The Most Important Thing: Uncommon Sense for the Thoughtful Investor – Howard Marks

Market Meditations | March 11, 2021

The Most Important Thing

It was Warren Buffet who encouraged Howard Marks to write: The Most Important Thing: Uncommon Sense for the Thoughtful Investor. A book that provides helpful guidelines for those aspiring to be successful investors or traders ✅ Let’s take a closer look at these timeless lessons today.

1️⃣Market Cycles

Market cycles will always exist because the markets are never completely rational; try as we may, investors and traders don’t just bring their money to the table, they also bring their emotions ❌

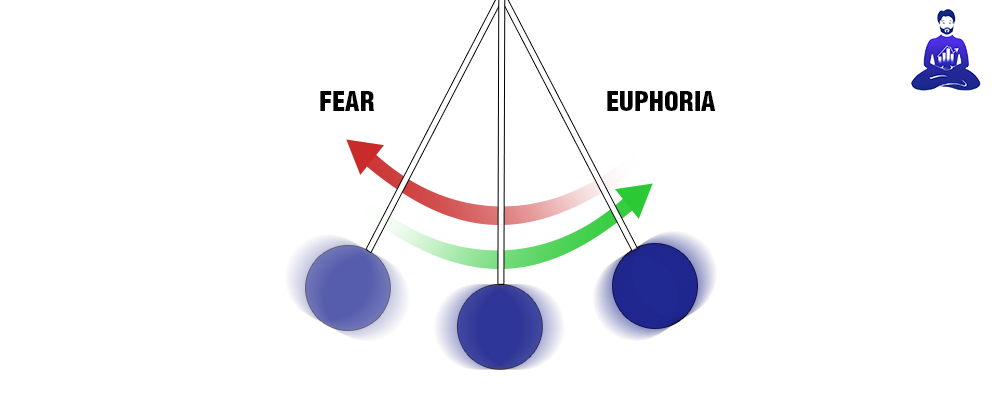

Howard Marks describes market cycles as a pendulum that swings from one side to another. The extremes are the turning points at each end and the pendulum is almost always swinging between these extremes. On the one side we have euphoria, greed and over-priced assets ? and on the other we have depression, fear and under-priced assets ? The market is never stationary or fixed, it is constantly in this motion. The sooner we understand this, the sooner we will stop:

- Thinking that every bull phase is parabolic and will never correct

- Thinking every bear phase is the end and that the asset is doomed

And the sooner we can start recognising where we are in the broader context of a market cycle and how we can best predict and profit from future turning points ?

2️⃣Risk and Randomness

It is essential to first understand risk. For example, higher risk does not guarantee higher reward. Then, we need to be able to recognize risk. The market does not always reflect an accurate reflection of risk ? so it is critical that we do not take things at face value but rather, we determine our own risk identification strategy. To draw on a recent example, there is a lot of hype on NFTs right now but does that make them a guaranteed short term success? Check out our ? video ? on why we think this is more of a long term play.

Finally, we need to control risk. Good trading or investing is more about minimizing risk and losses than it is maximising gains. A big part of this is appreciating the role of luck. Sometimes good decisions create a loss and sometimes bad decisions create a profit. The best way to mitigate this is to protect your downside. Many people can achieve this through a stop loss which we have a full video guide on.

3️⃣Trading Psychology

We need to combat greed, fear, envy and ego. Or at the very least, we should understand that they are influencing our decisions. As impactful as they can be on an individual, the impact is tenfold when a whole group gets behind it ? For instance, when FUD takes over twitter during a dip. Even if you were bullish in the morning, the force of the herd when you check your homepage can be enough to turn you bearish due to fear. Commonly known as confirmation bias.

If we refer back to the pendulum examples, if times of fear and doubt convey a market extreme or tipping point, wouldn’t it in most cases be more wise to pre-empt the pendulum swinging back? In fact, contrarianism often yields the most profits ? Whilst many prefer to follow the trend, those who dare to take a contrary view can sometimes yield serious returns.