Tools of Traditional Finance Guide

Market Meditations | October 14, 2021

Traditional finance continues to be increasingly usurped by cryptocurrencies. As the evolution continues, we are fortunate to have a template to reference. As many things as TradFi got wrong, it undeniably provided us with some indispensable investment methods.

What Are My Options?

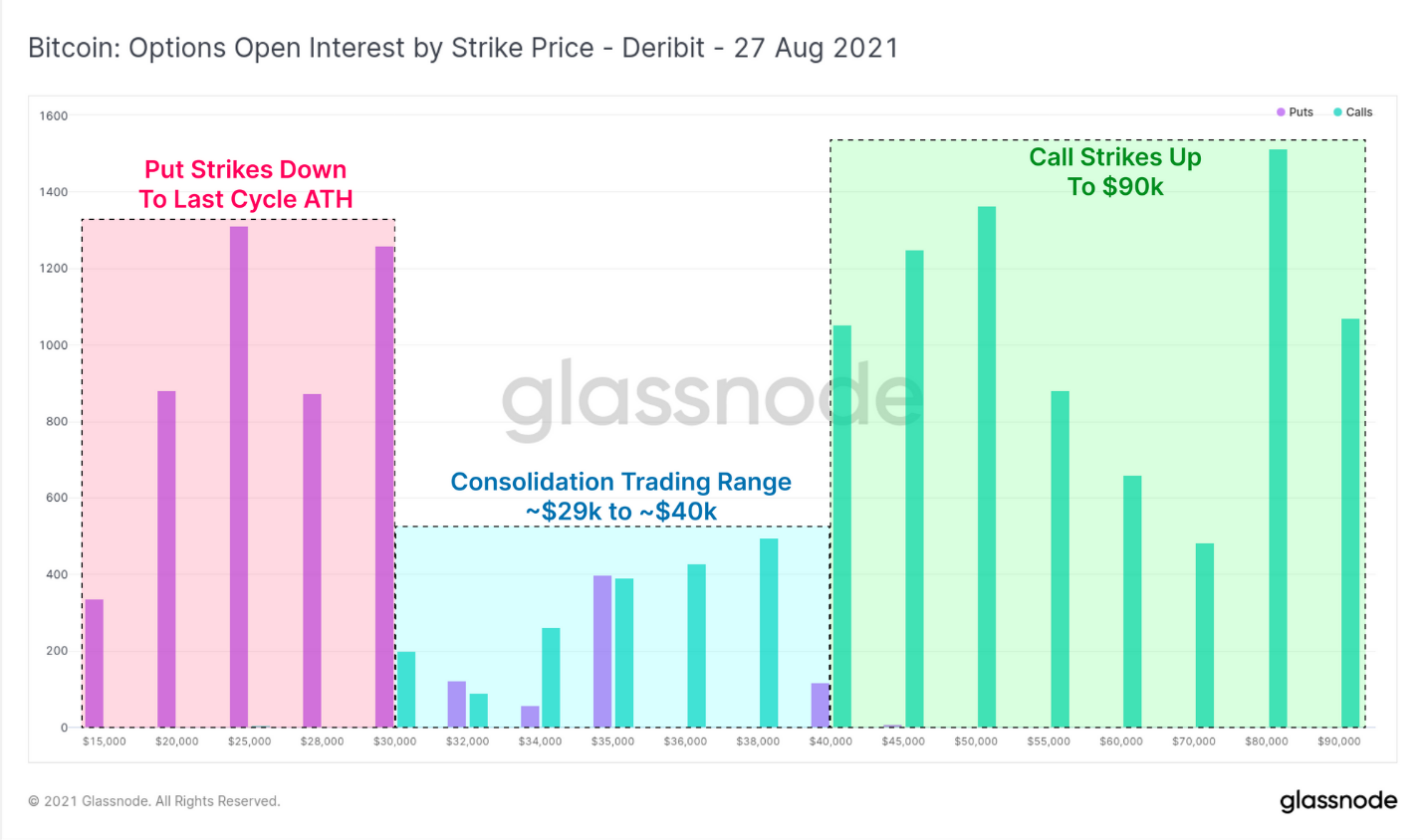

- ?Calls and Puts – Some of the most popular options in traditional finance, these contracts are bought at a fee (premium) and give the purchaser the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a specific price (strike price) on a predetermined date in the future (expiration date). These methods are already widely used by some crypto traders and investors on platforms like Deribit and Bakkt.

- ❓Interest Rate Derivatives – IRD make up well over half of the volume in traditional derivatives markets, accounting for $121t (yes, trillion!) in the first half of 2021. Interest rate swaps allow users the choice of either paying a fixed rate or floating rate over a predetermined period to benefit from volatility.

These tools of the trade are immensely popular with good reason. As crypto finance continues to undermine the conventional status quo, seasoned financiers are continuing to demand these methods in the cryptocurrency markets because they introduce new strategies.

- Limiting downside risk by avoiding potential liquidations.

- Hedging against riskier investment endeavours.

- At an advanced level, option combinations can be employed to further mitigate risk of loss.

Interested?

With interest rate swaps accounting for over 80% of the traditional OTC derivatives market, they’re now making a push to become staples in cryptocurrencies.

These swaps are contracts in which future interest payments at one rate are exchanged for another.

- The most common IRS contract is a fixed-to-floating model. In it, one party agrees to pay a fixed interest rate for an agreed upon term. In return, they receive a floating interest rate for the lifespan of the contract.

It’s not that hard to find an exchange offering call and put options, but interest rate swaps are only getting started. STRIPS is an interest rate derivatives exchange on Arbitrum addressing demand for just such a void.

- The decentralized exchange will offer interest rate swaps using leverage based on low position collateralization.

- With leverage on yield farms, hedging, and arbitrage opportunities, STRIPS is bringing highly demanded traditional finance tools into the cryptoverse.

- It also offers staking in its Automatic Market Maker (AMM) and insurance fund to earn passive income.

Calls, puts and futures have all established themselves as staples in cryptocurrency finance. Options and other derivatives are popular for many reasons, though the limitation of downside risk remains chief among them.

The amount of money changing hands using interest rate swaps is mind-boggling. It’s obvious the demand is here. Investors and traders just await the supply.

Interested in derivatives? We’ve got you covered, our Options 101 guide offers a good starting point for those looking to up their game.