Rental Property Investing: Part 2

Market Meditations | June 23, 2021

Today’s focus will be on the disadvantages of rental property investing. There will always be disadvantages. To every type of investment. If anyone tells you differently, don’t listen to them. They’re likely trying to sell you something. After we discuss disadvantages, we’ll conclude with the Market Meditations approach to rental property investing.

☠️ Disadvantages of Rental Property Investing

1️⃣ Building Wealth Through Rental Property Investing Takes Time & Money. This is not a get rich quick scheme. Becoming rich through rental property investing requires that you take consistent action over a long period of time. Whilst you can purchase crypto with a minimal cash outlay, real estate investing requires money. To get started, you’ll need to place a deposit, repair the property and pay mortgage payments.

2️⃣ It May Become All Consuming. Like many other passions, there is a risk that your rental properties will be the only thing you can think about. Particularly if you have a mortgage, this can become a strain on your life and freedom. You have committed to significant monthly payments for a long period of time. Quitting a stable job for a dream job, or moving countries, or any other decision that may impact your finances becomes much more difficult.

3️⃣ Active Management Requirements. Unlike crypto and stocks, properties require active management. They need to be periodically maintained, refurbished and tenants need to be managed. This costs both time and money. From unforeseen repair costs to tenants failing to pay rent or simply moving out, leaving the property without cashflow, property can be a risky business.

4️⃣ It Involves Paperwork and Bookkeeping. Much like any other business but the point is if you hate this type of work, you’ll need to consider the cost of outsourcing it to someone else.

5️⃣ You Can Lose Your Investment & The Market is Illiquid. Just like in any other investing activity, returns are not guaranteed. Whilst you can increase your odds of succeeding, you can’t guarantee it. Real estate investors deal with fluctuating demographics and volatile economies, which can either add or take away from bottom-line profits. Real estate also has low liquidity. Many investments are highly liquid (can be bought and sold for a profit in a fraction of a second). Real estate investments are comparably illiquid: properties can’t be quickly and easily sold without a substantial loss in value. You’re buying a tangible asset that you can’t liquidate for cash if you need emergency funds.

? The Market Meditations Approach

It comes down to trade-offs. This is an asset class that can yield decent returns, is relatively accessible (cheap leverage) and can act as an inflation hedge. At the same time, it requires a great deal of money, time and is relatively illiquid.

The benefits of rental property investing suggest it does have some role to play in our overall portfolios. It could be an attractive 10-20% allocation, for instance. The problem is that rental property investing is very cash intensive. Suppose a deposit costs $60,000. You’ll require about $600,000 in investing capital for a 10% allocation to rental property investing. For most people, a mortgage (and the other associated rental property investment costs) takes up the lion’s share of their investing capital. Meaning they are heavily overexposed to just one asset class and they pay a significant opportunity cost. They will forgo the opportunity to invest in: stocks, bonds, crypto, commodities and more.

What if there were methods to get a smaller exposure to rental property and real estate? Fortunately, there are. A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or finance any properties themselves. Suddenly, a much smaller allocation becomes possible.

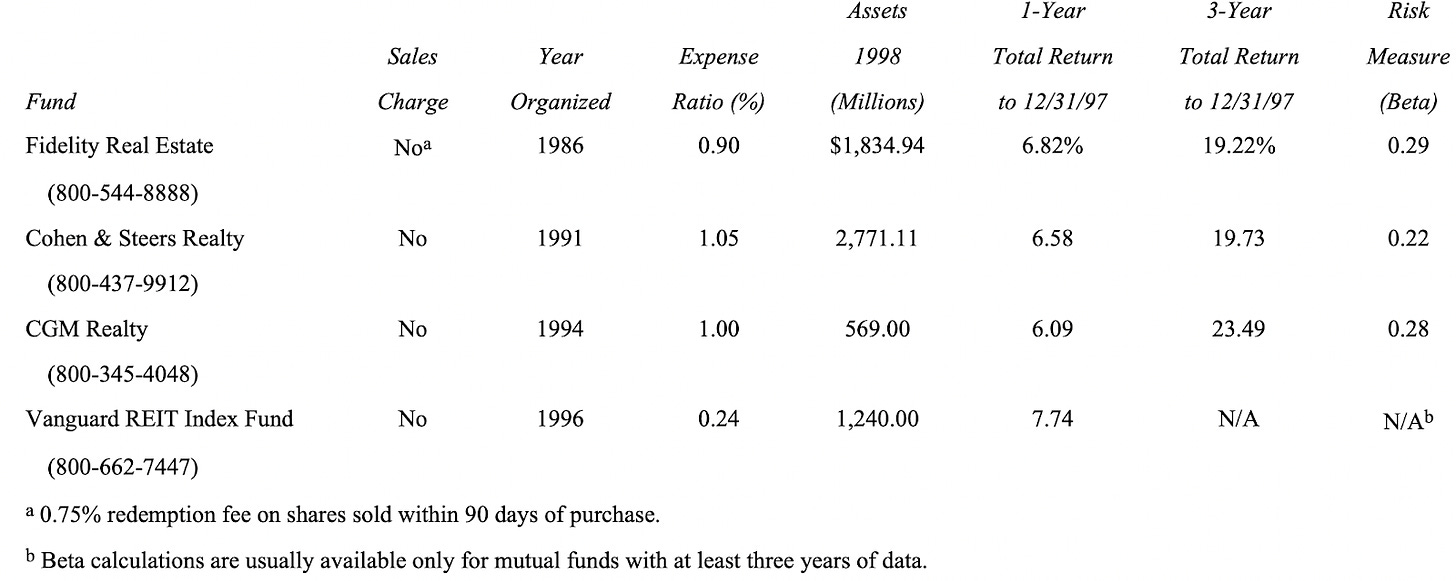

The table below is taken from A Random Walk Down Wall Street and provides information on some REITs:

Source: A Random Walk Down Wall Street

And thus concludes today’s Market Meditation. Every investment decision comes back to you, as an individual. What are your goals? What are you aiming for? How quickly are you looking to get there? How much are you willing to risk? How much time can you invest? These are but a few variables that add another dimension to investment decisions. Know yourself before you try any of these things. That is critical for success and without it, failure is likely.