Smart Money Movements

Market Meditations | September 22, 2022

A significant barrier to profit in crypto is the sheer amount of low quality information regularly shared with the community. In reality, top investors have information that others do not, and seldom share this on social media or major news outlets.

However, with on chain-data, we can level the playing field.

Smart Money – Stablecoins

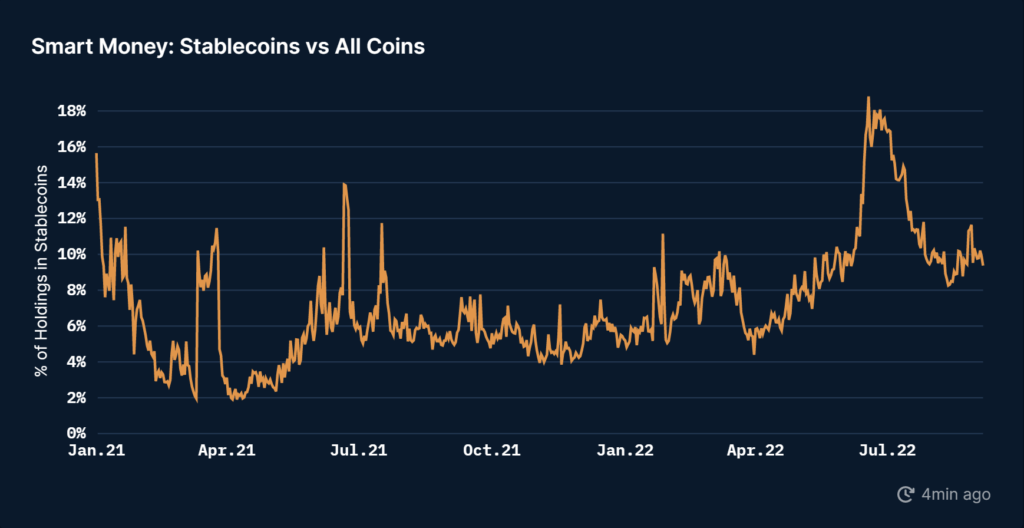

First, we can consider the % of total smart money holdings in stablecoins. The higher the % allocation to stablecoins, the less risk top investors are willing to take.

Nansen.ai: 07/09/2022: Total % of Smart Money Holdings in Stablecoins

- In June this reached peaks of over 18%, showing that smart money had side-lined significantly more of their capital than usual.

- Since then, stablecoin allocation has dropped to 10%, an indication smart money have been deploying their capital.

- However, even after this drop, allocation to stablecoins remains higher than majority of 2021, highlighting a macro aversion to risk.

Token Holdings

We can then dive deeper to see exactly which tokens these investors have been purchasing:

Nansen.ai: 07/09/2022: Token Flows sorted by positive 1 day change

- 4 of the 5 assets are used for yield generation. aWeth_v2 for example signifies deposits of Eth into AAVE – one of the most established yield generation platforms in the space.

- Another key trend is the movement into stETH, Lidos derivative token that is received when Eth is staked. Due to the mechanism of staking, 1 stETH could be redeemable for 1 Eth in the future however in recent months the market has applied a discount to stETH. Smart money have used this an opportunity to buy ETH at a below market value.

How Can I Take Advantage of This Data?

1️⃣ Consider your own stablecoin portfolio. Altering the % of stablecoins in your crypto portfolio can alter your risk and limit portfolio volatility. Consider how risky your current portfolio is and ensure you are happy with the amount of risk you are taking.

2️⃣ Do due diligence on the stETH arbitrate trade. If you are a long term believer in Eth and the Lido staking project, this may be a good opportunity to secure a discount on ETH.

3️⃣ Keep an eye on smart money movements. We can use this to understand what the top investors in the space are doing with their capital. Whilst this can give us an edge, remember that every investor has a different strategy and a decision can be profitable for one investor but not another depending on that strategy. Do not blindly follow smart money movements.

4️⃣ Limit yield farming risk. Whilst 4 of the top 5 tokens being moved into by smart money are used for yield generation, most of these are viewed as the lowest risk yield opportunities in the space – a sign that smart money is not looking for aggressive strategies to earn yield on their crypto.