks circling those struggling to stay afloat. Three Arrows Capital was just court-ordered to liquidate due to insolvency issues and overextension.

Are these isolated incidents, or the first few dominos to fall in a collapse of contagion?

Today’s Meditations:

- Liquidations 101

- Can LUNA Re-Eclipse?

- Drama Brewing at CoinFLEX

This article is brought to you crypto.com, the world’s fastest growing crypto app.

- ? Join 500+ users buying and selling 250+ cryptocurrencies at true cost

- ? Spend with the crypto.com Visa Card and get up to 5% back

- ✅ Grow your portfolio by receiving rewards up to 14.5% on your crypto assets

You can use our link to download the crypto.com app.

⏰ Top Headlines

For today’s top headlines, head over to the Market Meditations YouTube where you can watch our first Market Update Video.

- We will be releasing Market Update Videos 4 times a week on the Market Meditations YouTube.

- These will be concise, straight-to-the-point 10-minute crypto market updates.

- Our team of expert analysts spend hours researching and summarising the most important crypto news events so that you don’t have to.

Watch, enjoy and accelerate your crypto profit-making journey!

? How the Mighty Have Fallen

At a high level, most hedge funds and venture capitalist firms (VCs) operate similarly.

- Users invest in a fund with the promise of a return on their investment. In the case of Celsius, users deposited cryptocurrencies, like ETH, to earn a yield on those deposits.

- Institutions have to make money to cover the cost of paying incentives. To do this, they assume certain risks to earn returns.

This is pretty standard practice. Banks operate in the same way by earning interest on deposits, then sharing some of it with their users in interest-bearing accounts.

?Going Sideways

Some of these institutions took on higher risk to earn higher rewards.

- While Celsius claimed to only use user funds for lending and bitcoin mining operations, large investments were made to accrue staked ETH (stETH). When stETH “de-pegged”, dropping in value against ETH, Celsius was no longer able to sell stETH to honor promised yields and withdrawals without realising loss. As the price gap between stETH-ETH widened, Celsius headed toward insolvency.

- Separately, Three Arrows Capital faced troubles of its own. One investment involved providing $245 million worth of ETH to Aave, and borrowing $189 million in stablecoins against it. If the loan-to-value ratio on this loan falls below 85%, ETH is liquidated (sold on the open market) by Aave until the ratio is restored to 3AC’s position.

Sure, it’s easy to wag the finger at these institutional investors. The only thing in shorter supply than liquidity for these two might be sympathy, but even the most prudent investor could be in for their fair share of fallout.

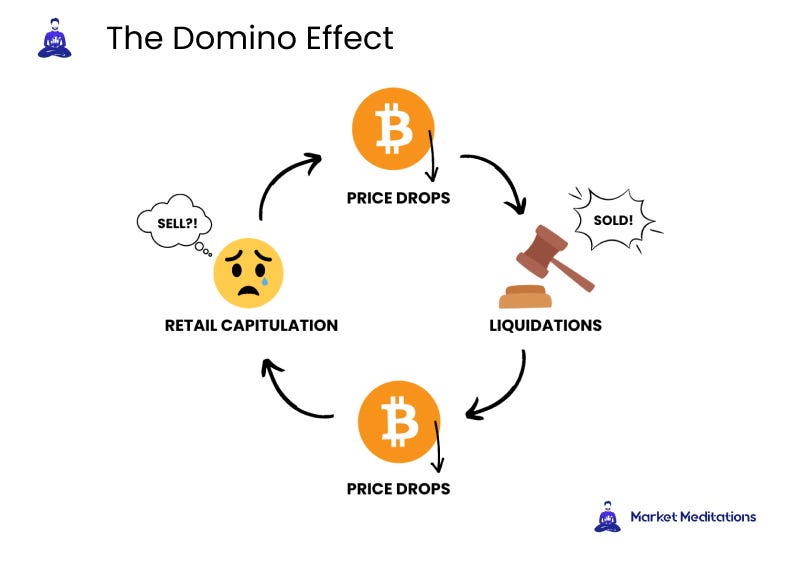

As falling prices trigger liquidations of positions held by lending bodies like Aave, more tokens enter the market which drives prices down further. This causes fear in investors, which incites them to take action and sell what they have left, perpetuating the cycle.

⏬ Look Out Below!

While million-dollar margin calls and leveraged liquidations may not affect the everyman, the affected price of assets could be cause for concern.

- When collateral is liquidated by lenders, sell pressure is applied to the open market. This translates to higher available supply in the face of already lowered demand. Crypto assets, like ETH and BTC may suffer as they’re sold to honour loans.

- In anticipation of a Celsius token (CEL) price crash, some whales have been aggressively entering short positions, betting on falling prices to play out.

- A growing trend on twitter dubbed #CelShortSqueeze is calling on retail investors to purchase CEL and remove them from exchanges, lowering the supply in hopes of mimicking the Game Stop short squeeze of 2021.

❗Don’t Be Exit Liquidity

Just like with Terra, warning signs are in plain view, but very few of us thought to look. Now that prevention is out of the question, we’re postured to protect ourselves if history repeats.

- Nansen is absolutely indispensable in monitoring token movements. Learn how to use it using our guides available here.

- Twitter is one of the best places to identify emerging headlines. Fill your feed with sources like TheDeFiEdge, TheCalculatorGuy, and others committed to looking into risky positions.

- Put these tools to use before investing in a platform. Assume nothing is safe. Always do your research before depositing.

Retail investors aren’t the only parties subject to defaults and liquidations, but they may stand to lose the most. Get informed and be proactive to minimize the chance of paying someone else’s debt.

? Can LUNA Re-Eclipse?

The Chronicles of Terra Luna continue as Terra Classic (LUNC), the original chain of the collapsed Terra (LUNA) ecosystem, gains new interest amongst investors.

- Terra Classic continues to receive support from various crypto entities allowing for speculative retail buy-pressure.

- According to on-chain data, the number of LUNC wallet holders increased by over 500% between May 9th and June 5th.

- The recent price rally seems retail-driven, and there are some indications that LUNC could live on within the market’s ‘meme coin’ sector.

- Additionally, the spike had followed an announcement by hacker activist group ‘Anonymous’.

- They stated they would be looking into Do Kwon, the founder of Terra, over his involvement in the crash as more evidence suggests the crash was intentional.

A recent study conducted by CoinDesk Korea and blockchain security firm Uppsala Security revealed that Terra Labs had near $3.6 billion in USDT and UST that could have been used to manipulate the price of LUNC (the old LUNA) or money laundering via centralised (CEX) and decentralised exchanges (DEX).

? Drama Brewing at CoinFLEX

Sam Bankman-Fried mentioned that many exchanges will fail after recently bailing out Voyager and BlockFi. He is saying that some exchanges are already “secretly insolvent” and past savings. Today, we look toward the exchange CoinFLEX. They are saying that a bitcoin.com executive owes them $47 million!

- CoinFLEX CEO Mark Lamb tweeted that bitcoin.com executive chairman Roger Ver has debt which forced the exchange to halt withdrawals last week.

- CoinFLEX issued a new token – rvUSD – to stabilize their balance sheet. Their goal was to raise at least $47 million.

- Lamb said the token will have a 20% yield. They also mentioned that if the $47 million is raised then users would be able to withdraw their funds.

- Roger Ver originally denied this claim, going as far as to say that the exchange actually owed him a substantial amount of money.

- Lamb responded that the debt is 100% related to Ver’s account and that the company doesn’t owe Ver anything.

This is a messy situation for everyone involved. If Ver owes the money, then he ought to pay it. At the same time, it is slightly interesting – and perhaps not best practice – for an exchange to be set to default if one party refuses to pay their debts.

- #PeckShieldAlert ~46% (~42,000 $ETH) of stolen funds have already been laundered via @TornadoCash from @harmonyprtocol Horizon Bridge exploiter – PeckShieldAlert

- Meet our new brand ambassador @KhabyLame, the most followed creator on TikTok. Through this partnership we will: Drive crypto education, Launch exclusive Khaby Lame NFT collections, Debunk crypto & Web3 myths, Grow the industry & #Binance ecosystem. Welcome aboard Khaby! – Binance

- The first week or so of the Arbitrum Odyssey has been very exciting to say the least! But we’ve decided to pause the Arbritrum Odyssey as of now, to be resumed after Nitro is released. More info below. – Arbitrum

?Act

- Fill your Twitter feed with newsworthy sources like TheDeFiEdge and TheCalculatorGuy and PeckShieldAlert

- Find out more about the Celsius Short Squeeze

? Read

- Learn to use Nansen using our extensive guides.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Misael Calleja, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.