Tokenomics 102

Market Meditations | May 10, 2022

? Tokenomics 102

Time to Invest? ?

When’s payday?

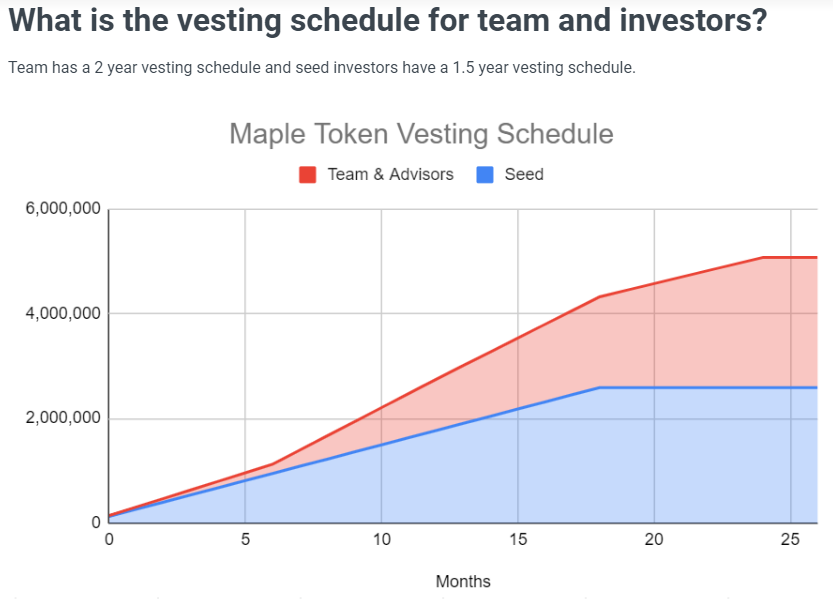

Vesting refers to how long tokens are required to be held before they can be sold. This can range from years to no requirement at all.

Functionally, this can be interpreted as an indication of how longevity-minded founders are.

If a team features no unlock of their own token allocation, there would be no mechanisms in place to prevent a huge sell-off, resulting in big profits for them, and big problems for us.

- Vesting cliffs outline the required time that must pass before tokens begin their unlock. Cliffs of a year or more usually indicate a respectable time frame.

- Vesting occurs in a number of different formats, but linear unlocking is a popular choice. This method releases a static amount of tokens regularly over a span of days, weeks or months until the group’s entire allocation is met.

- Some projects feature no vesting terms for one or more groups of investors. These should be approached with extreme caution, since there is no guarantee against founders dumping huge amounts to seize opportunity at your expense.

Maple Finance features a 2 year vesting term for its team, and a 1.5 year term for seed investors. Even with no mention of a cliff, the team will only receive their $MPL allocation linearly over 24 months. This implies founding members are less likely to be looking to make a quick buck, and more likely to concern themselves with the long-term success of their work.

Cliffs, lock-up periods and vesting schedules reveal critical information.

If you spot a project with no mechanisms in place to control how quickly early investors and developers receive payouts, it should give you pause.

Those networks and protocols with respectable release schedules usually coincide with a sincere desire to see their project succeed.

Slices of Pie?

Everybody wants a piece.

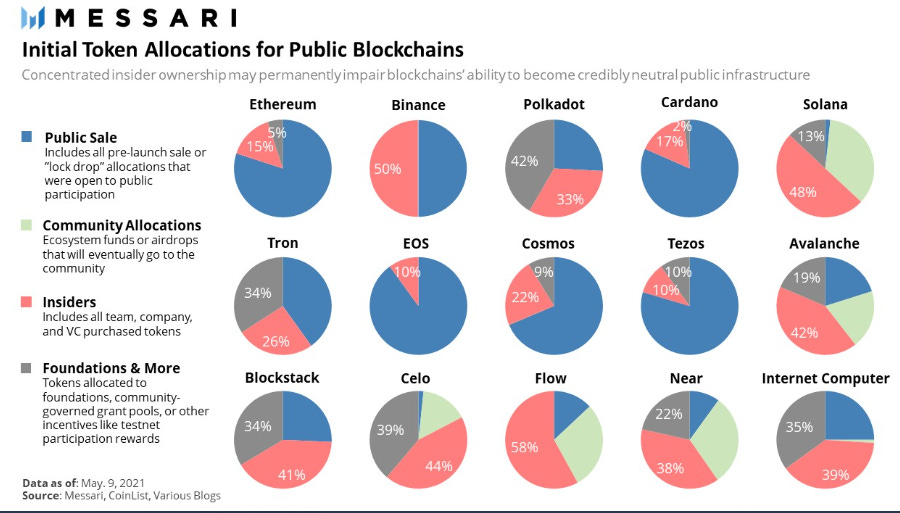

Token distribution says a lot about a project’s economy. The proportion of user and investor ownership of tokens can reveal just how fairly assets are allocated.

Proper designations for community, internal owners, early investors, foundations, marketing, development, etc, must all be considered before responsibly moving forward.

Messari published a comparison of public blockchain distributions in 2021. Looking at how each network and protocol divided its initial token supply shows that every project approaches distribution differently.

A token distribution with team members enjoying an allocation higher than 30% should be scrutinised. Though this is not always a negative signal, it does warrant a deeper look. If team members reserve the lion’s share of tokens for themselves, it’s easier to exit at the expense of others.

Follow the leader.?

Community calls.

Though not a conventional category placed within the scope of tokenomics, community followings are easily one of the most important areas to investigate.

The conviction and knowledge levels of people excited to engage the project has major implications for its token.

- Join Discord, talk in Telegram, scroll Twitter… all of these are a must. When speaking to members, make note of staff response time, depth of knowledge, and overall sentiment.

- Ask about the token. Seeing how readily answers come to you should provide a hint as to whether or not others are familiar with the project’s tokenomics.

- Make yourself at home. Sit back and people watch. If the chat is spammed with “wen token” or “MyCoin MOON!” constantly, you might be dealing with irrational mania instead of sound bullishness.

When taken into consideration, community sentiment and the following provides a potential confluence to your own assessment of a protocol or network’s tokenomics.

Though this concludes our look into tokenomics, it should only serve as the beginning of your journey toward becoming an educated investor.

As Einstein said:

“Life is like riding a bicycle. To keep your balance, you must keep moving.”