The Intelligent Investor – Benjamin Graham

Market Meditations | February 9, 2021

Last week, in ? The Millionaire Next Door letter, we explained that becoming a millionaire is well within your reach. Today, we really wanted to drive the point home.

? Attention Market Meditators: successful investing does not require insider information, ridiculous luck or record IQ.

Rather, as Benjamin Graham explains in ? The Intelligent Investor, ? what is necessary is a solid investing framework combined with an ability to keep emotions from ruining it.

Historically, the book has been one of the most popular books on investing and Graham’s legacy remains to this day.

This publication has resulted in Graham being commonly referred to as “the father of value investing” and Warren Buffet describes it as ?

“By far the best book on investing ever written”.

✅ So let’s dive in and let’s continue to explore the best resources out there on trading and investing.

That way, Market Meditators will open their trading views each day, with the knowledge and experience of the world’s greatest traders and investors behind them.

Meet Mr. Market

In my tutorial for setting up your ? Trading View ? I recommended switching your colours from green and red to colours with less psychological implications.

?Green normally means go / nature / ”yay, I am making money” and other emotional attachments.

?Conversely, red means stop / danger / panic and all encompassing negative.

Graham’s idea of Mr. Market serves a similar purpose of trying to strip market prices from their psychological attachments.

Imagine an annoying neighbour called Mr. Market. Mr. Market knows you bought 1 Bitcoin ? Everyday, and sometimes multiple times a day, he rings your doorbell. He seems to constantly have an opinion on how much your Bitcoin is worth. He offers to buy your Bitcoin or sell you another Bitcoin on that basis.

In your historical experience, Mr. Market has been a pretty rubbish judge. That is, during the bear market, he thought your Bitcoin wasn’t worth very much at all and nowadays, he thinks it is the best thing since Pepe the Frog ?

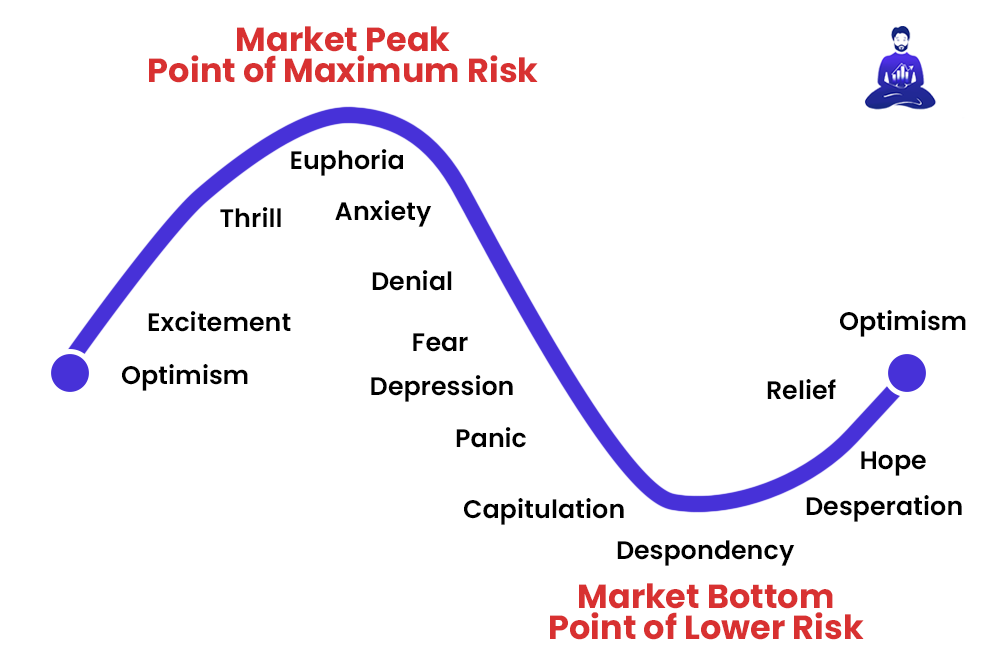

Mr Market’s Mood Swings:

So, would you let Mr. Market determine the worth of your Bitcoin? Of course not. He is just someone with a view that constantly changes and wants to deal with you based on that.

What many people fail to realize is that the screen you view on your trading platform is the same idea. The market price at any given moment is not an accurate reflection of worth. The market (like Mr. Market) is not always rational and the underlying value of an asset can differ significantly from the price he is willing to buy or sell to you.

If you take away one thing from that, let it be that value ≠ price.

Mr. Market can easily become over optimistic or indeed pessimistic. This was true back when Graham wrote the book and even more so today when we receive a constant stream of news and headlines. If you don’t have a go to source for this, consider following us on ? Market Meditations ? for crypto market news and insights.

It follows that you should only buy an asset if you are able to withstand Mr. Market’s mood swings. In fact, if you are able to keep your cool, there is an opportunity to make a great deal of money off of Mr. Market.

When he is extremely pessimistic, you find an opportunity to buy from him and then to sell to him when he is very optimistic. If you can’t keep your cool, you will most certainly be shaken out along the way ?

When presented with an opportunity, you can decide calmly whether to take it. Otherwise you can ignore the market / Mr. Market and move on with your day.

Defensive and Enterprising Investors

Graham identifies two types of investors:

1️⃣The Defensive (Passive) Investor

2️⃣The Enterprising (Active) Investor

Defensive Investor

The majority of people are more suited to Defensive investing. To this cohort, Graham recommends a Dollar Cost Average (‘DCA’) type method. For more on this, check out my video explanation ? In essence, you invest a fixed amount of capital at regular intervals. For instance, straight after you get your salary.

Regular readers of the Market Meditations will know this is the bitcoin strategy we suggest to many people: buy and hold sustained through DCA where the amount invested is capital that you understand is at risk.

? The benefits of DCA being that you more or less guarantee an average purchasing price of the asset and that you refrain from constantly checking and that you don’t concentrate your buying at the wrong time.

Enterprising Investor

If the majority of people are defensive investors, you might think it would be easy to be an enterprising or active investor. It would apparently just be the case of devoting more time to investing than these average investors do.

Unfortunately, it is a lot more difficult than logic might suggest. It requires:

1️⃣Unwavering patience

2️⃣Strict discipline

3️⃣Motivation to learn

4️⃣An abundance of time

Should any of these criteria be missing, you are highly susceptible to falling victim to Mr. Market ? Indeed many people fail when it comes to criteria no. 4. ☝️ Particularly, if they have a full time job.

Only people with all the boxes ticked should consider an enterprising approach that involves actively selecting price levels and deviating from DCA, particularly during bull markets and price discovery. To get started with this you can check out our ? Introduction to Technical Analysis ? course. Once you have done that, you might want to head over to our Altcoin Trading ? video.

Risk and Reward

Risk and reward are not always correlated.

Academic theory holds it to be true that the rate of return an investor can expect must be proportional to degree of risk that she is willing to invest. Where, risk is measured as the volatility of the return on the investment.

? Your typical: high risk, high reward and low risk, low reward relationship.

Graham rejects this thesis.

He argues that the price and value of assets are often disconnected. Therefore, the return that an investor can expect is a function of time, effort and skill in the pursuit of selecting assets to invest in.

✅ Traders and investors can select their investment decisions based on their investment approach (defensive or enterprising) and then ought to ignore the market noise created by Mr. Market in order to seize the opportunities that are presented to them.

The minimum return goes to the defensive investor, while the maximum goes to the enterprising investor who exercises maximum intelligence and psychological skill.

In seeking the highest reward, it would suit all Market Meditators to apply the lessons of Mr. Market to their trading and investing.

For more on managing risk, we have a ? full Risk Management course.

Conclusion

In contrast to the typical risk, reward thesis, Graham suggests that the rewards in the market are a function of decisions and skill. The decision to select the right trading approach and then the skill to exercise discipline. The discipline point is based on understanding the market / Mr. market for what it truly is. A reflection of opinions on, rather than worth of, an underlying asset. This is the approach that will ensure the identification of and swift response to market opportunities.