🧘♂️Beginner’s Cryptocurrency Exchange Guide

Market Meditations | June 28, 2022

Dear Meditators

For crypto traders and investors, choosing the right exchange is critical. Transaction costs, interface customisation, sufficient liquidity, platform trustworthiness… There are so many variables that can make or break your crypto experience and journey.

We at Market Meditations have navigated the cryptocurrency markets for many years. We’ve experienced: bull markets, crab markets, bear markets, and more major security breaches and protocol collapses than we would like. Through it all, we’ve arrived at the conclusion that FTX and FTX.US are among the top cryptocurrency exchanges.

We appreciate it can be difficult and time-consuming to know where to start and figure out how to master a cryptocurrency exchange. That’s why we are releasing a full series of FTX Tutorials. All you have to do is follow along. It doesn’t get much quicker and easier than this.

Today’s Meditations:

- How To Open Your FTX Account

- Has the BTC Floor Formed?

- Tracking the Harmony Hacker

⏰ Top Headlines

- Tether CTO refutes stablecoin FUD as short-sellers circle

- Crypto exchange Huobi says layoffs are a ‘possibility’

- a16z leads $7.5 million seed round for web3 authentication startup Dynamic

- Compass Mining loses facility after allegedly failing to pay power bill

? FTX Tutorials Volume 1, Part 1: Opening Your Account

Step 1: Sign Up With A Link That Will Give You Discounts & Rewards

We at Market Meditations are proud to be partnered with FTX. That means, we are able to provide you with unique sign up links that will secure you discounts and rewards.

- Residents of the EU and UAE, can sign up by clicking here.

- Resident of the US, can sign up by clicking here.

Discounts -> Everyone who signs up using these links will get 10% off trading fees. This is the biggest discount you can get for FTX.

Rewards -> the first 1,000 users to sign up, are eligible to receive $15 for free.

The links will take you to a screen similar to that which is presented in the below image.

On this page, confirm that you are using the referral code “FREE15.” This will give you 10% off all trading fees and $15 for free for the first 1,000 users who sign up.

Next week, we will reveal in our newsletter exactly how you can get your free $15. For now, we will focus on how to set up your account.

Step 2: Open An Account

Now you’ll need to register an account by entering your email address and password. We recommend that you open an email that is reserved only for trading so you don’t miss any important messages. While any email provider will work, using an encrypted email address such as ProtonMail is best practice.

Be sure to choose a secure password. Password managers like LastPass or Dashlane are great solutions for increasing password security.

For plenty more on best practices when it comes to security, check out our 9 Step Essential Cryptocurrency Security Guide.

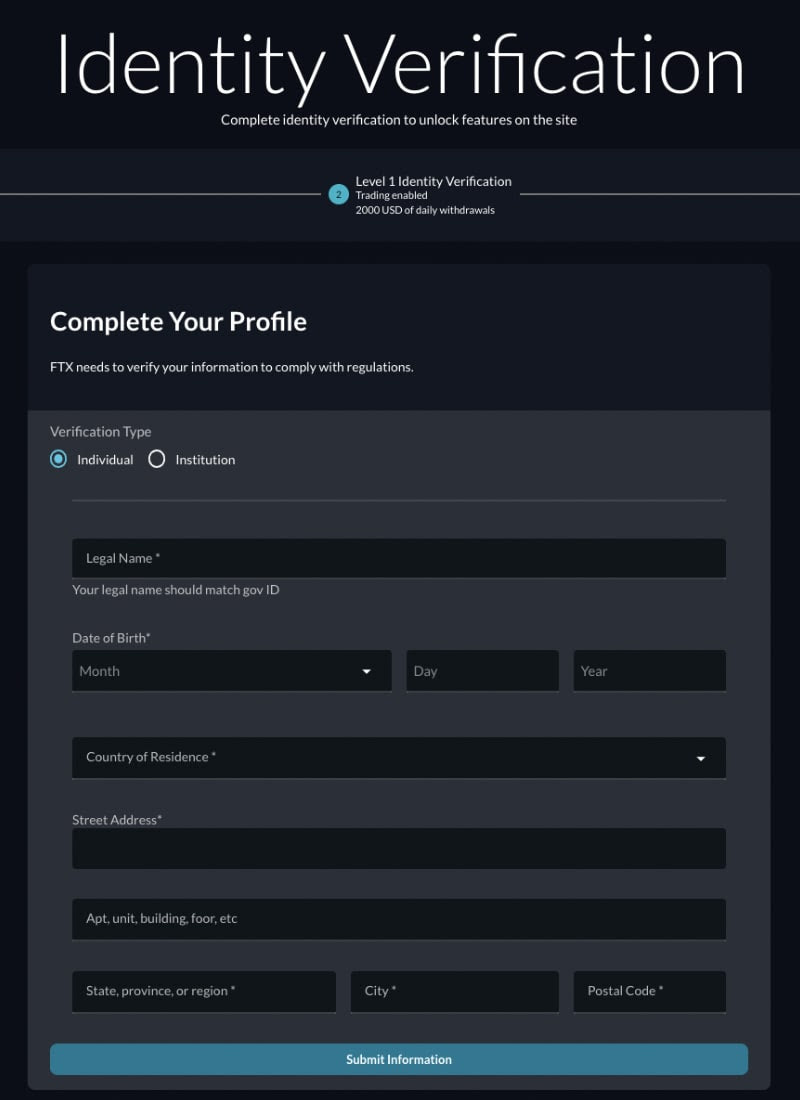

Step 3: Complete Identity Verification

In order to deposit funds and begin trading, you’ll need to complete identity verification.

While other exchanges often take weeks or months to verify your identity, FTX has an incredibly fast turnaround.

Navigate to settings and complete Level 1 Identity verification.

Note: You will need to complete Level 2 identity verification if you would like to enable unlimited crypto withdrawals.

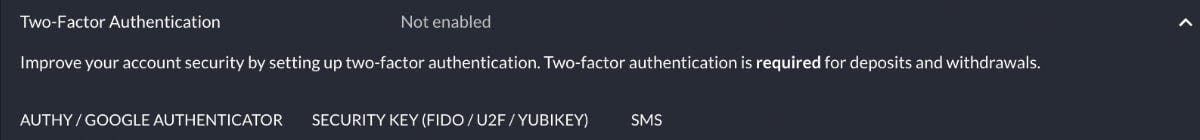

Step 4: Complete 2FA Authentication

Note: If one-factor authentication is a password, two-factor authentication would be anything that adds an extra layer of security on top of that.

- Another often-overlooked feature of FTX is requiring users to enable 2FA when opening an account.

- When setting up 2FA, three options exist: using an authenticator app, security key, or SMS.

- We recommend using either a security key or an authenticator app on a cold device (a device that doesn’t connect to the internet).

- For a full explanation of 2FA as well as the various 2FA options, make sure to check out our 9 Step Essential Security Guide.

Congratulations! Your account is set up.

Next week, we will be sharing Part 2, where we will reveal how to deposit on FTX and how to get your $15 for free.

? Floor Formation?

“We’ll never see $20k BTC again“, Willy Woo boldly declared on January 3rd 2021. The well-known Bitcoin on-chain guru added that losing the $24k support “would need a black swan event“. Well one of those things came true and now his go-to analytics company, Glassnode, is trying to assess whether the floor is in:

- A massive de-leveraging event has taken place, many people were liquidated and many more lost the confidence to hold on.

- As CZ of Binance notes in his blog, there can be two speeds of de-leveraging, and when funds lend to other funds it can take quite some time before the extent of the pain is felt.

- BTC and ETH are currently showing statistical deviations far away from historical means and Glassnode has used five models to assess the probability of a floor being in.

- The models show that only 13 out of 4,360 trading days (0.2%) have experienced these conditions, during the Jan 2015 and March 2020 events.

- There is some accumulation happening now, mostly driven by Whales (>10k BTC) and Shrimp (<1BTC). While this could be a bottom indicator, it also happened during the first dips after the 2021 ATH.

- Though there has been Long Term Holder selling, it has predominantly been of coins bought in the 2020-2022 cycle, rather than a loss of conviction of the Very Long-Term BTC holders.

Historical data is only useful if we believe it helps predict the future. The bet is now one of conviction in the narrative of whether crypto has a future or not. Whether it is just a period of low demand or an over-extension to the downside is yet to be seen.

? Tracking The Harmony Hacker

As reported on June 26th, Horizon Bridge, a cross-chain bridge linked to the Harmony blockchain, was hacked for $100 million in ETH. According to reports by PeckShieldAlert on Twitter, the hacker responsible has begun laundering the stolen funds.

- Etherscan shows that the hacker’s wallet has sent approximately 18,000 ETH ($22 million) to another wallet.

- This transaction was split, with the hacker sending around 6,000 ETH to three different addresses.

- According to Etherscan, the first two addresses have already successfully laundered the funds via Tornado Cash, which breaks up transactions to help the user stay anonymous.

- At the time of writing, the third address has just begun laundering the funds in batches of 100 ETH ($122,000).

- The Harmony Team tweeted an offer of a $1 million bounty for the return of $100 million in Ethereum stolen and offered to wave any criminal charges should the hacker accept.

- The hacker’s wallet still holds around $60 million in ETH tokens and approximately $66,000 worth of other tokens stolen during the bridge exploit.

Hacks and exploits are becoming increasingly more common during the current bear market. Check out our ‘Cryptocurrency Security’ guide series to learn how you can best protect yourself from these events.

- Solana’s Biggest DeFi Lender Almost Got Rekt. Then Binance Stepped in – CZ Binance

- June 27, 2022: Previewing the Unlockening. Data analysis of trends to watch in the upcoming $CVX unlock. – crv.marketcap.eth

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Kyle F., Misael Calleja, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.