🧘♂️Next Airdrop Opportunity?

Market Meditations | June 21, 2022

Dear Meditators

One of the magical things about being in crypto is the opportunity for airdrops. Airdrops are tokens or other digital assets gifted to users as a reward for protocol participation. That’s why we are dedicating today’s main feature to a particular airdrop opportunity…

Today’s Meditations:

- Incoming Airdrop?

- When Impermanent Loss Gets Lost…

- Proshares is making history again

⏰ Top Headlines

- Deloitte and NYDIG set up alliance to help businesses adopt Bitcoin

- BlockFi secures $250 million bailout from FTX

- Tech giants opt into newly-formed Metaverse Standards Forum

- Japanese film studio announces the production of a series based on crypto

? Another Layer 2 Airdrop Incoming?

Arbitrum Explained

Arbitrum is a layer 2 scaling solution built on top of Ethereum offering faster and cheaper transactions by using optimistic rollups, while still retaining the security of Ethereum’s network. Currently, Arbitrum has no governance token, but many users are predicting one is imminent.

At this time, the only promised airdrop from the Arbitrum Odyssey event is the NFT you can mint each week after participating in the activity.

Arbitrum Odyssey is an 8-week event tasked with bringing users to dApps on Arbitrum. Each week, Arbitrum will announce activities to complete in their ecosystem. Participants will be eligible to mint exclusive NFTs created by crypto-renowned artists, Ratwell and Sugoi.

Week one starts today at 1PM EST!

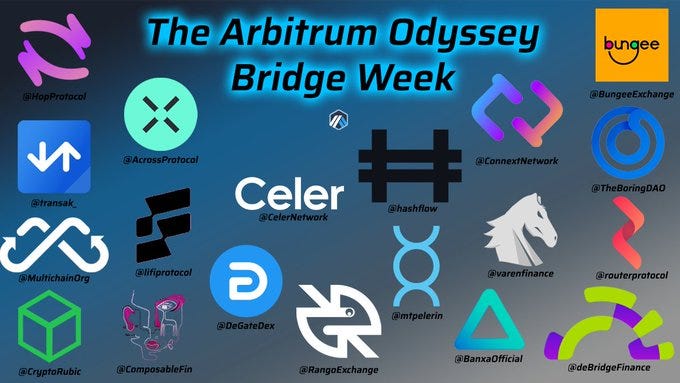

Week 1: Bridging to Arbitrum

- You can earn your first participation NFT by bridging to Arbitrum using one of the following bridges:

- According to Arbitrum’s Twitter, users on the protocol with the most bridging participants are eligible for an additional bonus. The Arbitrum-Odyssey FAQ hosted on Discord further identifies this as the bridge seeing the most ETH traffic.

Week 2-8: Activity

- After bridging to Arbitrum, two tasks will be available for completion each week. These objectives qualify users for future NFT mints.

- Minting fees must be paid in ETH.

- Details of the required tasks have not yet been disclosed, but some participating protocols have already been revealed on Twitter.

Should I Participate?

It is impossible to guess what the market may look like for the resale of the NFTs earned, but earning the NFTs may create value in other ways. Previous airdrops like the one on Optimism (Arbitrum’s most direct competitor) used specific criteria for allocation. Participating in the Arbitrum Odyssey could not only earn NFTs, but could also help meet the eligibility criteria if there is a future Arbitrum airdrop. Not to mention, the dApps used in the Odyssey event could lead to future airdrop qualifications.

Important Things to Note

- Each participant has the opportunity to claim up to 17 NFTs.

- Choose your bridge wisely. Not only could it qualify you for an NFT, but you can bridge from any chain the bridge supports. The official Arbitrum bridge is not part of the campaign.

- Tasks must be completed within the assigned time frame.

- Collecting at least 12 of the NFTs will grant access to the most exclusive NFT of the group, specifically for those who conquer the Arbi-verse!

If you are interested in earning the bonus NFT for bridge week, you can refer to our guide on how to use data analytics from Nansen to follow the money!

Join the odyssey by staying up to speed with Arbitrum’s Twitter and Medium accounts, or join in on Discord for discussions and tips!

Want to learn more about airdrops? Check out our intro to Airdrops here.

? When Impermanent Loss Gets Lost…

Bancor launched in 2017 as one of the first decentralised exchanges (DEX) on the Ethereum network. The platform became extremely popular as users could receive protection against impermanent loss.

✅ Tip: Impermanent loss is a temporary loss of funds when providing liquidity to two unrelated crypto assets to a liquidity pool.

Following the recent crypto crash and heavy selling pressure of the native Bancor (BNT) token, the DEX has paused its impermanent loss protection feature.

- The BNT token acts as an intermediary token connecting liquidity pools in the network and across blockchains.

- According to Dune Analytics, there was a massive spike in the number of BNT tokens minted in June to provide impermanent loss protection.

- Large centralised entities have recently sold large amounts of BNT tokens paid to them as impermanent loss protection, creating selling pressure.

- To protect BNT from further depreciation, the team have temporarily halted any impermanent loss protection until the market stabilises.

In a blog post shared on Monday 20th June, Bancor stated that “the temporary measure to pause IL protection should give the protocol somen room to breath and help BNT recover”. The team also confirmed that there are currently no ongoing attacks and that funds on the protocol are secure.

? The Shorts Are In

Proshares was the first company to offer a crypto futures ETF in the United States, back in October of 2021. The ETF (BITO) surged past expectations with almost $1 billion in volume on its first trading day. Now Proshares is making history again, by launching the first Short Bitcoin Strategy ETF.

- The ETF will trade under the ticker BITI. BITI aims to deliver the opposite performance of the CME Bitcoin Futures Index and will also gain exposure through bitcoin futures.

- The Proshares Short Bitcoin Strategy ETF aims to allow investors to profit from the decline of Bitcoin prices or hedge their crypto positions.

- The product launches today after the observance of the Juneteenth holiday.

- A mutual fund company affiliated with ProShares, ProFund will also launch a short bitcoin strategy mutual fund that begins trading today as well under the ticker (BITIX).

- ProShares CEO Michael L Sapir said in an announcement on Monday “As recent times have shown, bitcoin can drop in value,” and this product will allow investors to obtain a short position in a traditional brokerage account.

- These are the first bitcoin short strategy funds available in the US, but markets in Europe and Canada already offer short bitcoin exchange-traded products.

If the bitcoin futures ETFs, (along with million-dollar monkey pics) signaled a market top, will these bitcoin short offerings signal the market bottom is finally in? Stay tuned to the bitcoin technical analysis in our newsletter to see when this downtrend might finally turn around.

- NEW: @CelsiusNetwork Ltd., which put millions in limbo and sent cryptocurrencies into a global tailspin by halting transactions last week, now says it “will take time” to normalize operations, as digital assets such as bitcoin continue to plunge. $BTC – Temur Durrani

- Ethereum’s shift to a more environmentally-friendly model could cut its power consumption by 99% — and put miners out of a job – Bloomberg Crypto

- Solana whale shuffles $25 million to reduce risk to DeFi protocol Solend (via @vishal4c) – The Block

? Did you enjoy today’s newsletter? This survey is your chance to tell us how we can improve the product for you. Link here.

??♂️✍️ Stories in this newsletter were written by Isambard FA, Kai.A, Nick T., Max P., Kimia K., Ellen B. and Koroush AK. Graphics were produced by Ellen B.

Not financial or tax advice. The content in this newsletter is for informational purposes only. Nothing in this email is intended to serve as financial advice. We are not financial advisors. Every investment and trading move involves risk. Do your own research when making a decision. See our important security disclaimers here.

Disclosure. Some of the links we’ve included are affiliate, they give you rewards and discounts and earn us a commission. Additionally, the Market Meditator writers hold crypto assets. See our investment disclosures here.