The Cycle of DeFi Money Flows

Market Meditations | October 20, 2021

DeFi has been hugely successful in revolutionizing the way we interact with finance. Ethereum alone is currently home to over $150bn locked in DeFi proctols.

Understanding the cycle of money flows in DeFi can help us find the best yields and understand which new protocols may succeed in the long term.

1️⃣ Project Launch

- First, comes the launch of a new protocol such as a lending platform. New protocols with untested code are risky so why would any users want to put their assets on such a platform ?

2️⃣ High Yields and High Inflows

- These new protocols offer huge incentives to use their platform in the form of their token. Users see the opportunity for profit and move large amounts of capital onto the platform .

- An example of this which we covered last week was Geist protocol on Fantom. Within only 24 hours of launching they had managed to secure $3.8bn in total value locked. Their growth was so explosive because of the high yields they were offering.

✅ TIP: To find the highest yields – actively seek new protocol launches that are offering large rewards programs.

3️⃣ Low Yields and High Outflows

- Protocols cannot pay users to deposit their capital forever so these rewards must come to end.

- Leveraging our example, Geist currently has $1.7bn TVL – over 50% down from the same metric one day post launch.

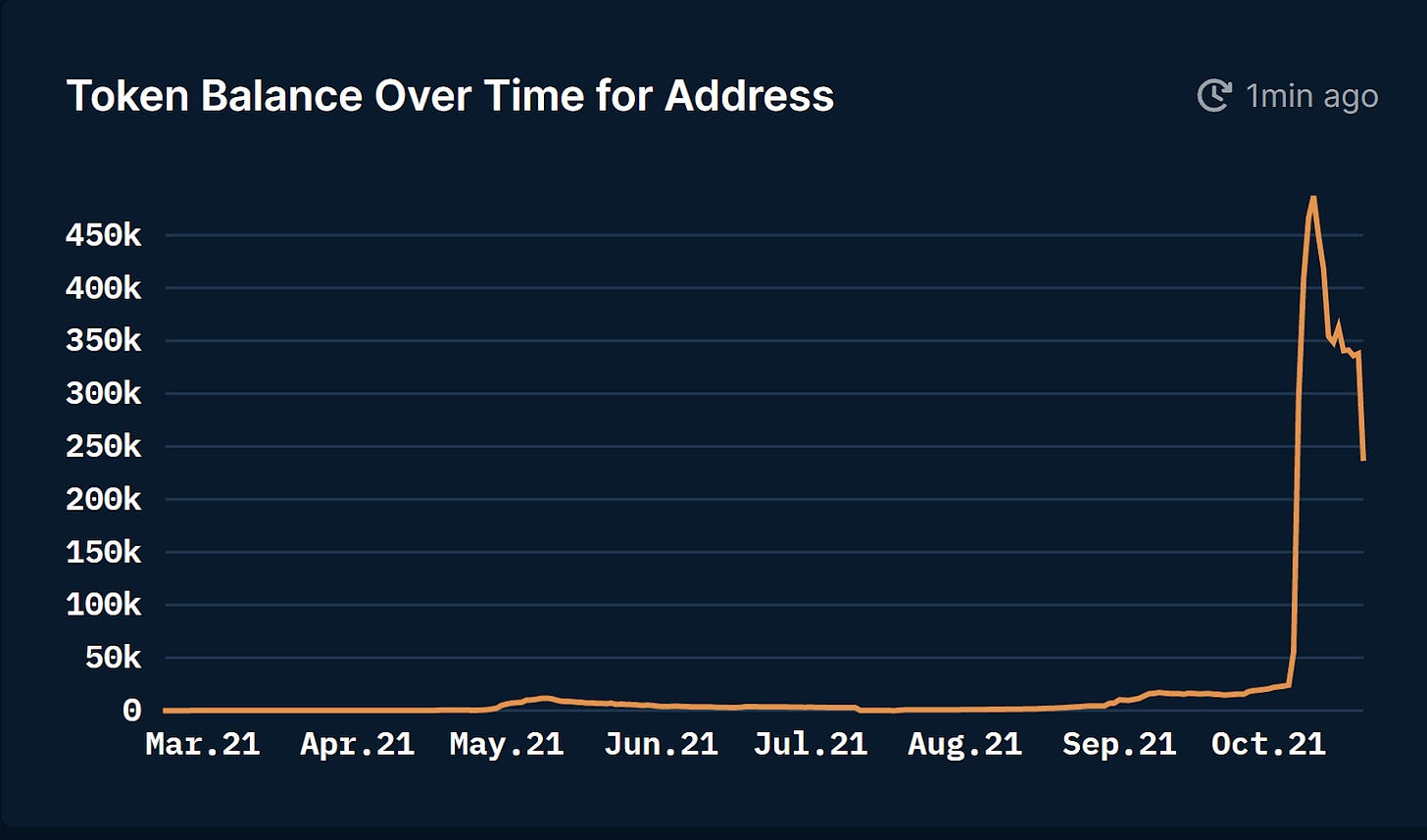

With Nansen we can also see impact on the wider Fantom ecosystem ?

Source: Nansen.ai: Graph of Balance of WETH Deposited in Fantom Bridge

- The graph shows us that after a huge increase in WETH on Fantom, the cooling off of rewards have led to outflows which look set to continue.

- Wrapped Ether (WETH) represents the largest asset that is bridged from Ethereum to Fantom.

✅ TIP: Adoption of a Layer 1 chain does not always equal price movements however they can be helpful to understand wider narratives and when these are cooling off.

☄️ Liquidity Mining and DeFi 2.0

The Geist saga has demonstrated the big issue arising from liquidity mining – it is incredibly short term. When reward programs end – capital simply moves to another project.

So what is the solution and can we profit from spotting this early?

- There has been a new narrative surfacing around protocols that look to solve this issue which have been coined DeFi 2.0.

- Tokens within this sector have outperformed the market and may continue to do so.

- However remember, all solutions are experimental and we do not know whether they will work in the long run.

⚡️ Conclusion

Understanding the DeFi money flow cycles allows us to focus our search for the highest yields by looking at new launches and new protocols that solve real issues in DeFi.

Using Nansen we are able to keep track of these flows and see the money flow cycle in real time.