🧘♂️Beginner’s Smart Money Guide

Market Meditations | May 25, 2022

Dear Meditators

In last week’s edition of our yield farming guide, we demonstrated how anyone can assess the activity of top-performing wallets to protect their returns whilst yield farming.

? Our yield farming guide is a weekly series, where we explain how you can use Nansen to find the best and hottest yields in crypto.

What can we do to protect ourselves from sudden market events?

How can we ensure that we are alerted of any major movements before the rest of the market is aware?

Today, we explain how you can use Nansen to identify top-performing wallets and then set up smart alerts that keep you informed of any real-time movements.

Today’s Meditations:

- Get Smarter With Your Yield Farming

- Latest Celebrity Hack Wanting Their NFT Back

- Crypto and Future Presidential Elections

⏰ Top Headlines

- StarkWare’s valuation quadruples to $8 billion in new funding round

- Babel Finance hits $2 billion valuation in new funding round

- a16z announces $4.5 billion fund for crypto and blockchain startups

- WEF 2022: NFT custody is ‘the missing piece’ for mainstream adoption, says Veritic CEO

?? Protect Your Farm

Step 1 – Finding Top Wallets

Nansen tags certain wallets, showing the top performers in certain segments of the market. For yield farming these wallets are labeled:

- Smarter LP: The top 1% of addresses by profit made from providing liquidity across a number of decentralized exchanges.

- Smart LP: Any address that has made more than $100k providing liquidity on Uniswap or Sushiswap.

- First Mover LP: The top 200 addresses by the number of times the address has been one of the first to enter a liquidity pool.

To find wallets of interest we have two options:

(1) Nansen’s Smart Money dashboard. By filtering by the relevant label, we can find a list of recent transactions, diving into individual wallets to find out if we want to track that address.

(2) Consider existing opportunities. If already involved in an opportunity, you can use the top deposits feature as shown in part 4 of our yield farming series to identify specific wallets:

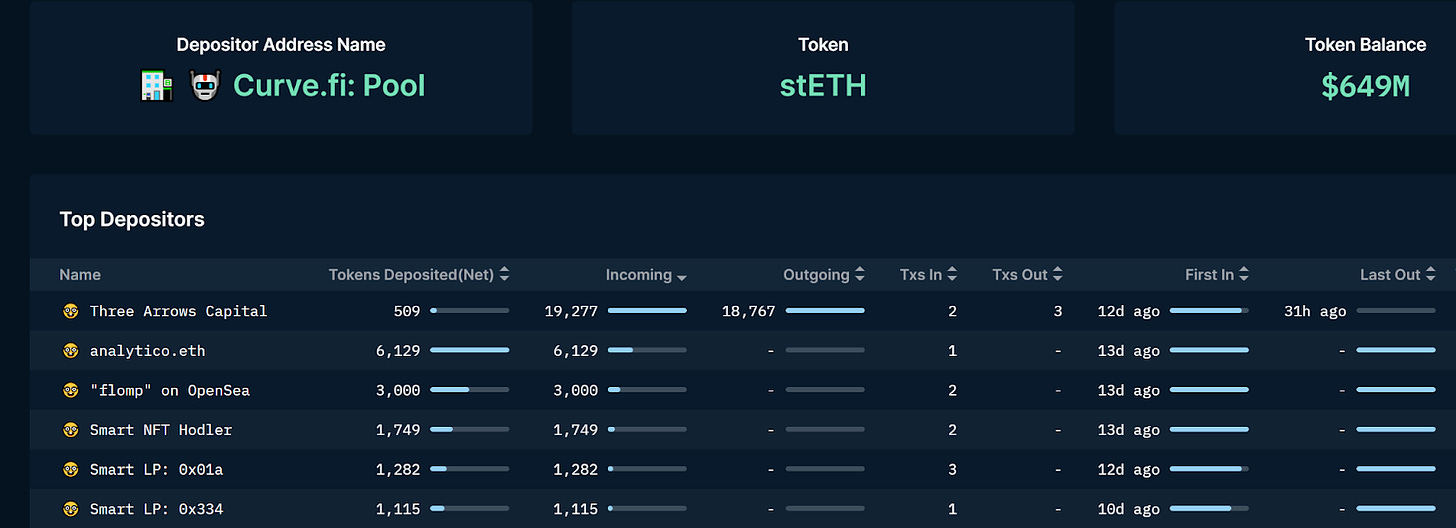

Nansen.ai: 25/05/2022 – Top Depositors of stETH to Curve wETH / stEth Pool filtered by Smart Money

- Last week we identified that Three Arrows Capital had recently started farming the wETH / stETH curve pool.

- We can see that over the last week, they have withdrawn the majority of their position (as shown in the “outgoing” column).

- If we had been using smart alerts, we would have been notified the exact moment this was complete.

Step 2 – Setting Up Smart Alerts

Once we have identified specific wallets or smart money segments we want to track, we are able to use Nansen to set smart alerts:

Nansen.ai: 25/05/2022 – Smart Alert Configuration

- In this example, the smart alert is configured to give a notification upon any stablecoin transactions above $10,000 for smart money addresses involved in yield farming.

✅ Tip: You can also use Etherscan to track specific wallets by creating an account, going to “watch list” and adding the relevant address.

Yield farming is a risky activity (a full breakdown of these can be found in part 1 of this series).

Additionally, you can never rely on another market participant’s actions. Everyone has their own strategy and their decisions may not be profitable, especially when in isolation.

Having said that, through identification and real-time tracking of top wallets we can gain an edge over the rest of the market, helping us to protect our returns.

All these abilities and more are brought to you by Nansen.

Join now and unlock a world of opportunities and profit-making strategies:

- Perform Due Diligence. Get more information on projects or tokens before you invest.

- Defend Your Positions. Create real-time custom alerts and get notified when and where a wallet has been moving its funds.

- Track The Biggest NFT Traders. See what the most profitable NFT wallets are investing in.

You’ll also be better placed to follow along with the rest of the Yield Farming series.

? Money is Power

It’s awfully quiet right now in the crypto space. But while most of the white noise has abated, the more established players are still making moves and not always in trading. Take Sam Bankman-Fried, FTX founder and CEO, whose donations to political candidates have started to come under the spotlight:

- Just over a week ago, Carrick Flynn, a first-time candidate for an Oregon congress primary, lost his race, polling only 18% of the votes.

- What made this more notable was that a Democratic Super PAC had poured more than $10 million into his campaign, three times as much as the competition.

- Most of this funding came from SBF, whose values purportedly aligned with the candidate’s Effective Altruism philosophy.

- SBF is not new to political donations, having spent more than $5 million on Joe Biden’s campaign a year and a half ago.

- Speaking on Jacob Goldstein’s ‘What’s Your Problem?’ podcast, SBF said in future election cycles he could see himself spending much more.

- When quizzed on numbers he said he would “guess north of $100 million”, and “eminently possible” that it would beat the current record of $215 million from an individual.

- SBF also emphasised the importance of not spending money on those you believe have a 99% chance of winning.

What do you think about the role of money in politics?

? Will The Show Go On?

BAYCs are one of the few NFTs that give owners an unlimited worldwide license to create derivative works, something widely viewed as a reason for the collection’s super-size success. At VeeCon, an NFT conference, American actor Seth Green revealed that a BAYC he had previously purchased intending to use that license, was stolen along with other NFTs in a phishing attack.

- According to Green, he purchased the BAYC in July of 2021 and has “spent the last several months developing and cultivating the IP address to make it into the star of his show.”

- Just a few days before the world debut, the NFT was stolen and sold to someone for $200,000.00 on OpenSea.

- OpenSea has since placed a freeze on the NFTs that Green reported stolen, however, they can only stop them from being sold on OpenSea and have no control of other marketplaces or decentralized NFT marketplaces.

- Green sought out a Twitter user with the same handle as the purchaser, DarkWing84, hoping to get the Bored Ape back so he could move forward with the show.

- Drew Hinkle, an NYU adjunct-law professor tweeted that stealing something doesn’t give you rights and reminded users that digital assets give you system powers, not legal rights, which come from the law.

- Another lawyer James Grimmelmann responded on Twitter that the rights to the BAYC depend on property law, copyright law, and the interpretation of the BAYC license, which he calls “hopelessly ambiguous and not fit for purpose.”

It is unknown if Green will be able to release the show, without owning the BAYC. This situation highlights the need for clearer laws regarding digital ownership, the need for more thoughtful legal teams in NFT creation, and vigilance in security. If you are concerned about the security of your digital property, check out our security guide.

- BREAKING: ‘Terra Ecosystem Revival Plan 2’ vote has passed – The Defiant

- #Bitcoin mining is the fastest, most reliable way we have to slow climate change. This may surprise you, but that’s because there’s an ESG gaslighting campaign against Bitcoin. – Willy Woo

Stablecoins have gone from iconic to ironic as stability proves elusive for some coins.

While Terra tries to rebuild, the effects of UST’s collapse continue to reverberate throughout the cryptocurrency industry.

It seems that algorithmic stablecoins have suffered the most, but is the cause fear or fact?

Join us tomorrow for a deep dive to find out if there’s really a reason to hit like for the algorithm.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Isambard FA, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.