🧘♂️Magical Crypto Project

Market Meditations | June 22, 2022

Dear Meditators

While other crypto firms are walking back job offers and laying off staff, business is booming at Magic Eden, the NFT marketplace on Solana. After a $130 million series B funding round, their current valuation sits at $1.6 billion.

Today’s Meditations:

- A Little Magic in The Market

- Using Nansen to Identify DAOs

- The Latest on Celsius

With Nansen’s On-Chain data, you get an edge over everyone else by tracking the behavior and on-chain activity of prominent wallet addresses.

- Exciting New Opportunities. Follow Smart Money, identify new projects, and trace transactions down to the most granular level.

- Perform Due Diligence. Get more information on projects or tokens before you invest.

- Defend Your Positions. Create real-time custom alerts and get notified when and where a wallet has been moving its funds.

- Track The Biggest NFT Traders. See what the most profitable NFT wallets are investing in.

Every Wednesday, we share new ways you can use Nansen to profit in the crypto markets. So simply sign up and follow along!

⏰ Top Headlines

- Prime Trust raises $107 million to add new crypto products

- Binance-owned Trust Wallet adds buy option via Binance Connect

- Powell says the Federal Reserve is tracking crypto market volatility ‘very closely’

- Shopify unveils tokengated commerce as part of new connect-to-consumer experience

? A Little Magic In The Market

While other crypto firms are walking back job offers and laying off staff, business is booming at Magic Eden, the NFT marketplace on Solana. After a $130 million series B funding round, their current valuation sits at $1.6 billion.

- This round comes only 3 months after their $27 million Series A round. It is estimated their value at that time was around $162 million, meaning their valuation has increased 9x in 3 months.

- Investors rushed to the funding round after seeing Magic Eden’s growing share of the NFT market on Solana coupled with their #3 spot as the largest NFT marketplace.

- Leaders of the round include Electric Capital and Greylock Partners, but Sequoia Capital, Lightspeed Venture Partners, and Paradigm all participated.

- Another reason for the gold rush to Magic Eden is the success of its game discovery portal, Eden Games. To date they have launched 45 games, owning 90% of the gaming NFT volume on Solana.

- Magic Eden currently has 100 employees and plans to increase its labor force by 50% over the next year.

- Although he wouldn’t name any chains specifically, Zhuoxun Yin, a co-founder, and COO at Magic Eden says they plan to release multi-chain expansion plans over the next few weeks.

This Series B funding round might not have been big news when the crypto market had a $2-3 trillion market cap, but with declining valuations all around us, a 9x in 3 months is something to celebrate!

? When the Market Goes DAOn

Traditional governance structures have a number of issues in today’s world including a lack of transparency and a hierarchical model that gives power to only a few. In this 2 part series, we will explore the current DAO landscape, asking ourselves, is there a better way?

A Decentralized Autonomous Organization (DAO) is a member-owned community with no centralized leadership where code is used to automatically enforce decisions.

Governance is controlled via ownership of its token which allows members to create and vote on proposals. Understanding the current DAO landscape can help you spot opportunities to get further involved in crypto and vet existing projects.

Different Kinds of DAOs

- Social DAOs: These exist to create communities of like minded individuals. They can be used to network or further a common goal.

- Protocol DAOs: Used to make decisions in the running of a decentralized protocol. If an active user of that protocol, you can vote on issues that may affect your use of the protocol or simply consider proposals to vet its community before making an investment.

- Investment DAOs: Participants pool together capital and make shared investment decisions. Whilst these can be difficult to become a member of, the profit opportunity is clear.

Most Valuable DAOs

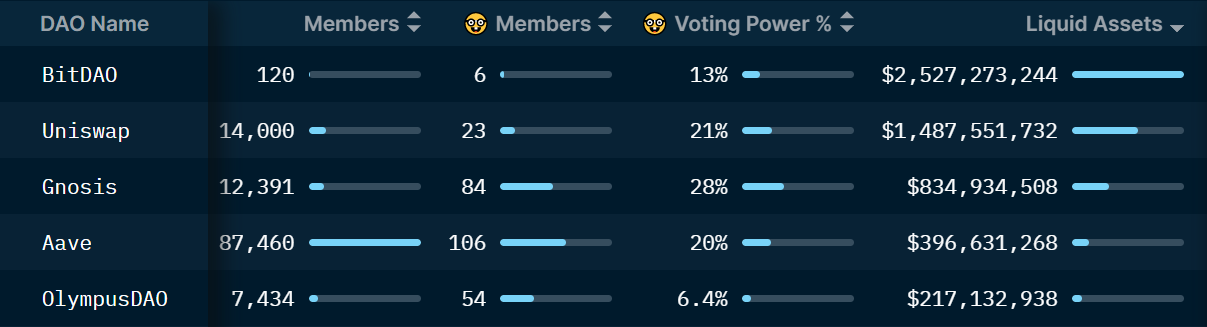

So how can we find the top DAOs to get involved in? Using Nasen we can see the DAOs with the highest number of liquid assets:

Nansen.ai: 22/06/2022 – DAO Billboard – Top 5 By Liquid Assets

- BitDAO: This is the largest DAO by liquid assets with over $2.5bn. Their goal is to build a decentralized tokenized economy that is available to everybody.

- AAVE: This is a protocol DAO that makes decisions on the running of one of the largest protocols in the DeFi space, AAVE.

✅ Tip: We can also use Nansen to find those with the most voting power in a DAO, showing who controls the organization and whether we want to get involved.

DAOs represent an exciting shift in governance structure that has the potential to open opportunities for anyone in crypto. Using Nansen we can identify the top DAOs via liquid assets or smart money members.

In part 2, we will demonstrate how to dive into DAO treasuries and use their on-chain movements to inform decision-making.

? The Short Squeeze Is On

A little over a week ago, Celsius froze all withdrawals. They cited liquidation reasons among others for why they acted in the manner they did. Fast forward to two days ago when there were rumblings of a short squeeze happening. All over Twitter, #CELShortSqueeze was trending… and… they did it!

- Members of this community orchestrated a short squeeze. As a reminder, a short squeeze takes place when traders bet that a price will drop, but the price goes up. The traders will then be forced to close their positions.

- Holders rallied around the hashtag #CELShortSqueeze and followed the “instructions.” They first bought CEL on the FTX crypto exchange, then they were to move it to decentralized exchanges. They then would set sell limit orders.

- Celsius had been ranging anywhere from $0.45 to $0.65 for the days leading up to this. As the short squeeze happened, it went up to $1.53! Since then, it has dropped back down to $1.06 at the time of writing (according to coinmarketcap.com)

- There are several people who believe Celsius was part of a coordinated attack from institutional players. There is currently a $20 million bounty for anyone with information about an attack on Celsius.

While this does not mean Celsius is back up and running, it does mean the community is fighting back. The lender is also not giving up saying that their “objective continues to be stabilizing [their] liquidity and operations.”

- [DB] Voyager’s exposure to 3AC consists of 15,250 BTC and $350 million USDC, 3AC has not repaid requested amounts. Voyager: Failure to repay by June 27 will constitute an event of default. Voyager intends to pursue recovery from 3AC – db

- I have discovered evidence that TFL and Hashed were manipulating Anchor interest rates by inorganically inflating Borrow, making Anchor look more sustainable than it really was. This insidious protocol-level fraud robbed people of the ability to do their own research. – FatMan

We’re Watching

The economy’s seen better days. From Coinbase to Gemini, layoffs are rampant in the space. Yet some companies, like Binance, are actively seeking applicants.

It’s easy to misinterpret the mixed signals.

In tomorrow’s edition of Market Meditations, we pick up the classifieds and lay out a step-by-step approach for landing your dream job in digital currency.

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by D. Beverly, Isambard FA, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.